.

Should investors buy AMD stock after correction?

Since reaching $227 per share at the beginning of March, theAdvanced Micro Devices (NASDAQ: AMD)AMD has attracted increasing attention for its potential as an AI stock, and its valuation has risen to a higher level. Now that the valuation has come down after the market correction, investors who missed the last bull market may see this as an opportunity to add to their holdings, while others may still see the stock as too expensive.

The question for investors is whether the lower valuation is a reason to buy AMD now, or whether they should remain on the sidelines. Let's see if we can find the answer.

AMD's Current Status

Even with the recent correction, AMD's stock price has risen about 85% in the last 12 months, and much of that increase is likely due to interest in its line of artificial intelligence chips, the Instinct MI300 series of gas pedals. As much as possible.INVISTA (NASDAQ: NVDA)Claiming at least 80% of that market, market research firm MarketDigits forecasts the AI chip market to grow at a compound annual growth rate of 38% through at least 2030, which would allow the company to prosper despite its small share of that market.

In fact, the company's financials reflect this growth, with revenues up 101 TP3T year-over-year to $6.2 billion in the fourth quarter of 2023. Revenue from the data center business, which includes AI chips, was $2.3 billion, an increase of $38.1 trillion.

In addition, investors should not forget about AMD's other divisions, the fastest growing being its $1.5 billion fourth-quarter revenue. The fastest-growing division was Customers, whose fourth-quarter revenue of $1.5 billion was up 62% year-over-year. thanks to this growth, the decline in the gaming and embedded divisions did not derail AMD's fourth-quarter resurgence.

The company declined to provide full-year 2024 guidance. However, analysts are forecasting revenue growth of 231 TP3T this year and 261 TP3T by 2025. this growth would lead to a significant increase in net income, which would be bullish for the stock in the long term.

AMD's Continued Struggle

However, not all of the numbers are in AMD's favor. full-year 2023 industry performance reflects the recent cyclical downturn across the industry. $23 billion in revenue was down 4% from last year. during this period, AMD's data center and embedded divisions were the only divisions of the company to achieve growth.

This decline resulted in a significant decrease in operating income of $4.3 million in net income, resulting in a decline in adjusted net income of $22%.

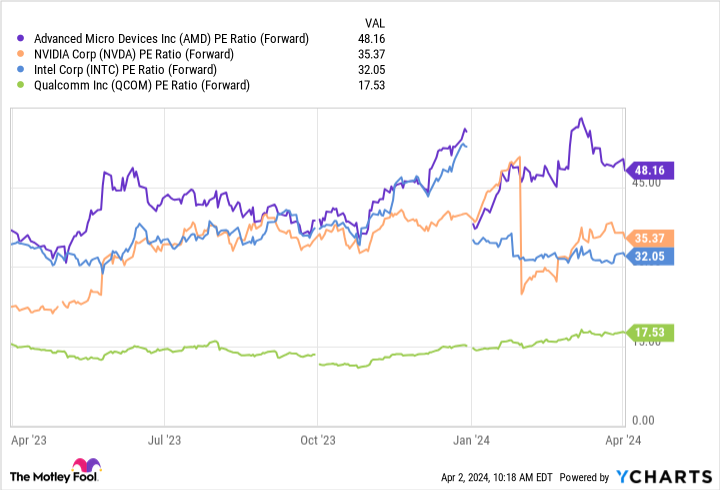

Moreover, a closer look at its earnings multiple may not bode well for investors. The company's price-to-earnings ratio of around 350 probably reflects declining profits more than its valuation, although its forward price-to-earnings ratio of 48 makes the stock look expensive.

Such a valuation is in line with theIntel (NASDAQ: INTC)respond in singingQualcomm (NASDAQ: QCOM)The two companies have also developed chips that can be used for artificial intelligence. In addition, the company's forward P/E ratio is much higher than that of market leader Nvidia. Considering this gap, there may be pressure to reduce earnings over time, and perhaps even a reversal.

Should investors buy Shu Zheng?

Just looking at the growth of the AI chip market, AMD looks like a buy. As it helps meet the demand for these chips, its revenue and earnings should increase significantly over time. The fourth-quarter growth shows that this trend has already begun.

AMD's shares are already expensive, even compared to Nvidia and other emerging competitors in the AI space. But with the AI chip market growing at a big rate, the rising tide should bring all boats to the wind. Between this market and the rest of AMD's business, a drop in its stock price is more likely to be a buying opportunity than a sign to move away from this semiconductor stock.

Should you invest $1,000 in Advanced Micro Devices now?

Before buying shares of Advanced Micro Devices, consider the following:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Only ...... and Advanced Micro Devices were not included. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 4, 2024

Will Healy owns shares of Advanced Micro Devices, Intel, and Qualcomm.The Motley Fool owns and recommends Advanced Micro Devices, Nvidia, and Qualcomm. The Motley Fool recommends Intel and also recommends the following options: Intel January 2023 $57.50 Calls Long, Intel January 2025 $45 Calls Long, and Intel May 2024 $47 Calls Short. The Motley Fool has a disclosure policy.

Should Investors Buy AMD Stock After Correction? This article originally appeared in The Motley Fool.