.

Why INVISTA Stock Rallied in March 14

Last month.INVISTA (NASDAQ: NVDA)'s stock price climbed again as the AI leader continued to benefit from investor enthusiasm for artificial intelligence.

Additionally, the company received a positive response at its annual developer conference, 鈥竝he gained some momentum in early March on the back of its strong fourth-quarter financial results in February.

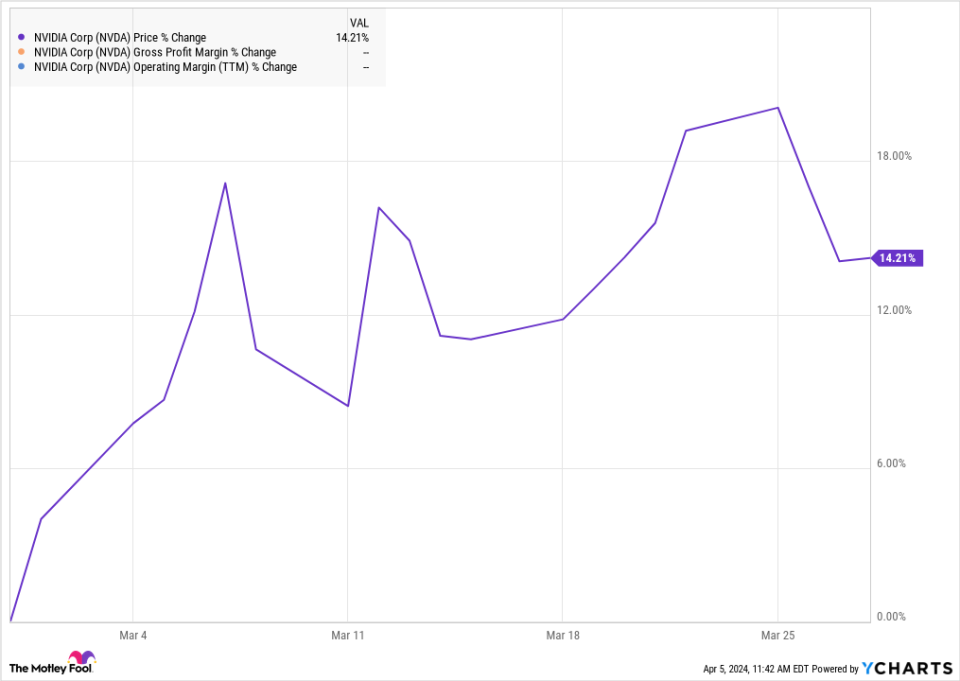

According to S&P Global Market Intelligence, Nvidia's stock price has risen 14% this month, and as you can see from the chart, Nvidia didn't show a clear trend last month, as strong as it was to begin with.

Artificial Intelligence continues to grow in popularity

Nvidia has become a leader in the AI boom, as the company's GPUs (graphics processing chips) and superchips have been in high demand and in short supply.

At the start of March, INVISTA's share price jumped as it appeared to benefit from fellow AI winnersupercomputer's stock price soared after the company, which specializes in producing artificial intelligence servers, was included in theStandard & Poor's 500 The stock jumped after the index.

Artificial Intelligence stocks have a tendency to go hand in hand, as good news for one is often good news for the other, and Nvidia and Supercomputer are close partners.

Later this month, Nvidia unveiled its new Blackwell platform at its developer conference, and in his keynote address, CEO Jen-Hsun Huang shared his vision for the company and AI. Nvidia said the new platform will allow organizations to run real-time generative AI for programs such as large-scale language models at up to 25 times less cost and power than the previous generation of Hopper. Nvidia said the new platform will allow companies to run real-time generative AI for programs such as large language models at up to 25 times lower cost and power consumption than the previous Hopper.

Nvidia also announced several other new products and partnerships, validating to investors that the company is well-positioned to maintain its leadership in artificial intelligence. Analysts generally raised their price targets and commented favorably at the meeting.

Finally, INVISTA's stock declined in the last week of March, with little news about the company.

Where does INVISTA go from here?

There's no doubt that Nvidia dominates the AI hardware market, but there are a number of companies competing to try and break Nvidia's grip on the technology, including some of its biggest customers likeMicrosoft,Alphabet respond in singingMeta PlatformsThe

If the company can maintain a clear lead in AI, the stock will likely continue to grow, but Nvidia investors should keep an eye on the competition, as serious hypochondriacs could erode Nvidia's fat profit margins.

Should you invest $1,000 in Nvidia now?

Consider this before buying shares of Nvidia:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Nvidia is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the coming years.

Consider that on April 15, 2005NvidiaOn the list at ...... If you invest $1,000 at the time of our referralYou will have $526,345.! * *The

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisor's Report as of April 4, 2024

Suzanne Frey, an Alphabet executive, is a member of The Motley Fool's Board of Directors. Randi Zuckerberg, former Facebook Market Development Armsmaster and Spokeswoman, and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool Board of Directors. Jeremy Bowman works at Meta Platforms, and The Motley Fool owns shares of recommended stocks of Alphabet, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: Microsoft January 2026 $395 Call Options The Motley Fool recommends the following options: Microsoft Jan 2026 $395 Call Option Long and Microsoft Jan 2026 $405 Call Option Short The Motley Fool has a disclosure policy.

Why did Nvidia stock rise 14% in March?