.

Berkshire Hathaway Inc. stock: buy, sell or hold?

Facts have shown thatDr. Konrad Hathawayfirms(NYSE: BRK.A)(New York Stock Exchange: BRK).B) is one of the most profitable investments in history. Since 1980, the company's stock price has risen more than 2,000 times! A $100 investment is now worth about $250,000.

Now that Berkshire has a market capitalization of $900 billion, its biggest gains may be behind it. But that hasn't prevented the stock from gaining more ground over the past three years thanStandard & Poor's 500The rate of return of the index is high.double the amountThe

But what should investors think now? Should you buy, sell or hold Berkshire stock?

Conventional wisdom doesn't apply to Berkshire.

For decades, investors have expected Berkshire's rate of return to slow down. And so it was. From 1980 to 1990, Berkshire's stock value increased 28 times. From 1990 to 2000, the stock price increased about six-fold. From 2000 to 2010, the share price approximately doubled. And in the last ten years, the stock value has increased about threefold.

In total, Berkshire's gains have slowed, but its share price continues to rise after a decade, usually faster than most market indices. This is a remarkable achievement. After all, the larger the portfolio, the harder it is to outperform the broader market. That's because, with a market capitalization of $900 billion, Berkshire now has a relatively small portfolio. Even if Bria invested billions of dollars in a company whose stock price has quadrupled in a year, it would not have much impact on Berkshire's large portfolio.

"The highest rate of return I ever achieved was in the 1950s. I blew up the Dow Jones. You should see the numbers," Buffett famously said in 1999. "But I was investing in peanuts. But at that time I was investing in peanuts. Not having a lot of money was a huge structural advantage. I think I can make you 50% per year with $1 million. no, I know I can. I guarantee it."

The fact that Berkshire & Co. continues to beat the market has surprised many experts, but in reality, the performance makes perfect sense. Warren Buffett, arguably the best investor of all time, remains at the helm of the company. He's also been helped by other legendary investors, including Ted Weschler, Todd Combs and the late Charlie Munger. Together, Buffett and his team still have plenty of investment options, even if those options are limited to larger companies. For example, the currentApple Inc.Berkshire's largest holding company, with a stake worth about $153 billion. Apple itself is worth more than 2.6 trillion dollars. In theory, Berkshire could invest the entire portfolio several times over in Apple and still not come close to owning the entire company.

Yes, Berkshire's returns have slowed down. Yes, its investment universe is more limited than ever. But the key to the company's success - assembling a group of legendary investors who invest for the long term - is still there. Expect resonance to continue to beat the market for decades to come.

But is it a good idea to buy this stock now?

Just because a resonable name of Berkshire's portfolio is expected to perform well over the next few years does not necessarily mean that you should buy the stock. After all, resonance shares may be overpriced, which means that you will be paying too much for the performance of its portfolios, thus jeopardizing your investment returns.

Is Berkshire's stock properly priced now? Valuing a company is notoriously difficult. It has a publicly traded portfolio, which is easier to value because there are publicly traded prices to look at. But much of Berkshire's value is bundled into its privately held business portfolio, ranging from insurance underwriters to national railroad companies.

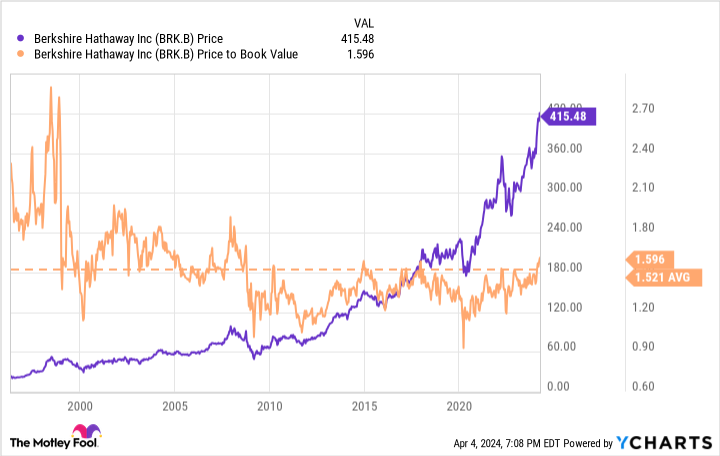

A simple way to assess the resonance valuation of Berkshire is to look at its price-to-book ratio. This is a measure of how much the market is willing to pay for Berkshire's assets. Currently, the price to book ratio of Berkshire's stock is 1.6, which is slightly higher than its long term average. Relatively speaking, resonance shares are not cheap compared to previous years, but they are not too expensive either.

This is especially true given that the company has purchased tens of billions of dollars of stock in recent years - an act that has added value for shareholders, but has in fact been a major source of revenue for the company's shareholders.reducesThe book value of the company creates a disconnect between the accounting value and the true value.

In total, after all these years, is it still worth buying shares of Berkshire? Sure. All the pieces are in place for resonance to continue its success, and its valuation, while not cheap, is still a reasonable price for one of the best businesses on the market.

Should you invest $1,000 in Berkshire Hathaway now?

Before buying shares of Berkshire Hathaway, consider the following:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Only ...... and Berkshire Hathaway are not included. The 10 stocks that made the list could generate huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 4, 2024

Ryan Vanzo does not own any of the stocks mentioned above.The Motley Fool holds shares of recommended Apple Inc. and Berkshire Hathaway Inc.The Motley Fool has a disclosure policy.

Berkshire Hathaway Stock: Buy, Sell or Hold? This post was originally published by The Motley Fool.