.

Is it too late to buy shares of Viking Therapeutics?

The field of weight loss treatment is one of the hottest areas in the pharmaceutical industry today.Novo Nordisk(math.) andEli Lilly) are major innovators. Their pioneering glucagon-like peptide-1 (GLP-1) agonists are in high demand for the treatment of diabetes and weight loss, and are marketed under the names Ozempic, Rybelsus, Wegovy, Mounjaro and Zepbound.

But while these two companies have dominated this market segment in recent years, they may finally have a real competitor. At the end of February, the clinical stage biopharmaceutical companyViking Therapyfirms(Viking) Therapeutics (NASDAQ resonance stock code: VKTX)The announcement of the second batch of trial data for its obesity drug candidate VK2735 caused a huge stir. After the news broke, the company's stock price soared, rising more than 300% so far this year.

With the dramatic volatility in the stock price now a thing of the past, have investors missed the opportunity to join the next giant in the weight loss space?

Shares of Viking Therapeutics are way up, but...

While there are a number of pharmaceutical companies working to enter the weight loss arena, Viking seems to have the most promising future.

In the second arm of the trial, patients taking the highest dose of VK2735 experienced a mean weight loss of 13.11 TP3T after 13 weeks, and the safety and tolerability of the drug candidate were also encouraging. According to the company, in this study, 131 TP3T of patients taking VK2735 discontinued treatment. In contrast, 14% of patients taking placebo withdrew from the trial.

In addition, Viking has just announced the results of a Phase I trial of an oral version of VK2735. This is a smart move considering that Novo Nordisk is also looking to bring an oral weight-loss drug to market. However, even with this momentum, there are some risk factors that investors should be aware of before buying Viking stock.

...... has a long way to go!

Viking Therapeutics is still a clinical company - its products have not yet been commercialized and approved for sale by the regulatory body. Since it is a non-revenue generating business that is investing heavily in R&D, liquidity could be a real issue.

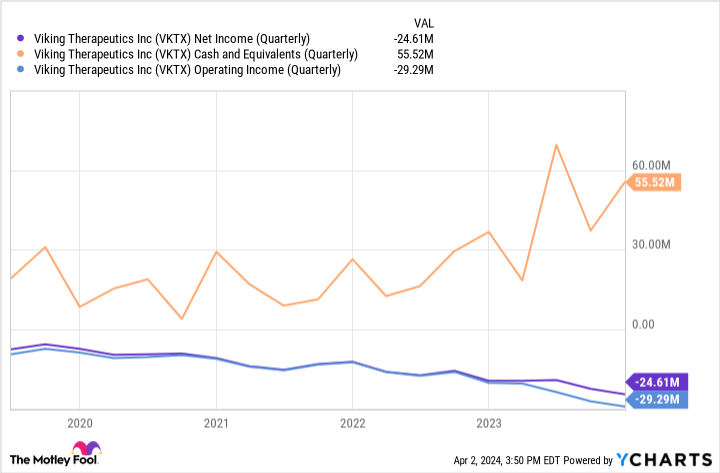

The chart above shows that Viking has consistently incurred operating losses. Therefore, the company's long-term cash position is questionable and should be a cause for concern.

Should you invest in Viking Therapeutics?

While Viking Therapeutics seems to be moving in the right direction, it is important to understand the clinical trial process. It takes years of research to bring a drug to market, and there can be many problems along the way. Most drug candidates never get approved. While Viking was able to get VK2735 off the ground quickly in Phase III clinical trials, there is no guarantee that it will be approved by the U.S. Food and Drug Administration (FDA).

In addition, even if Viking's drug candidate is approved by the FDA, veteran leader Novo Nordisk currently controls nearly 60% of the GLP-1 market, and Eli Lilly and Company's Mounjaro and Zepbound have been highly successful. Viking still has a lot of work to do to win market share.

While Viking could someday make a big splash in the weight loss space, I think the current investment outlook for its stock is too speculative. In addition, Wegovy has just received approval to expand its heart disease indication, while Eli Lilly has been able to expand its heart disease indication through its partnership withAmazon Its distribution network has been strengthened by the use of the name of the person.The These measures can only help them to stay ahead of any potential competitors.

Even though Viking Therapeutics shares are soaring, I don't think it's too late to buy. In fact, I think it's too early. The new interest in Viking has resulted in a valuation premium that is out of line with the company's fundamentals. For these reasons, I am staying away from Viking Pharmaceuticals for the time being, and will look for more suitable positions in established companies such as Novo Nordisk and Eli Lilly.

Should you invest $1,000 in Viking Therapeutics now?

Before buying shares of Viking Therapeutics, consider the following:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)Worth investing in10Only ...... and Viking Therapeutics were not included. The 10 stocks that made the list could generate huge returns in the coming years.

Consider April 15, 2005Nvidia) on the list at ...... If you invest 1,000 in our recommendedIn dollars, you'll have $526,345.! *Stock Advisor provides easy-to-use stock investment tools for investors.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View these 10 stocks."

*Stock Advisor's Circular as of April 4, 2024

John Mackey, former chief executive officer of Whole Foods Market, an Amazon subsidiary, is a board member of The Motley Fool.Adam Spatacco owns shares of Amazon, Eli Lilly, and Novo Nordisk.The Motley Fool holds a recommendation for Amazon.The Motley Fool recommends Novo Nordisk.The Motley Fool has a disclosure policy. The Motley Fool has a disclosure policy.

Is It Too Late to Buy Viking Therapeutics Stock? This post was originally published by The Motley Fool.