.

Palantir Technologies stock to buy now?

Palantir Technologies (NYSE: PLTR)'s shares fell more than 6% as the soaring software platform provider received an analyst downgrade. Analyst Brian White of brokerage Monness, Crespi, Hardt & Co. downgraded the company's stock to sell from neutral, predicting that the company could face a reality check after its dramatic rise over the past year.

Thanks to the company's growing reputation in the artificial intelligence (AI) software market, Palantir's stock price has soared 185% in the past year, and White's $20 price target suggests that Palantir could fall 13% from its previous level due to overvaluation. Is this a warning to investors to hit the sell button, or should savvy investors take the recent correction in Palantir as a buying opportunity? Is this a warning to hit the sell button, or should savvy investors take Palantir's recent reversal as a buying opportunity? Let's find out.

Palantir Technologies is really expensive right now.

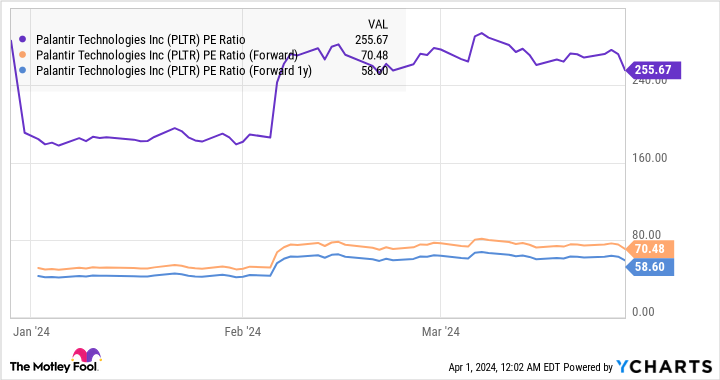

White notes that the "unprecedented generative AI hype cycle" has brought Palantir's stock to a "staggeringly high valuation." A closer look at the company's price-to-earnings ratio shows that this analyst竝s not wrong.

Palantir currently trades at a price-to-sales ratio of 24.6. In addition, the company trades at a price-to-earnings ratio of 264 times. These multiples are much higher thanNasdaq Resonance 100 Technology SectorIndex 7.3 Sales Multiple and 47 Earnings Multiple.

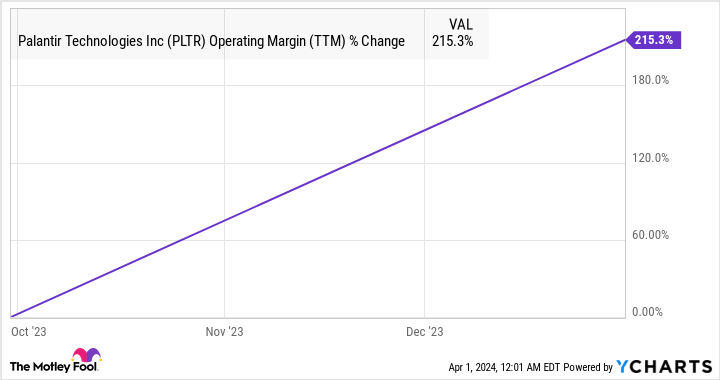

It's worth noting that Palantir's growth hasn't been as robust as some other AI stocks. The company's 2023 revenues only grew 17% from the previous year, but full-year earnings quadrupled year-over-year to $0.25 per share last year, up from $0.06 per share in 2022, driven by a sharp improvement in the company's margins.

In the company's February earnings call, Palantir's Simmons CEO Alex Karp noted that the company enjoys "strong per-unit economics," which simply means that it makes more money from each customer it acquires. So while Palantir's current top-line growth may not be robust enough to justify its sales multiples, its earnings growth has been impressive.

What's more, consensus estimates suggest that Palantir can sustain excellent earnings growth over the long term, with annualized earnings growth over the next five years reaching 85%. If Palantir can indeed sustain this rate, then its high valuation is justified. For example, applying Palantir's projected earnings growth rate of 85% over the next five years to its 2023 earnings, its earnings per share could rise to $5.42 by the end of 2028.

The average forward earnings multiple for the Nasdaq Resonance 100 Index is 28. Assuming Palantir trades at a similar multiple five years from now and achieves the expected earnings calculated above, its stock price would jump to $150 per share. This would be a huge jump from current levels. Analysts expect Palantir to deliver impressive growth, which explains why its forward earnings multiple is much lower.

So the only way for Palantir stock to maintain its red-hot uptrend is to keep earnings growing at a high rate. And for that to happen, its revenue growth must accelerate as well. The good news is that the company's most recent quarterly industry results suggest that, thanks to artificial intelligence, its revenue growth will indeed accelerate.

Artificial Intelligence is Accelerating Business at Palantir

For Palantir, artificial intelligence is more than just hype. It's because the popularity of the technology is actually driving real growth for the company. This can be seen in a few simple metrics.

In the fourth quarter of 2023, Palantir closed 103 deals worth at least $1 million. This is a significant increase from the 55 deals valued at at least $1 million closed in the same period last year. Even better, customers are now signing larger deals with Palantir. In the fourth quarter of 2023, the company reported closing 37 deals worth at least $5 million and 21 deals worth $10 million or more. This is a significant increase from the same period last year when there were 11 deals worth $5 million or more and five deals worth at least $10 million.

This strong deal activity explains why Palantir ended 2023 with a Residual Performance Obligation (RPO) of $1.24 billion, an increase of nearly 28% from the same period last year.This metric refers to the aggregate value of the company's future carry obligations, so it is growing faster than Palantir's topline, which suggests that the company is preparing for strong growth over the long term.

Palantir attributes the improvement in trading activity to the growing popularity of its Artificial Intelligence Platform (AIP), which enables customers to deploy generative AI applications in the context of their business. The AI software market is forecast to exceed $1 trillion in annual revenue by 2032, compared to $170 billion last year, so Palantir has a lot of room to grow in the long term.

What should investors do?

While Palantir's rally has certainly made the stock price expensive, it will likely be able to justify its high valuation due to healthy growth in both the top and bottom lines. Artificial intelligence is more than just hype for the company's business, and as its margin profile continues to improve, the new business the company has won should eventually lead to stronger earnings growth.

So if Palantir continues to fall after analysts downgraded it, savvy investors might consider holding this AI stock for the long term, as it appears to be becoming a leader in the AI software space.

Should you invest $1,000 in Palantir Technologies now?

Consider this before you buy shares of Palantir Technologies:

Motley Fool Stock AdvisorThe analyst team has just selected what they think is the best name for investors to buy now.10Only ...... and Palantir Technologies were not included. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 4, 2024

Harsh Chauhan does not hold any of the shares mentioned above.The Motley Fool holds a recommendation for Palantir Technologies.The Motley Fool has a disclosure policy.

Is Palantir Technologies Stock a Buy Now? This post was originally published by The Motley Fool.