.

Should You Buy This Mysterious AI Stock Before It's Too Late?

The boom in artificial intelligence (AI) spending is unprecedented. Companies are investing billions of dollars in data centers and other computing infrastructure in hopes of winning the AI technology war.

It has been reported thatMicrosoftand OpenAI will be on one of thesupercomputerIt is a huge amount of money to spend on computing systems. This is a huge amount of money spent on computing systems.

Investors are rushing to the logs and shovels of the AI gold rush.Such as Nvidia(math.) andSuper Micro Computer). But there is another AI winner that has gone unnoticed:Dell Technologiesfirms(NYSE: DELL)The

As hard as it may be to believe, the staid PC brand is indeed a force to be reckoned with in the artificial intelligence space. The traditional technology provider has expanded its services beyond consumer devices, positioning itself to capitalize on the potential boom in data centers and cloud computing.

This makes Dell Technologies a potential winner in the artificial intelligence space, but should you buy this stock? Let's find out.

Dell: More than just PCs

Dell is well known for its Windows branded computers. They still make up a large part of the company's business. Its focus is on 耑 laptops and PCs, gaming machines, and business PCs.In fiscal year 2024 (ended February 2), Dell's Computing Division within its Customer Solutions Group reported revenues of $48.9 billion and operating income of $3.5 billion.

The division grew rapidly during the pandemic, but sales in fiscal 2024 were essentially flat compared to fiscal 2020. The division has also maintained operating profits of more than $3 billion in each of the past five years.

Even more exciting is Dell's Infrastructure Solutions division, at least from an AI perspective. The division helps AI companies organize and build high-performance data centers around the world. Jensen Huang, Nvidia's chief executive officer, even touted Dell as the premier solution for building data centers in his latest keynote.

While Dell's financial numbers haven't rocketed as high as Nvidia's, Dell's Infrastructure Solutions division generated $4.3 billion in revenue last year. If companies continue to choose Dell to help them optimize the computing power of advanced computer chips from companies like Nvidia, then investors should see revenues from this division grow in the coming years.

Potential and Caution for Beneficiaries of Artificial Intelligence

Expectations are high for Dell, especially after Nvidia's chief executive officer mentioned Dell directly. Over the past five years, Dell's stock price has risen more than 300%, outpacing its computing hardware competitors.Apple Inc.The

Dell's Infrastructure Solutions division is poised for rapid growth in the coming years if companies keep building more and more AI computing systems. Dell is one of the top brands in the space, with tens of billions - maybe hundreds of billions - of dollars in sales to chase. So it's not surprising that some are excited about Dell as one of the next big AI winners.

But it's risky to bet on a stock simply because of this hype. Every year, Wall Street launches a new story around which "hot" sectors investors should buy into. Sometimes these sectors become huge opportunities to drive the global economy, such as cloud computing.

For the most part, Wall Street's hot sectors one year are a sideshow the next. In the last decade alone, investors have seen booms and busts in industries like marijuana, 3D printing and meta-universes. These industries have been touted as the next big thing, but most of the stocks in these sectors have severely underperformed the broader market.

That's not to say that AI is overhyped, but investors should exercise caution when investing in current trends.

Is it time to buy stocks?

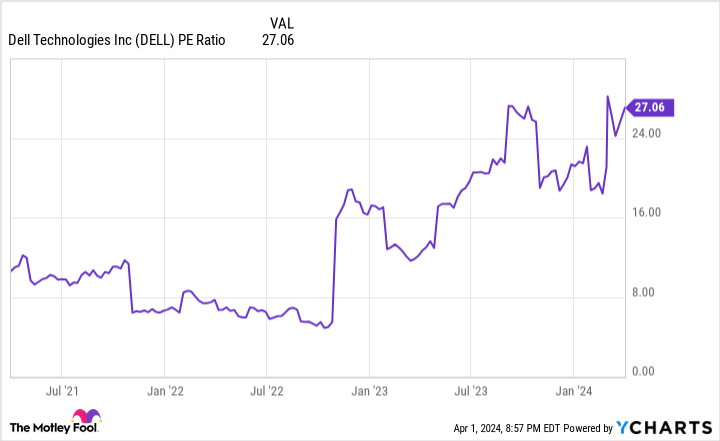

In 2022, Dell's price-to-earnings (P/E) ratio is below 8. withStandard & Poor's 500This is a very cheap P/E ratio compared to the market average for the index, and has been a key reason for the stock's great returns over the past few years.

However, the company's underlying earnings have been volatile over the same period, with FY2024 EPS essentially flat compared to FY2021. Despite this, it is still a significant increase from pre-pandemic levels.

As a result, most of the stock's gains have come from multiple expansion. Currently, the stock has a price-to-earnings ratio of 27, which is close to the S&P 500 average.

Buying the stock at a price-to-earnings ratio of 27 implies that the company is expected to deliver strong earnings performance in the coming years, and that it will live up to its claims of being a beneficiary of artificial intelligence through sustained financial growth. So far, it's hard to see evidence of that, while its competitors like Nvidia and Super Micro Computer are rocketing in revenue and earnings.

If Dell Technologies can push earnings higher, the stock could still be worth trading after its recent run-up. But if the bottom line remains stagnant or even declines, it will be difficult for the stock to maintain its current momentum.

Should you invest $1,000 in Dell Technologies now?

Consider this before buying shares of Dell Technologies:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)The name of the person is suitable for the investor to purchase10Only the stock ...... Dell Technologies was not included. The 10 stocks that made the list could generate huge returns over the next few years.

Consider April 15, 2005NvidiaWhen on the list ...... if you invest 1,000 at the time of our referralIn dollars, you'll have $526,345.! * *

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 4, 2024

Brett Schafer does not own any of the stocks listed above. the Motley Fool holds recommendations on Apple, Microsoft, and Nvidia. the Motley Fool recommends the following options: long Microsoft January 2026 $395 calls and short Microsoft January 2026 $405 calls. the Motley Fool has a disclosure policy. Motley Fool has a disclosure policy.

Should You Buy This Sneaky AI Stock Before It's Too Late? This post was originally published by The Motley Fool.