.

Three Reasons to Buy Superior Stock

Are you interested in holding Advantage Technologyfirms(NYSE: UBER)Is the Government hesitant to take up the shares? If so, it's understandable. The ride-hailing business still feels shaky, and Uber's shares aren't cheap, especially after rising 150% in the last 12 months.

On balance, however, the case for Uber is stronger than the case against. If you're ready and willing to take the plunge, just be patient. To that end, here are the top three reasons to buy Uber stock now.

Profit (finally) explodes

If you're not familiar with Uber, it's a ride-hailing company. It's the equivalent of a taxi service, except that it uses technology and contracted drivers to improve its efficiency.

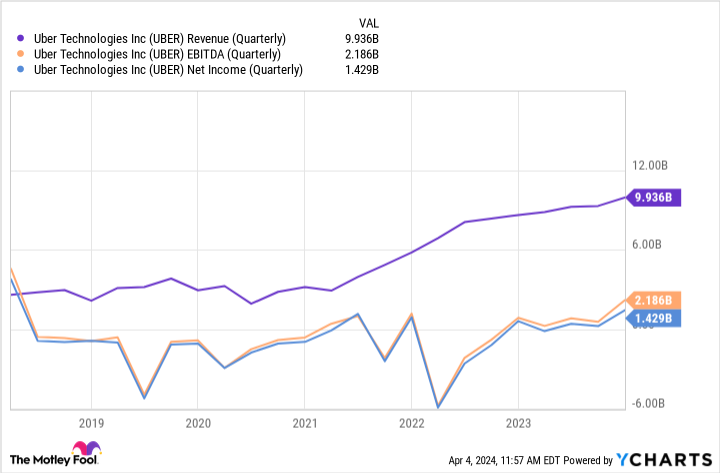

Like most other companies, Uber started out losing money. But it's no longer losing money. Since the end of 2022, it's been profitable on a regular basis. And over time, its earnings estimates have gotten higher, from last year's earnings of $0.87 per share to this year's estimate of $1.34 per share to a projected earnings of $2.17 per share by 2025.

Interestingly, net profit is currently growing much faster than the company's sales. What are the reasons?

In the simplest terms, Uber finally has what all young, small startups eventually want: momentum. That is, it's now doing enough business to cover all of its variable costs (such as paying its drivers) and fixed costs (such as company rent, advertising and government salaries).

The larger the company, the higher the overall profit margin, because fixed costs tend to be fixed. That's why Uber's bottom line can grow faster than its revenue. For this reason, analysts believe that Uber's earnings per share will more than double between 2024 and 2026.

Huge room for future growth

There are a couple of not-exactly-related reasons why Uber may see more growth of the same magnitude after 2026. Both reasons are worth keeping an eye on.

1. Delivered daily

While it's no longer uncommon to pay strangers for a ride in your own private car, it's no longer a high-growth business. Mordor Intelligence predicts that the global ride hailing market will grow at an annual rate of less than 9% by 2029.

However, Uber drivers don't just get people from point A to point B. They also deliver pre-authorized meal orders. They also deliver pre-order meals and, increasingly, merchandise purchased online from neighborhood stores. In the last quarter of 2023, the business nearly doubled its EBITDA year-on-year.

And here's why: data from Straits Research shows that the market for so-called "seldom-used logistics" is expected to grow at an average annual rate of more than 21% through 2030. The researcher adds that the food delivery market is expected to grow at an annual rate of more than 18% during the same period.

2. The aging of consumers is beneficial to YouTuber.

While getting people where they want to go is no longer a high-growth business, it is a (very) long-lasting one. It's probably no surprise that millennials (25 to 40 years old) are the most frequent users of ride hailing services. These people essentially grew up in an era when cell phones were commonplace, and real smartphones have been in use for most of their adult lives.

Most Millennials are now also high-income earners who are willing and able to pay for ride-hailing services, and as much as possible, they are more likely to own their own cars.

Generation Z (teens to 25 years old) are also fans of ride-sharing services, and they don't have fond memories of a time when smartphones didn't exist. The main reasons they don't use these services as often as they should are lack of time, money, and reason. Even so, Uber recently changed the age limit for riding in its chauffeur-driven vehicles, allowing people between the ages of 13 and 17 to ride in its vehicles with their parents' permission. This decision shows who the company's next big market might be.

As for Gen Xers (40 to 60 years old) and Baby Boomers (60+ years old), some of them will take Uber...but the aggregate will not. For most people, the premise of Uber is still too unusual.

The younger the connected consumer, the more likely they are to use ride hailing services. As the world ages, the more likely it is that the average consumer will embrace ride hailing. This trend is also underscored by the apparent decline in interest among young people in obtaining a driver's license. The U.S. Federal Highway Administration reports that between 1995 and 2021, the percentage of 16- to 19-year-olds with a driver's license dropped from 64% to 40%.

Be patient, but don't be stubborn

The backdrop may be bullish for Uber, but it's important to respect the fact that Uber's stock has been on a tear since late 2022, eventually stalling out after hitting an all-time high in February of this year. Most of the big gains are still intact. However, the fact that the pace of progress has stalled suggests that the bulls have suddenly become cautious. That in itself is a hint that too many investors may now be skeptical of the stock's bubble price. Trade accordingly.

That said, it's also important to realize that it's easy to be overly cautious and skimpy when waiting for a better entry point for a stock. If you're interested in getting into Uber, it's probably better to get in early than wait too long. This stock doesn't seem to go down too far when it goes down, and it doesn't go down for too long when it goes down.

Should you invest $1,000 in Youtube Technologies right now?

Consider the following before purchasing stock in Superior Technology, Inc:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only ...... and Uber Technologies are not among them. The 10 stocks that made the list could generate huge returns in the years to come.

Consider April 15, 2005Nvidia) when it was on the list ...... If you invested $1,000 at the time of our recommendation.You will have $526,345.! *Stock Advisor provides easy-to-use stock investment tools for investors.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 4, 2024

James Brumley does not hold any of the above stocks.The Motley Fool holds a recommendation for Uber Technologies.The Motley Fool has a disclosure policy.

Three Reasons to Buy Advantage Stock Like There's No Tomorrow was originally published by The Motley Fool.