.

Lee's Automotive (NASDAQ:LI): Growth Potential Remains Despite Weak Koon Delivery Forecasts

Li Shufu, China Motor Corporation(NASDAQ:LI)) just announced that its March 2024 deliveries climbed 39% year-over-year, solidifying its leadership position in the electric vehicle space. With the electric vehicle market expected to grow rapidly, this production momentum is likely to continue, driving the stock price sharply higher. However, despite the sharp rise in deliveries, Li recently lowered his delivery forecast.

Analysts have touted Li as one of the emerging leaders in China's fast-growing electric car market. I share their optimism, especially since the stock is currently trading more than a third below its recent high of more than $46 per share in February. In total, I'm bullish on Lee. However, there are a variety of positive and negative factors to consider before buying Lee's auto stock. Let's analyze them in detail below.

Profitability sets Li Shu Fu apart

In the highly competitive electric vehicle industry, one of the things that sets Li Shu Fu apart from its competitors is its profitability. in the last quarter of 2023, the company reported operating income of nearly $428 million, with an operating margin of 7.3%. net profit for the quarter was more than $810 million.

Electric cars are notoriously unprofitable for automakers. Whether it's a new entrant focusing on this type of car, or a newcomer like Ford(NYSE:F)For an established automobile company such as the U.S. Motor Car Corporation (U.S.M.C.C.), each electric vehicle sold often faces a loss of tens of thousands of dollars. This is probably due to the high cost of batteries and other technologies behind electric vehicles.

Some competitors, such as Ford, and even the American electric car giant Tesla(NASDAQ:TSLA)While Li Shufu has made up for the loss of electric cars through other car sales, batteries, and other equipment and services, Li Shufu focuses only on electric cars. That makes its unique profitability all the more remarkable.

Li Auto: growth and enviable market position

For many of the new EV manufacturers, another key challenge after profitability is mold. Because of the high production costs and complexity of these vehicles, developing capacity to increase production and delivery is a huge challenge.

In terms of a number of indicators, Li has managed to realize an impressive growth rate. Net income in the last quarter was $810 million, up a whopping 20,681 TP3T from the same period a year ago. vehicle deliveries in the first quarter of 2024 were slightly above 80,000 units, up about 531 TP3T from the same period a year ago. as of the end of March 2024, Lee had 474 retail stores in 142 cities, up from 299 stores in 123 cities a year ago.

Li Shufu is also well positioned in China's huge electric vehicle market, where new sales of electric vehicles will almost double in 2022, outpacing the growth rate in the United States and many European countries. More than half of the electric vehicles on the world's roads are in China, and China exports more than a third of all electric vehicles. As this market continues to thrive, Li is likely to benefit from increased domestic sales and global demand for Chinese exports.

Li's delivery expectations downgraded

Although Li Shu Fu's deliveries have increased significantly in recent months compared to a year ago, the company's recent deliveries have been lower than initially expected. In March, the company lowered its delivery forecast for the current quarter to 78,000 units from a high of 103,000 units. This led to a sell-off in Li's stock.

Li attributed the cut in part to what he called a "pacing-less" operating strategy for the recently launched minicar, the Li MEGA, which Li says is the largest passenger electric vehicle on the market.

Investors may be cautious to learn that Li has lowered its delivery expectations. However, it is important to remember that even the downward revision in delivery expectations reflects a significant increase in the number of vehicles delivered compared to the previous year.In the first three months of 2023, Lee delivered more than 52,000 vehicles. If the company meets its downwardly revised estimate of around 70,000 vehicles in the first quarter of 2024, that would represent a year-over-year increase of about 50%.

Do analysts think Li Shu Fu's stock is worth buying?

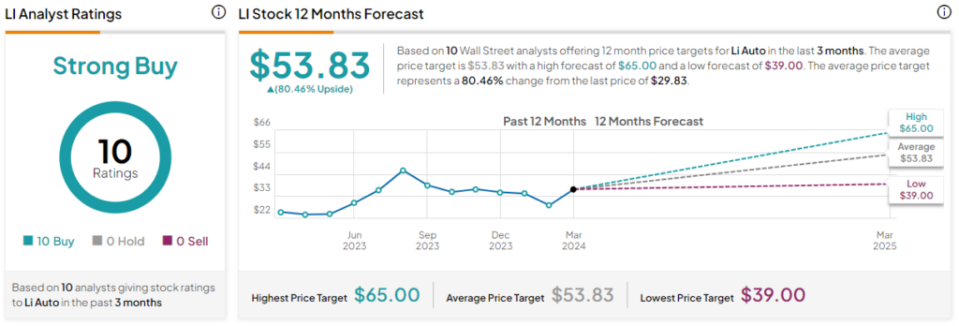

For optimistic investors, the recent stock sell-off means a great opportunity to buy LI. While LI stock has fallen about 20% in the last month, it has risen more than 26% in the past year. these factors may be the reason why the stock has received a consensus buy rating from Wall Street analysts. This is based on 10 buys, 0 holds and 0 sells. Leo has an average price target of $53.83, implying an upside of 80.5%.

Conclusion: Despite the setback, Li Shufu is still well-positioned for growth.

While Koon will need to recalibrate the launch of the MEGA to get its deliveries back on track, there is still strong potential for growth based on its profitability, its position in the Chinese EV market, and its track record of successful scalability.

Disclosure of information