.

Better Artificial Intelligence (AI) Stocks : Dell and Supercomputer

The artificial intelligence (AI) server market has grown exponentially over the past year as cloud computing companies and data center providers have invested in building AI infrastructure and developing AI applications. This explains whyDell Technologies (NYSE: DELL)respond in singingsupercomputer (NASDAQ: SMCI)The stock price of server makers such as

Dell's stock price has nearly tripled in the past year, while Supermicro's shares have soared 873%. Surprisingly, though, both companies are still attractively valued, despite their spectacular share price rises in the past year.

So, if you had to buy one of these two AI server companies right now, which would be the better choice? Let's find out.

Reasons for Dell Technologies

Dell Technologies is a leader in the global server market. According to third-party estimates, the company's share of the overall server market will reach 19% by the end of 2022, so it's easy to see why the company is benefiting from the growing demand for AI servers.

Dell Inc. reported that orders for AI optimization servers grew nearly 40% in the fourth quarter of fiscal year 2024 (ended February 29, 2024) from the previous quarter, when the company sold $800 million worth of AI servers. That number should continue to rise as Dell's AI server backlog almost doubled from the previous quarter to $2.9 billion. The AI server market is forecast to reach $150 billion in annual revenue by 2027, up from $30 billion last year, and Dell still has a lot of room to grow in this market.

It's worth noting that AI servers currently represent only a small portion of Dell's overall business. The company reported revenue of $22.3 billion in the fourth quarter, down 11% from the same period last year. the year-over-year decline was attributed to Dell's Customer Solutions division, which sells personal computers (PCs) and workstations through the division.

Last year, the health of the PC market wasn't good, with shipments down nearly 141 TP3T from 2022, which explains why Dell's customer solutions revenue fell 121 TP3T year-over-year in the last quarter. the good news is that the segment could return to growth in 2024, thanks to the adoption of AI PCs. Market research firm Canalys estimates that annual shipments of AI PCs will jump to 205 million units by 2028, up from 48 million this year.

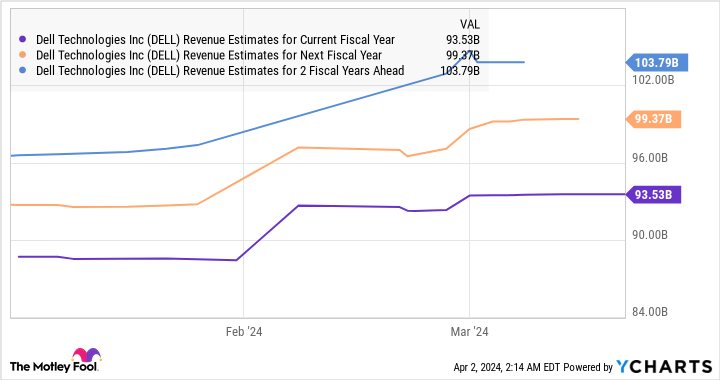

As a result, Dell has two lucrative AI-related catalysts that are likely to help it return to growth starting this fiscal year. in fiscal 2024, the company realized revenue of $88.4 billion, a decline of $14% from the year-ago period. nevertheless, as shown in the chart below, its revenue will grow starting in fiscal 2025.

The Case of Supercomputer, Inc.

Supermicro is a much smaller company than Dell. Its revenue for fiscal year 2023 (which ended last June) was just $7.1 billion. However, the smaller size means that sales of AI servers are a bigger driver for Supermicro.

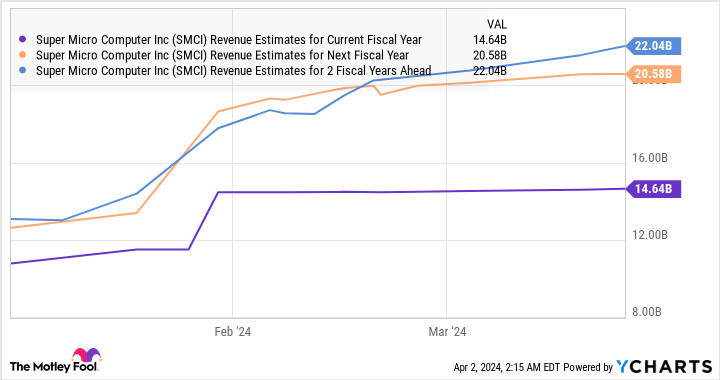

In the last quarter, the company's revenue from the sale of artificial intelligence-related server solutions accounted for more than 50% of total revenue. This explains why the company's revenue is expected to double to $14.5 billion this fiscal year. If half of Supermicro's FY2024 revenue comes from AI server sales, it will generate at least $7.2 billion in sales from this fast-growing market. This means that Supermicro's quarterly AI server revenue is growing at a higher rate compared to Dell.

In addition, it is worth noting that Supermicro could translate its revenues from current levels as it has expanded its manufacturing operations to support more than $25 billion in annual revenues. The company's current capacity utilization is improving rapidly. Our factories in the U.S., the Netherlands and Taiwan are utilizing approximately 65% of production capacity, and these factories are filling up quickly," said Supermicro's management on the January earnings call.

It is therefore easy to understand why the consensus forecast is for SuperMicro to continue to grow at a solid pace in FY2024 and beyond.

Not surprisingly, Supermicro exceeded the FY2026 consensus estimate. That's because, in the words of management, "Next-generation AI and CPU platforms continue to drive strong levels of design wins, orders and backlogs from top-tier data centers, emerging cloud providers, enterprise/channel and edge/IoT/telecom customers.

Conclusion

I've already pointed out that Supermicro's smaller size is an advantage, as demand for its AI servers is driving stronger growth than Dell's. This explains why analysts are forecasting Supermicro's earnings to grow at 48% per year over the next five years. This also explains why analysts forecast Supermicro's earnings to grow at a rate of 48% per year over the next five years. Dell's annual earnings growth over the next five years is expected to be almost negligible.

However, Dell's fortunes could change, as its earnings growth could accelerate once its AI server business gets bigger and AI PCs start to drive customer business growth. That's why investors looking for potential AI winners at attractive valuations may want to consider buying Dell, which trades at a forward P/E of just 15.7 times, below Supermicro's 36 times forward P/E.

However, we see that Supermicro is growing much faster, which justifies a higher valuation. Therefore, growth-oriented investors may want to consider buying Supermicro over Dell, as Supermicro's fast-growth nature will help lead to healthier returns in the long run.

Should you invest $1,000 in Dell Technologies right now?

Before buying shares of Dell Technologies, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only one stock, ...... Dell Technologies, was not included. The 10 stocks that made the list could generate huge returns in the years to come.

Consider April 15, 2005Nvidia) on the list at ...... If you invested $1,000 at the time of our referralYou will own 539,230dollar! *Stock Advisor provides easy-to-use stock investment tools for investors.

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 4, 2024

Harsh Chauhan does not hold any of the above shares.The Motley Fool does not hold any of the above shares.The Motley Fool has a disclosure policy.

Better Artificial Intelligence (AI) Stocks : Dell and the Supermicrocomputer was originally published by The Motley Fool.