.

History has shown that brilliant companies can also be disappointing stocks. Will Inventec be next?

Fear of Missing Out (also known as FOMO) can lead to shocking excesses on Wall Street. A so-called bubble can push stocks so high that you start to believe there's no way out. Right now.INVISTA (NASDAQ: NVDA)It doesn't seem to go wrong, and its stock price has risen along with it. However, if you follow Wall Street history, you'll see that buying INVISTA today could easily be the wrong decision.

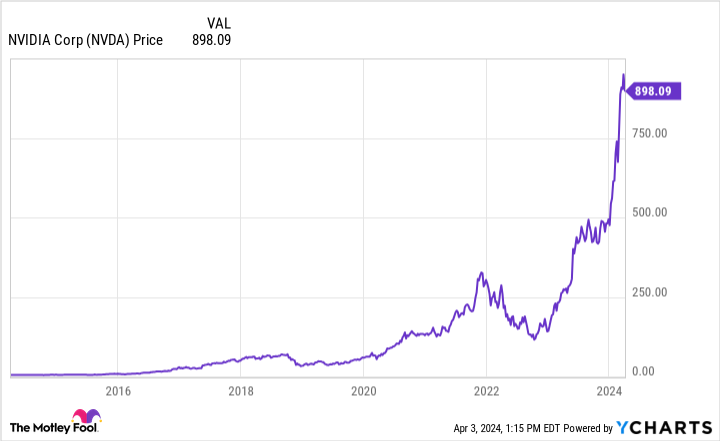

INVISTA's stock price has risen incredibly.

Nvidia's biggest draw is its ability to produce high-powered chips that run artificial intelligence (AI) applications. AI is a big deal in technology today, and almost every company is either developing AI products directly or explaining to investors how AI will directly benefit the company in some way (e.g., by improving efficiency or automating tasks). Wall Street is obsessed with AI and everything related to it.

Thanks to Nvidia's direct connection to the field of artificial intelligence and the lucrative gains it has made, Nvidia's stock price has been on a tear. In the past year alone, the stock has risen 2,23%, in the past three years it has risen more than 5,50%, and in the past five years it has risen more than 18,60%.

Scanning the 10-year price chart on Noodle's face, Nvidia's stock price has shot up like a rocket. Rising prices and artificial intelligence fever have investors clamoring to buy. But don't jump on this rocket without considering some Wall Street history.

Ben Graham's Wisdom During the Great Depression

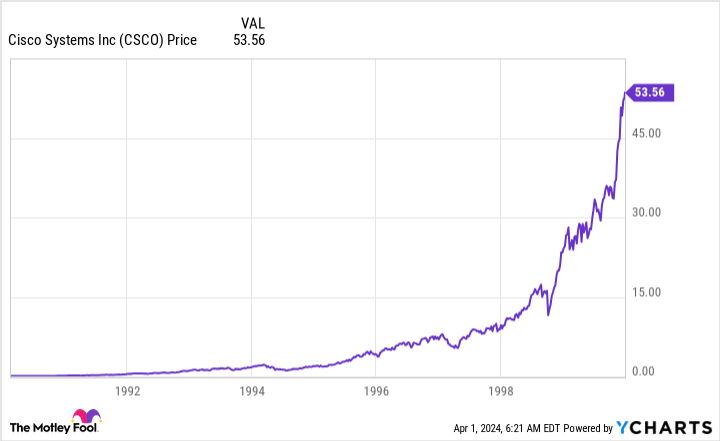

Benjamin Graham is Warren Buffett's mentor and the author of the classic investment tomeThe Intelligent Investor.The author of the book To paraphrase this Wall Street giant, even a good company can be a bad investment if you pay too much for it.Cisco Systems, Inc. (NASDAQ resonance code: CSCO)This is a good example. See the picture below.

It's hard not to notice how similar its rocket trajectory is to Nvidia's in the chart above. But the key feature of this chart isn't really the stock price, it's the date. The chart ends on the last trading day of 1999. The next chart brings the story up to the present, and it's enough to scare any investor who currently has a full position in Nvidia.

In short, the huge peaks of the dot-com boom were followed by the huge crashes of the dot-com bust. Cisco's stock price has yet to regain its lost ground. If you bought near the peak, your investment is still in the red (before reinvesting dividends).

You could argue that this is an example of a misstep, and you'd be right. But Wall Street doesn't have a crystal ball, and there's no way to know if Nvidia will avoid a similar fate. In fact, while Nvidia currently dominates the field of AI-enabled chips, its competitors are trying to catch up. At that point, Nvidia may not be so special anymore, and investors may grow weary of its stock. Wall Street history suggests that Nvidia's shocking mass of stock price inflation will one day come to an end, as it has for many other stocks.

Don't forget gravity.

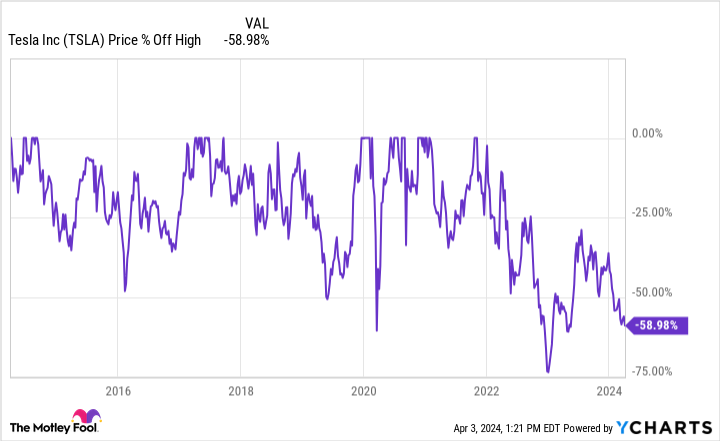

Few companies can defy gravity forever. TakeNikola Tesla (1856-1943), Serbian inventor and engineer (NASDAQ: TSLA)For example, since the electric car giant became profitable on a sustainable basis around 2020, its shares have fallen about 50%, or nearly 60% from the all-time highs reached at the end of 2021, which may seem counterintuitive, but on Wall Street, stories often have more impact than profits. When the story runs out, the high stock price falls painfully to the ground.

Don't let the "FOMO" fool you; Nvidia may be a great company, but it can still end up being a bad investment if you pay too much for it.

Should you invest $1,000 in Nvidia now?

Before buying Nvidia stock, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Nvidia is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 4, 2024

Reuben Gregg Brewer does not own any of the stocks listed above.The Motley Fool holds recommendations for Cisco Systems, Nvidia and Tesla.The Motley Fool has a disclosure policy.

History shows that great companies can also be disappointing stocks. Is Nvidia next? Originally posted by The Motley Fool