.

3 No-Frills Stocks Billionaires Own Right Now

Generally speaking, you don't want to unconsciously copy someone else's investment portfolio because different strategies work better for different investors. Not everyone has the same investment style, risk tolerance, financial goals or time horizon. That said, there is nothing wrong with a曏 investor-especially a successful one-seeking an investment philosophy.

There are two billionaires in particular, Warren Buffett and Cathie Wood, who are often the targets of investors seeking曏. If you're looking for stocks owned by billionaire investors to add to your portfolio, the following three stocks are good choices. These stocks are owned by Warren Buffett'sBerkshire Hathawayfirms(NYSE: BRK.A)(New York Stock Exchange: BRK).B) or held by Wood's ARK Invest.

1. Visa

Although Visa is only a small part of Berkshire Hathaway's equity portfolio, it is one of the more solid blue-chip stocks owned by Warren Buffett's company.

Visa's competitive advantage (and one of the reasons it's one of my favorite stocks) is its vast scope of business. There are more than 4.3 billion Visa cards in circulation, and more than 130 million merchants worldwide accept Visa cards. Both of these numbers far outstrip the runner-up!MasterCardThe network's reach continues to grow. Visa's reach continues to grow as a result of the network.

As a merchant, you're more likely to accept Visa because you know it's the most commonly used card and not accepting it could mean missing out on a lot of sales opportunities. As a potential cardholder, you would be more likely to accept Visa cards because you know that Visa is the most accepted card in the world. This is a win-win situation for the payment processing giant.

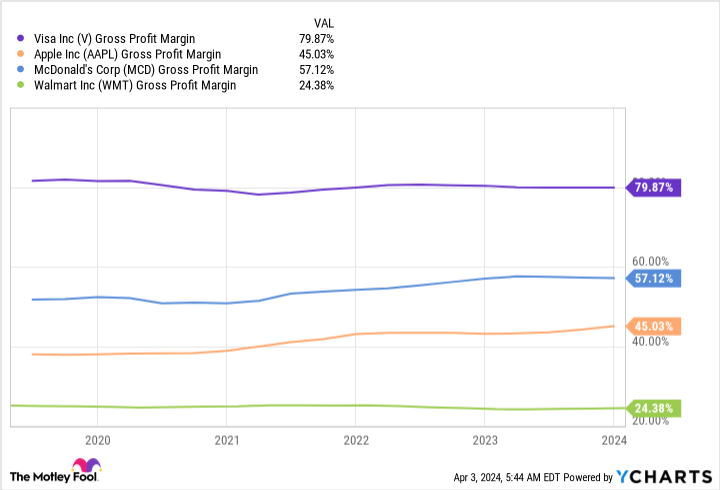

This network experience and organic growth has also helped Visa achieve profit margins that are unmatched by any company in the industry. Gross margins are typically around 80%. Here's how Visa compares to other industry market leaders.

Visa is well positioned to continue its market dominance. With its strong brand recognition and global reach, it will be a major beneficiary of the shift to digital payments for the world's bubbles.

2. Meta Platforms

Meta Platforms (NASDAQ resonance stock code: META)Wood's popularARK Innovation ETF One of the stocks held is also a member of the rather influential "Magnificent Seven". You could also argue that even though Meta's share price has soared by more than 130% in the past 12 months, it is still currently the best value of this esteemed group of companies.

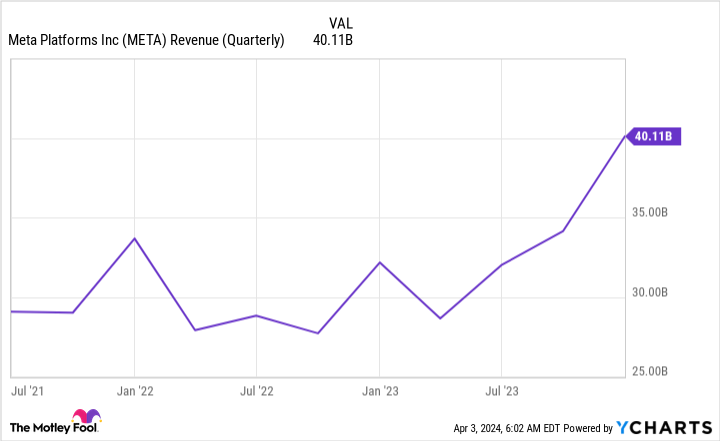

From a public relations perspective, Meta has had its share of problems over the past few years, and the slowdown in advertising spending has inevitably had an impact on its revenues. The latter is important because Meta relies on advertising for nearly 98% of its revenue. However, an optimistic economic outlook and increased advertising spending put the company on another financial footing last year.

Meta's breadth of reach (and the fact that it's a beneficiary of the network's utility) makes it a must-have for advertisers looking to reach a wide range of consumers, and while Facebook may be Meta's main platform, Instagram, WhatsApp, and Messenger also contribute to the company's nearly 4 billion monthly active users.

Another good thing about investing in Meta is that the company declared its first-ever dividend in February. The $0.50 per share dividend yields about 0.40%, which won't make income-seeking investors salivate, but over time it can add to an investor's total return, which will continue to grow each year.

3. DraftKings

DraftKings (NASDAQ: DKNG)Another stock in Wood's ARK Innovation ETF. The sports betting giant is one of the biggest platforms in the industry, and it should continue to gain momentum as the sports betting boom spreads.

The U.S. sports betting market has entered the mainstream, with 38 states and Washington D.C. now allowing some form of sports betting. This is a dramatic change from six years ago, when the U.S. Supreme Court decided to overturn the federal ban on commercial sports betting (with a few exceptions, such as in Las Vegas).

DraftKings has also capitalized on relatively recent growth. Five years ago, at the end of the fourth quarter (Q4) of 2018, there were 1.7 million unique customers on the DraftKings platform. Fast forward to Q4 2023, and that number has soared to 7.1 million.

DraftKings is the number one player in online sports betting and iGaming in the U.S., and as such, it is well-positioned for rapid growth alongside the industry. 2023 global online sports betting revenues are estimated to be approximately $43 billion. In 2023, global online sports betting revenues were approximately $43 billion, and by 2029, they are expected to exceed $65.6 billion. There are still plenty of opportunities for growth, and DraftKings' focus on capturing market share should give it a long-term advantage.

Should you invest $1,000 in Visa now?

Consider this before you buy Visa shares:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)The name of the person is suitable for the investor to purchase10Only ...... and Visa is not one of them. The 10 stocks that made the list could generate huge returns in the years to come.

Consider April 15, 2005Nvidia) on the list at ...... If you invest $1,000 at the time of our recommendation, theYou will own 539,230dollar! * *The

Stock AdvisorProvides investors with an easy-to-follow blueprint for success, including guidance on building an investment team, regular updates from analysts and two new stock picks each month. Stock Advisor The rate of return for the service since 2002 has been the same as that for the S&P 500 index, but the rate of return for the service has been the same as that for the S&P 500 index.more than four times*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 4, 2024

Randi Zuckerberg, former Facebook Market Development Mass Director and Spokeswoman, and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's Board of Directors. Stefon Walters serves on the boards of Apple, DraftKings, and McLean's. The Motley Fool owns shares of Apple, Berkshire Hathaway, MasterCard, Meta Platforms, Visa, and Walmart, which it recommends. The Motley Fool recommends the following options: Long January 2025 MasterCard Calls worth $370 and Short January 2025 MasterCard Calls worth $380. The Motley Fool has a disclosure policy.

3 Effortless Stocks to Buy Now That Billionaires Own was originally published by The Motley Fool.