.

The Best Performing "Magnificent Seven" Stocks of the Past Month (Hint: It's Not Nvidia)

Bank of AmericaAnalyst Michael Hartnett coined the term "Magnificent Seven" to describe seven large technology-focused companies. Because of their combined strengths of size, fundamentals, and growth, these companies are leading the market uptrend in 2023. They also provideStandard & Poor's 500 The rise in the index in 2024 contributes most of the strength.

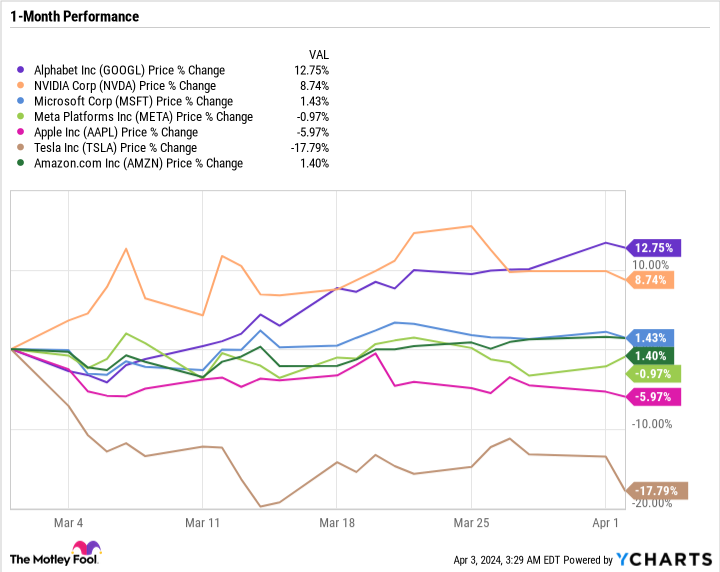

However, something changed last month. One of the three "Magnificent Seven" stocks, which had been declining so far this year, suddenly surged last month.

followingAlphabet (NASDAQ: GOOG) (NASDAQ: GOOGL)The reason it's suddenly the hottest "Magnificent Seven" stock, and why it's still a great value despite hovering near 52-week highs.

in a hopeless situation

In 2024, Alphabet's stock price was soaring. in late January, Alphabet's stock price was about the same as it is now - above $150 per share. But in early March, the stock fell to a low of $130 per share as investors became pessimistic about its artificial intelligence (AI) investments - particularly Google Gemini AI and its inaccuracies.

But in mid-March, news broke that Alphabet was working with theApple Inc.Negotiations to license Gemini AI in the iPhone put a much-needed stamp of approval on Alphabet's AI efforts. on March 18, the stock was up 7.7%, and has gained more than 12% in the past month.

The deal with Apple would be a big one for Alphabet. As much as Alphabet owns differentiated businesses like Google Search, YouTube, Google Cloud, and Android, the vast majority of its revenue still relies on advertising. The more it can get rid of advertising and diversify its business, the wider its moat will be, and the more leverage it can pull to achieve growth.

At least in the short term, Wall Street's favoritism for Alphabet stock has been mixed, depending on its capabilities and potential in artificial intelligence. In fact, the company has been monetizing AI for some time, with a large R&D budget and cash to invest in innovation.

Alphabet has a goal behind it.

With so many growth stories in the marketplace, it's easy to get caught up in the implied growth trajectory and overlook the companies that have already accomplished so much and are making so much money. In other words, ignore the unknowns and overlook the proven winners.

Alphabet is a proven winner, but there are questions about how it will stay a winner in the face of such fierce competition.

Google Search and YouTube rely on complex artificial intelligence algorithms. But TikTok andMeta Platforms Platforms such as Instagram Reels have been touted as an alternative search engine to Google by younger generations such as the Z generation.

Meanwhile, in terms of cloud infrastructure market share, Google Cloud is second only to Google Cloud in terms of market share.MicrosoftAzure andAmazon Network Services (Amazon Web Services), ranked third.

Android remains the dominant operating system globally, but iOS has a larger market share in core regions such as the U.S., and Apple has more control over hardware and software integration than Alphabet.

Change of mindset

The half-empty outlook for Alphabet is that it is a market leader in many different industries, but all of its industries are ripe for disruption.

Alphabet has been the leader in search for decades, but it remains to be seen if it can continue to lead in the face of increasing competition from short-form video platforms or new competitors.

With consumers having more entertainment choices than ever before, will YouTube lose market share to other streaming sites?

Can Google Cloud grab market share against its larger peers?

All these questions are valid.

When you like a company, it's good to consider the countervailing mass. Charlie Munger once said that the process of contrarianism is a way of expanding your mind. Before we buy a stock, we usually think about why the company is a good investment. But in the reversal process, we need to think about all the reasons why people want to sell a stock, why it might go lower, why it might underperform the market, and so on.

Even the best stocks usually have halfway decent counterarguments. But sometimes, if the market is as pessimistic about a stock as it is about Alphabet versus the rest of the "Magnificent Seven," even bad counterarguments can become the prevailing sentiment.

Alphabet. It's worth a fortune.

Alphabet has a proven cash flow business model and a large number of AI monetization routes. It is no stranger to competition, as there are other companies trying to get a slice of the high-margin industry.

Working in Alphabet's favor is its low valuation. Its price-to-earnings ratio is just 26.7, slightly higher than Apple's 26.3 and the second-lowest among the Magnificent Seven. In addition, its price-to-earnings ratio of 28.8 is also the second-lowest among the "Magnificent Seven" after Apple.

Alphabet may not be the most exciting growth stock right now, but it has a profitable business and room to grow. But it has a profitable business and room to take risks and grow, and Alphabet's deep pockets and track record of innovation are enough to keep its stock price from falling below the S&P 500 (as it is right now).

Alphabet's share price should never have fallen so far. Even now, it looks like a reasonable long-term buy for patient investors.

Should you invest $1,000 in Alphabet now?

Before buying Alphabet stock, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only ...... and Alphabet is not one of them. The 10 stocks that made the list could generate huge returns in the coming years.

Consider April 15, 2005NvidiaWhat it was like when it was on the list ...... If you invested $1,000 at the time of our recommendation.You will have 539 230dollar! *Stock Advisor provides easy-to-use stock investment tools for investors.

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 4, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former Chief Executive Officer of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's Board of Directors. Randi Zuckerberg, former Director of Mass Development and Spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool Board of Directors, and Suzanne Frey, former CEO of Alphabet, is a member of The Motley Fool Board of Directors. (Suzanne Frey, an Alphabet executive, is a member of The Motley Fool's Board of Directors. Daniel Foelber has no position in any of the stocks mentioned above. The Motley Fool recommends Alphabet, Amazon, Apple, Bank of America, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: Microsoft January 2026 $395 Call Option Long and Microsoft January 2026 $405 Call Option Short.The Motley Fool has a disclosure policy.

The "Top 7 Best Performing Stocks" of the Past Month (Hint: It's Not Nvidia) was originally published by The Motley Fool.