.

Best Stocks to Buy Right Now: Home Depot and Lloyd's List

At first glance, the two retailers look very similar, almost interchangeable. However, for investors, it's the details that make the difference. Home improvement chainLloyd's (NYSE: LOW)respond in singingHome Depotfirms(NYSE: HD)To the investor, it is a very different story. One stock is better than the other.

That winning name? Home Depot. Here's why.

Home Depot and Lloyd's

Don't get me wrong - both retailers face challenges, but both will survive for the foreseeable future. If you already own shares of Lloyd's, there's no need to switch to Home Depot right away. But if you're weighing the prospects of both now, go with Home Depot.

But first things first. Lloyd's operates 1,746 stores in the United States. For the fiscal year ending in early February, the company generated $86 billion in revenue, about three-quarters of which came from ordinary consumers like you. Another quarter came from contractors and other professionals.

Home Depot is slightly larger, at least in terms of physical footprint, with 2,335 locations covering most of North America and some parts of Latin America. But Home Depot's business is disproportionately large compared to Lloyd's, which generated $153 billion in sales in the same 12-month period. It's important to note that about half of Home Depot's sales come from specialty contractors.

Demand rekindling is just around the corner

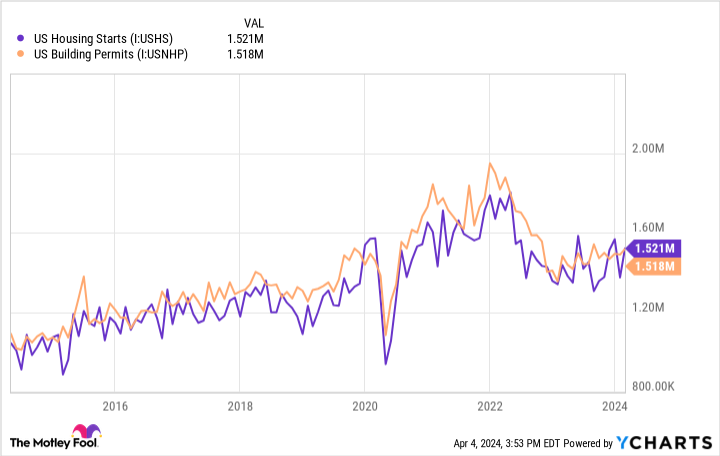

The contractor business, of course, will have a much bigger impact on Home Depot than on Lloyd's in 2022 and 2023, as the struggling real estate market leads to a decline in new home starts. Last year, Home Depot's same-store sales declined by 3.21 TP3T, which is significant by retail standards.

However, if we take a step back, we can see a broader picture. Whereas the real estate headwinds were only temporary, most economists still expect a few more rate cuts in the foreseeable future, despite lingering inflation. Most economists still expect inflation to linger, but there will be a few more interest rate cuts in the foreseeable future, which in turn will rekindle interest in home buying and building. To that end, the National Association of Home Builders/ National Association of Home Construction Companies (NAHBC) has issued a report.Wells Fargo BankThe Housing Market Index has risen nearly 40% since December to an eight-month high, signaling that homebuilders are finally seeing the light.

Even though the near-term outlook for homebuilding remains uncertain, Home Depot stock remains a long-term buying opportunity.Moody's) analysis shows that even with strong residential construction activity in 2024, the U.S. will still need between 1.5 million and 2 million homes by the end of this year. It could take years to close that gap, and homebuilders are struggling just to keep up with population growth.

Also, the Joint Center for Housing Studies at Harvard University says that while the slowdown in home remodeling and translations will likely continue to cool in 2024, that downward trend is also likely to bottom out this year.

Funding Issues

Home Depot's closer ties to specialty contractors aren't the only reason it's a better choice for investors. It also has the advantage of being bigger and better capitalized. Not only is Home Depot bigger than Lowe's, but it's also more profitable, with net income of $15.1 billion in 2023, compared to $7.7 billion for Lowe's. With more profits, Home Depot can invest more in its own growth.

And that's exactly what it did. Back in 2018, the retailer began investing billions of dollars in new technologies that are still paying well-known dividends today. These technologies include supply chain improvements, web search, e-commerce, and the entire range of online and in-store features.

The company continues to make such investments, and in early 2023, it earmarked $1 billion to pay its employees, ultimately as a means of improving its interaction with customers. Last year, the company established a $15 billion stock buyback program, an investment in the value of Home Depot's stock.

In perhaps one of the most positive and exciting moves, Home Depot recently announced plans to acquire SRS Distribution, which offers specialty construction products to specialty contractors through hundreds of independently owned stores. This is an excellent promotion for Home Depot's already sizable contractor customer base.

That's not to say that Lowe's can't spend this kind of money. But for the smaller Lloyd's, it would certainly be more difficult to make such an investment without adversely affecting its balance sheet or other businesses.

Connection Points

Again, if you already own Lloyd's, don't panic. It's fine.

However, you should know that over time, the little things can become big things. Home Depot has more than enough of those little things, and Lloyd's doesn't matter to long-term investors. Home Depot's model and customer base are two of the "big things," and the retailer is particularly well positioned to benefit from the eventual resurgence of the real estate market.

Arguably, this will help seal the deal. With a dividend yield of 2.5%, Home Depot is a great stock for newcomers to the market. That's much better than Lowe's current dividend yield of 1.81 TP3T. Remember, these little things are becoming more and more important as time goes on.

Should you invest $1,000 in Home Depot now?

Before buying Home Depot stock, consider the following:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Only ...... and not Home Depot. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 4, 2024

Wells Fargo is an advertising name partner of The Ascent, a Motley Fool company. james Brumley does not own any of the above stocks. the Motley Fool holds recommendations for Home Depot and Moody's. the Motley Fool recommends Lowe's Companies. the Motley Fool has a disclosure policy. The Motley Fool recommends Lowe's Companies The Motley Fool has a disclosure policy.

Best Stocks to Buy Right Now: Home Depot vs. Lloyd's was originally published by The Motley Fool.