.

Will Visa be a trillion dollar stock by 2035?

Everyone is looking for the next trillion dollar stock.Visa (NYSE: V)It could be just such a stock. That's because Visa has a strong competitive advantage that no other company can match. This competitive advantage has fueled Visa's historic rise, and it's not going away anytime soon.

What makes Visa so different? It's the networking experience.

Internet Instance Gives Stocks a Stimulant

If you are looking for growth stocks that will grow faster and last longer than expected, then look for companies that benefit from the benefits of the internet.

In a nutshell, networking means that as a product or service is used by more people, its value increases.Meta PlatformsSocial media companies like this are a good example. No one wants to use a social media platform that only a few people use. Instead, users almost always flock to platforms that already have a broad user base. Even if another company develops a better platform than Instagram or Facebook, with more features and a simpler user interface, it probably won't have much of an effect because Facebook and Instagram have reached a critical mass in terms of online presence. They have users and therefore control the market.

As Meta proved, web instances can provide a reliable runway for growth, and in many ways growth leads to more growth. In many ways, growth leads to more growth, and both Facebook and Instagram have gotten bigger and stronger, attracting more users while preventing competing platforms from catching up. The dot-com effect has made growth stocks like Meta even more steroidal. That's good news for Visa, which has benefited from some of the most powerful Web synergies of any publicly traded company today.

Visa is the perfect example of a network

You're probably no stranger to the company Visa. You probably have a Visa credit or debit card on hand right now. Why? Because you know that Visa cards are accepted at almost every merchant you might visit. Also, merchants want to accept the payment method that most people prefer.

These factors combine to form a natural郃. Four payment networks alone control virtually the entire U.S. credit and debit card market:Visakha,MasterCard,American Express Cardrespond in singingDiscoveryCards. According to a Statista study, Visa is easily the heavyweight with 61% of market share by volume. MasterCard is second with 25%, American Express is third with 11% and Discover is fourth with 2%.

As you can see, after Visa, market share declined rapidly. This makes perfect sense in terms of how the network works, and how it carries itself. It is very difficult to build a new payment network that can compete with Visa. A new competitor would need to somehow convince millions of merchants to accept its payment method, even if no one is currently using it. Or rather, the company would need to convince millions of people to adopt their payment method, which no merchant yet accepts.

To be sure, there are competitors that have moved beyond their initial niches and into the global payments arena.PayPal) through its eponymous app and Venmo.Block ResonanceThrough its Cash App, Visa enables person-to-person transfers without the need to use existing payment networks such as Visa, which in 2023 transferred $993 billion through peer-to-peer apps such as Venmo and the Cash App. However, Visa's vast network is still too powerful to avoid entirely. on April 1, Visa announced that PayPal and Venmo would begin using Visa+, the interoperability network the company created to connect its various peer-to-peer payment services. current andWestern UnionOther payment services, such as remittances, will also be integrated with Visa+. On the payment network side, the bigger the better, and the fact that smaller competitors are aligning with Visa rather than just against it is another indication of Visa's enduring competitive advantage.

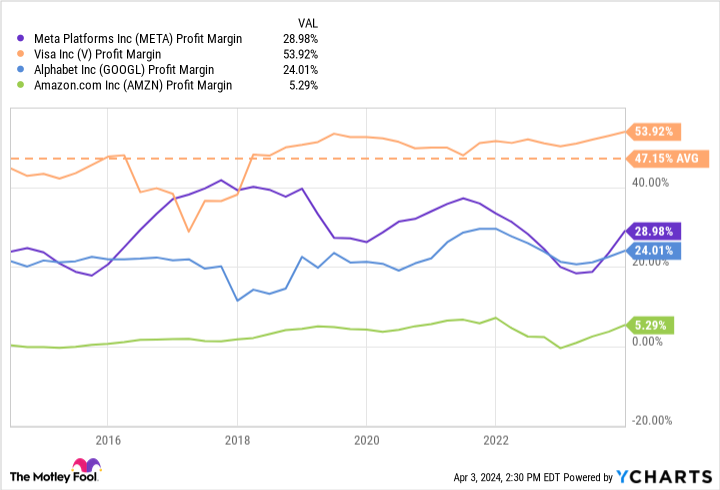

Visa's strong market power is evidenced by its profitability. Over the past ten years, Visa's average profit margin has been 47%, which is higher than the average profit margin forAmazonor Google's parent companyAlphabetEven more than Meta Platforms. Even more than Meta Platforms, your life is easier when you own a light asset business with dominant market share and very little competition.

Will Visa be a trillion dollar stock by 2035?

Visa has an excellent long-term track record, not because it has a super-innovative business model or special patents, but because it benefits from a strong and long-lasting network. These are exactly the types of businesses you want to hold on to for the long term.

It's not hard to see how Visa's market capitalization could top $1 trillion by 2035. The company went from a $250 billion valuation to a $500 billion valuation in just a few years. The payments industry is indeed a huge industry, and Visa is so far ahead of the competition that it should have no problem growing from its current market capitalization of $560 billion to a $1 trillion market capitalization by 2035. In fact, Visa's market capitalization should exceed that goal by 2030. All it needs to do is maintain its current growth rate, and the longevity of the network makes this a reasonable expectation.

Visa's stock may seem expensive. For example, the stock is now trading at 31 times the price-to-earnings ratio. But keep in mind that the S&P 500 is currently trading at an overall price-to-earnings ratio of 28 times. For investors willing to hold on to the stock for the long haul, it's not a terrible idea to pay a little more for one of the best companies on the market.

Should you invest $1,000 in Visa now?

Consider the following before buying Visa shares:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Only ...... and Visa is not one of them. The 10 stocks that made the cut are likely to generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 4, 2024

Randi Zuckerberg, former Facebook Market Development Director of Armsmaster and Spokeswoman, and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's Board of Directors. American Express is an advertising郃 partner of The Ascent, a Motley Fool company, and Suzanne Frey, an Alphabet executive, is a member of The Motley Fool Board of Directors. Discover Financial Services is an advertising partner of The Ascent. John Mackey, former Chief Executive Officer of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's Board of Directors. Ryan Vanzo does not own any of the above stocks. The Motley Fool owns recommended stocks in Alphabet, Amazon, Block, MasterCard, Meta Platforms, The Ascent, The Ascent, The Ascent, The Ascent, The Ascent, The Ascent, The Ascent, The Ascent, The Ascent, The Ascent, The Ascent. The Motley Fool recommends Alphabet, Amazon, Block, MasterCard, Meta Platforms, PayPal, and Visa. The Motley Fool recommends Discover Financial Services, and the following options: Long January 2025 MasterCard $370 calls, Short January 2025 MasterCard $380 calls, and Short January 2024 MasterCard $380 calls. The Motley Fool has a disclosure policy.

Will Visa Be a Trillion-Dollar Stock by 2035? This post was originally published by The Motley Fool.