.

Should you buy shares of ASML Holding before April 17?

Semiconductor Equipment GiantASML Holding Company (NASDAQ resonance code: ASML)Shares of the company have made impressive gains in the stock market so far this year, up nearly 28% at the time of this writing, and the company's Q4 2023 business results have played a key role in driving the stock's surge.

ASML released its fourth quarter financial results on January 24th. Investors liked what they saw, and the stock hit a new high. Since then, the Dutch semiconductor has maintained its momentum, but its gains will be put to the test when it releases its first-quarter 2024 results on April 17th. Can ASML issue another strong performance and guidance later this month?

Why ASML is a surprise

By the end of 2023, ASML realized total gross revenues of €27.6 billion, a year-on-year increase of 301TP3 T. However, the company has provided conservative guidance for 2024 and expects its revenues to be at the same level as in 2023.

Mr. Koon said in the fourth quarter report that the semiconductor industry is at a bottom and that the demand for its lithography equipment is showing signs of improvement. Nevertheless, Koon is taking a cautious approach, forecasting first-quarter revenues in the range of €5 billion to €5.5 billion.

This would represent a decline of 22% compared to €6.75 billion in the same period last year.In addition, ASML's gross margin guidance for the first quarter is in the range of 48% to 49%, which is down from a gross margin of 50.6% in the same period last year.

In short, ASML is forecasting a significant contraction in its first-quarter revenues and profits.

Still, the company is likely to surprise Wall Street. After all, its guidance of flat revenue for the year suggests that the company expects to see decent revenue growth in the following quarters as customers start buying more semiconductor manufacturing equipment. It wouldn't be surprising to hear that the turnaround actually started in the first quarter, for one simple reason.

ASML's orders increased significantly in the fourth quarter. The company received orders worth nearly €9.2 billion, more than triple the €2.6 billion in orders in the third quarter. This sharp increase can be attributed to the booming demand for artificial intelligence (AI) chips.

This is evidenced by the fact that ASML placed €5.6 billion worth of orders for its extreme ultraviolet (EUV) lithography machines in the last quarter. These EUV lithography machines are used to make advanced chips with process nodes of 7 nm or less. Foundries, chipmakers and cloud computing companies are actively seeking to increase their AI chip production capacity to meet demand.

For example, according to Taiwan'sBusiness TimesThe report said that the foundry giantTaiwan Semiconductor Manufacturing Co. Manufacturing Company) may raise its 2024 capex budget by more than $7% to between $30 billion and $34 billion, up from an earlier forecast of $28 billion to $32 billion.TheMeanwhile, Samsung plans to increase the production of high-bandwidth memory chips by 2.5 times in 2024 to meet the demand for AI microcontrollers.

All of this explains why sales of wafer fabrication equipment are expected to return to growth in 2024 at 3% after declining by 3.7% in 2023, and even better, equipment spending is expected to jump by 18% in 2025. As foundries and chipmakers begin to open up their pockets for semiconductor manufacturing equipment, ASML would do well to turn more of its €39 billion order backlog into revenue.

If that happens, ASML's revenue, earnings, and industry guidance will likely be better than Wall Street's forecasts, which would help its stock maintain its impressive uptrend.

But should you buy this stock before the earnings report?

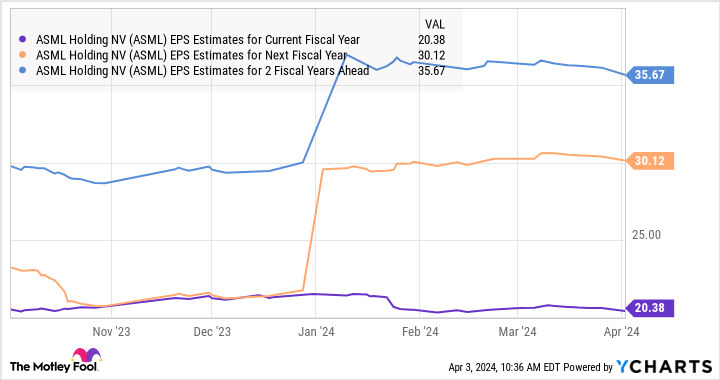

ASML's rising share price in 2024 has brought its price-to-earnings (P/E) ratio to 46. This is higher than its five-year average P/E of 41. Meanwhile, its forward earnings multiple of 50 suggests that analysts on average expect full-year earnings to shrink to $20.38 per share. But we've seen that ASML has the ability to surprise the market, and the upside is that analysts are forecasting a sharp acceleration in its bottom-line growth starting in 2025.

As a result, ASML appears to be on solid footing in terms of its near- and long-term prospects, and the stock looks poised to continue to move higher after its April 17 first-quarter earnings report. That's why investors looking to buy semiconductor stocks to capitalize on the AI boom may want to consider buying ASML ahead of the report.

Should you invest $1,000 in ASML now?

Before buying ASML stock, consider the following:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Only ...... and not ASML. The 10 stocks that made the list could generate huge returns in the coming years.

Consider this April 15, 2005NvidiaStatus at time of listing ...... If you invested $1,000 at the time of our recommendation, theYou will have 539,230dollar! *Stock Advisor provides easy-to-use stock investment tools for investors.

Stock AdvisorProvides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock recommendations per month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View these 10 stocks."

*Stock Advisor's Circular as of April 4, 2024

Harsh Chauhan does not hold any of the above stocks.The Motley Fool recommends ASML and Taiwan Semiconductor Manufacturing Company Limited.The Motley Fool has a disclosure policy.

Should You Buy Shares Held in ASML Before April 17? This post was originally published by The Motley Fool.