.

After the highly anticipated IPO, the reality of Reddit stock may have begun. 3 Things Smart Investors Should Know

The stock market of 2024 has gotten off to an exciting start. The frenzy around artificial intelligence (AI) has made theS&P 500Indices andNasdaq Resonance The index is at an all-time high, and the momentum doesn't seem to be slowing down.

Unsurprisingly, some companies are taking advantage of ripe market conditions, as 2024 has already seen a number of high-profile initial public offerings (IPOs).

Social Media PlatformsReddit (NYSE: RDDT)It recently began trading on the New York Stock Exchange. Although the stock price has risen over $1,20% from the issue price, the reality may be changing as the stock price has fallen over $30% from its peak.

Prospective Reddit investors should be aware of the company's key risk areas and how those risks could affect its long-term prospects.

1. Fierce competition in social media

The social media industry is highly competitive. While platforms may specialize in different areas, such as product reviews, peer-to-peer exchanges, or photo and video sharing, the underlying goal is to build a large, engaging community.

From a business perspective, this makes sense. If you can attract more users to your platform, then you have a greater chance of monetizing it. The most common way to monetize social media is through advertising.

With 73 million daily active users, Reddit clearly has some brand appeal. In addition, the company's revenue reached $804 million in 2023, a year-over-year increase of 21%. Similar to its competitors, Reddit's main source of revenue is advertising.

On the surface, it seems like a relatively stable business. However, Reddit is working withMeta Platforms,Alphabet,Snap, X (formerly Twitter),Pinterest The company has been competing with other companies for user accessibility.

Meta Platforms owns Instagram, Facebook, and WhatsApp, which together have more than 3 billion daily active users. Alphabet also owns the world's most visited websites - Google and YouTube - with more than 100 billion website visits per month.

Reddit's management clearly understands that it has an uphill battle against these big giants, and in the fourth quarter of 2023, the company's average revenue per user declined by 7% year-over-year, compared to a flat quarter in the previous year.

But the company's plan to move beyond the typical advertising business model is puzzling and, more worryingly, largely unproven.

2. Reddit's growth path is inexplicable.

In Reddit's S-1 filing, the company describes two other revenue areas it is exploring: e-commerce and artificial intelligence (AI).

E-commerce could complement Reddit's existing advertising business. However, the intersection between Reddit's social media brand and e-commerce could be a challenge for existing players in the space.

Thanks to the rise of small businesses on Instagram and the growth of Facebook's listings, Meta has successfully broken into the e-commerce space. But while smaller platforms like Snap are also experimenting with e-commerce, their success has been much more limited, and Snap's average revenue per user continues to fall, hinting at the challenge social media companies face in expanding their revenue streams.

On the artificial intelligence side, the company has signed data licensing agreements worth $203 million, including withAlphabet The Company has signed a $60 million Carburetor Agreement.

Given Reddit's vast database of user data, the idea that the platform's content could be used to help train AI-generated models makes sense. The risk, however, is that these models could end up taking away from the company's user base and popularity as people turn to AI to get the discussions and answers they were looking for on Reddit.

3. Excessive share price premium

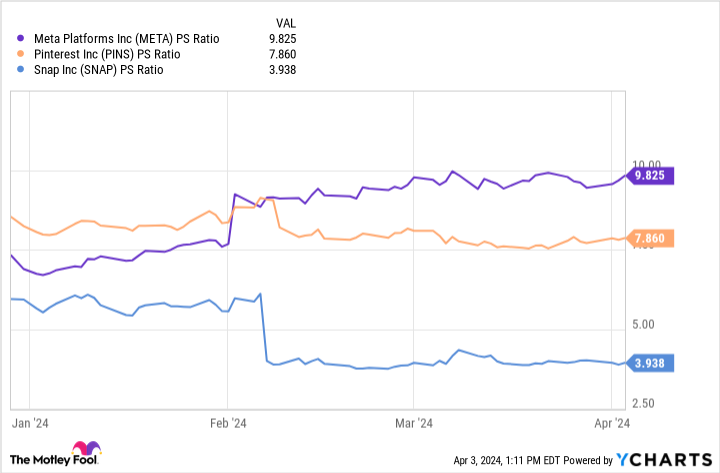

As of this writing, Reddit has a market capitalization of $7.5 billion and a price-to-sales ratio (P/S) of around 9.3.

This is comparable to Meta's market capitalization and higher than the likes of Pinterest and Snap. This premium valuation is difficult to justify given its troubling growth prospects.

According to Bloomberg, analyst Andrew Freedman of Hedgeye Risk Management recently called the stock "grossly overvalued" in a short report last week. Freedman believes that the stock is poised to fall back to its initial public offering price of $34 per share, which would favor short sellers who profit from a falling stock price.

Once Reddit starts holding earnings calls, investors will learn just how successful the company has been in the e-commerce and artificial intelligence space. But for now, I'd steer clear of Reddit and let the current hype surrounding the stock continue. There are other opportunities in the social media space for bigger, more established companies.

Should you invest $1,000 in Reddit right now?

Before buying shares of Reddit, consider the following:

Motley Fool Stock AdvisorThe analyst team has just selected what they consider to be the most suitable names for investors to buy.10Only the stock ......Reddit was not included. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorProvides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 4, 2024

Alphabet executive Suzanne Frey is a board member of The Motley Fool. Randi Zuckerberg, former Facebook Market Development Armsmaster and Spokeswoman, and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Adam Spatacco works at Alphabet and Meta Platforms, and The Motley Fool owns shares of stock that it recommends in Alphabet, Meta Platforms, and Pinterest, and The Motley Fool has a disclosure policy.

After the highly anticipated IPO, the reality of Reddit stock may have begun. 3 Things Smart Investors Should Know.