.

Better Artificial Intelligence (AI) Stocks : Qualcomm & Intel

So far this year.Qualcomm (NASDAQ: QCOM)respond in singingIntel Corporation (NASDAQ: INTC)The diametrically opposed share price movements may seem surprising at first glance, as both chipmakers are facing downside in their core markets and have been relying on the popularity of artificial intelligence (AI) to turn the tide.

In recent years, Intel's business has been affected by the decline in sales of personal computers (PCs), while Qualcomm is struggling because of sluggish sales of smartphones. Both 耑 markets are expected to benefit greatly from the use of artificial intelligence. However, Qualcomm's 19% gain and Intel's 23% loss on the stock market in 2024 suggest that the former may fare better in terms of utilizing AI catalysts.

Let's see if that's really the case, and if Qualcomm is the better AI choice of the two.

Reasons to support Qualcomm

The smartphone market is poised for a turnaround this year, and analysts expect a similar scenario for Qualcomm. The chipmaker's revenue for fiscal 2023 (ending Sept. 24, 2023) fell 191 TP3T from the previous year to $35.8 billion, while adjusted earnings fell 331 TP3T to $8.43 per share. That's not surprising, given that smartphone shipments fell 3.2% in 2023, according to IDC's estimates, and fell even more, to 11.3%, in 2022.

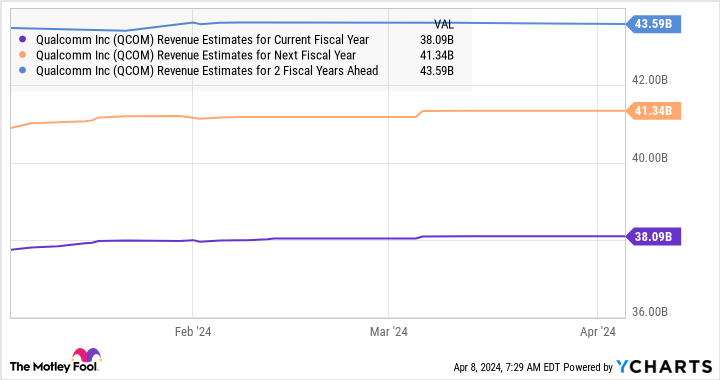

However, analysts expect Qualcomm's revenue to be higher this year, and to grow further in the next few fiscal years. This can be seen in the chart below:

The growth of AI smartphones will play a key role in Qualcomm's turnaround. Market research firm IDC predicts that shipments of AI smartphones will reach 170 million units this year, more than triple last year's 51 million shipments. What's more, IDC points out that AI smartphones will account for 15% of the entire smartphone market this year, which suggests that they still have a lot of room for growth in the future.

Even better, the AI smartphone market is projected to grow at a CAGR of 83% from 2024 to 2027.Qualcomm forAppleQualcomm is well-positioned to supply processors to top smartphone OEMs like Samsung and Samsung. Qualcomm's Snapdragon processor powers the AI features in Samsung's latest Galaxy S24 flagship smartphone, and it's looking to further advance the field with a new chip for mid-Beijing smartphones.

Notably, market research firm Counterpoint Research predicts that Qualcomm will account for more than 80% of the generative AI smartphone market in the coming years. This is not surprising considering that Qualcomm has already made strides in this market, gaining the favor of flagship customers such as Samsung.

Additionally, Qualcomm has its sights set on the artificial intelligence PC market, which will bring new opportunities for the company's future business growth. So Qualcomm seems well positioned to capitalize on several fast-growing opportunities related to artificial intelligence, which explains why the chip stock has been on a tear this year.

The situation in Intel

As time went on, things got worse for Intel, which began 2024 with a better-than-expected Q4 2023 earnings report that failed to provide a strong outlook. Intel's guidance for the first quarter of 2024 was much worse than expected, which is why investors pushed the panic button. Intel has been hit again after its foundry division posted huge losses.

In terms of the company's efforts in artificial intelligence, Koon's management noted on its January earnings call that its revenue from its AI gas pedal Koon now exceeds $2 billion. The company claims to have strengthened its supply chain "to support growing customer demand, and we anticipate a meaningful acceleration in revenue growth for the full year."

However, with the consensus estimate of $57.4 billion in gross revenue for Intel this year, the $2 billion revenue Koon suggests that AI is not likely to have a significant impact on the company. On the other hand, Chipzilla is facing challenges in the AI PC processor market from the likes ofAMDAMD's Ryzen processors are powering the 90%+ AI PCs on the market today, according to Lisa Su, AMD's chief executive officer.

This may explain why AMD's revenue growth in the B耑 business was much higher than Intel's. More specifically, in the fourth quarter of 2023, Intel's B耑 computing group grew by $8.8 billion, compared to $33% in the same period. More specifically, in the fourth quarter of 2023, Intel's B耑 Computing Group reported revenue of $8.8 billion, a year-over-year increase of 331 TP3T, while AMD's B耑 division revenue grew 621 TP3T in the same period.

With AI-enabled PCs, AMD taking Intel's share of the PC market, and Qualcomm looking to make a dent in that market, Chipzilla may find it difficult to capitalize on the growing popularity of AI.

Conclusion

Clearly, Qualcomm is in a better position to capitalize on the AI opportunity, as it is expected to have a solid share of the AI smartphone space. Meanwhile, Intel has a lot of work to do in the AI data center chip and PC market. In addition, Intel's price-to-earnings ratio is 110 compared to Qualcomm's, which is much cheaper at 24.

Additionally, Qualcomm's forward P/E of 18 is lower than Intel's multiple of 33. Investors are better off buying Qualcomm stock now, which is why they may want to consider buying it before Intel's AI stock jumps higher after a solid start to 2024.

Should you invest $1,000 in Qualcomm now?

Before buying Qualcomm stock, consider the following:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)Worth investing in10Only one stock, ......, and Qualcomm, is not one of them. The 10 stocks that made the list could generate huge returns in the years to come.

Consider this April 15, 2005INVISTAStatus at time of listing ...... If you invested $1,000 at the time of our recommendation, theYou will own 539,230dollar! *Stock Advisor provides easy-to-use stock investment tools for investors.

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 8, 2024

Harsh Chauhan does not own any of the stocks mentioned above.The Motley Fool recommends Advanced Micro Devices, Apple, and Qualcomm for their holdings.The Motley Fool recommends Intel and recommends the following options:Intel The Motley Fool recommends the following options: Intel January 2023 $57.50 Call Options Long, Intel January 2025 $45 Call Options Long, and Intel May 2024 $47 Call Options Short. The Motley Fool has a disclosure policy.

Better Artificial Intelligence (AI) Stocks: Qualcomm and Intel was originally published by The Motley Fool.