.

The International Monetary Fund (IMF) has warned that huge growth in the "opaque" corners of global finance could pose a risk to wider market stability

-

The International Monetary Fund (IMF) says the rapid growth of the private market could eventually pose a risk to wider market stability.

-

Last year, the "opaque" corner of the financial market had increased to US$2.1 trillion.

-

According to the IMF, infrequent valuations and uncertain credit quality are risk factors in this area.

The International Monetary Fund wrote in a blog post on Monday that the rapid rise of the private credit industry may ultimately undermine financial stability as little is known about the industry.

As more and more corporate lending moves from regulated banking institutions to less regulated firms, such as private credit funds, the window for lending behavior becomes opaque and the risks increase, the organization said.

"The shift of these loans from regulated banks and more transparent public markets to the more opaque world of private credit carries potential risks," analysts wrote Monday.

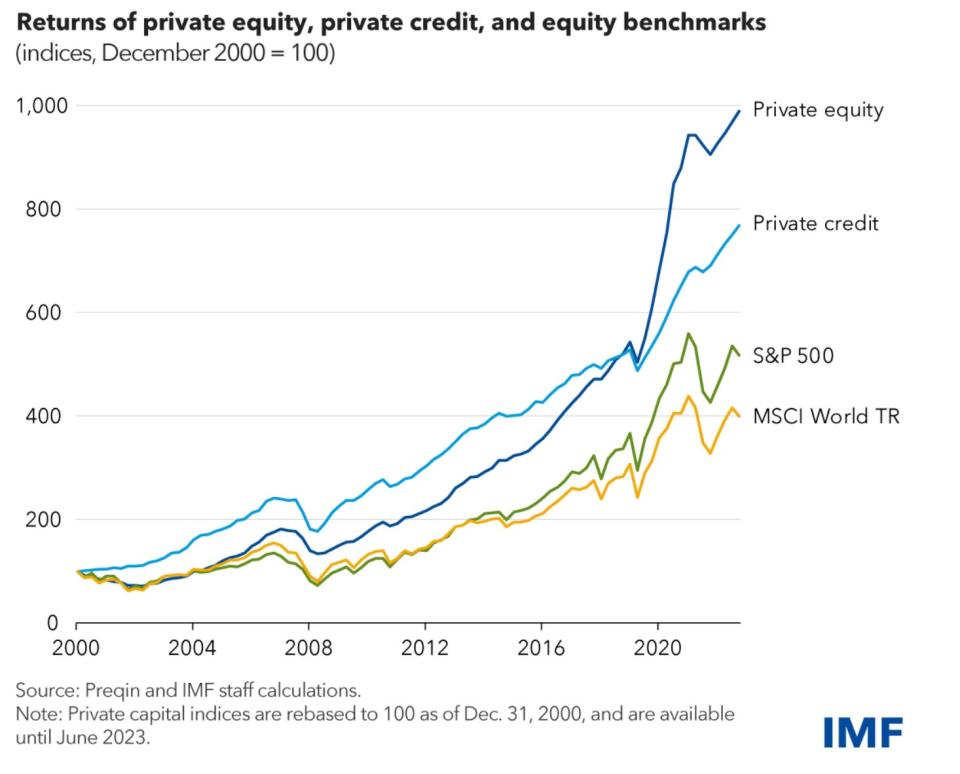

Since the turn of the century, the industry's rate of return has skyrocketed, increasingly outpacing both the S&P 500 and the MSCI Global Index.

The industry was created to provide much-needed financing to companies that commercial lenders considered too risky. The IMF writes that despite the illiquidity, the market's rich returns, speed and activity have won over investors.

But the sector is also largely unregulated and there are some worrying signs as the share of private credit in the lending market grows.

"Valuations are infrequent, credit quality is not always clear or easy to assess, and it is difficult to understand how systemic risk may have developed given the uncertain interconnections between private credit funds, private equity firms, commercial banks, and investors," the analysts write.

First, the borrowers are often debt-laden companies already dependent on leveraged loans or public bonds. The IMF says this means they are at greater risk when interest rates rise, with one-third of borrowers facing interest rate costs that already outweigh benefits.

However, credit providers have not tightened their lending standards as private credit has become increasingly competitive with large banks, and it is difficult to value them due to the infrequency of loan transactions.

Not only are private credit standards likely to be worse than they appear on the surface, but analysts may not fully recognize the interconnections between the industry and the broader financial system.

For example, banks' exposure to private credit may be larger than many realize, and pension funds and insurance companies have been acquiring larger shares of these assets, the IMF said. Meanwhile, new funds targeting individual investors have been popping up, spreading the risk from Wall Street to Main Street.

Because of these factors, private credit is likely to amplify the downturn as the recession approaches, one of the blog's authors said separately at a Brookings Institution event last week.

According to the industry news service Pensions and Investments, Fabio Natalucci said: "I don't think we see a risk to financial stability, but ...... from a macro-financial point of view, we don't know how the sector will function in a prolonged and severe recession. From a financial point of view, we don't know how the industry's modes of operation will work in the event of a prolonged and severe recession.

Read the original