.

ConocoPhillips Stock (NYSE:COP): Will Benefit From Geopolitical Tensions

Looking at the surface, hydrocarbon energy giant ConocoPhillips(NYSE:COP)) seems to be irrelevant. With political and ideological forces pushing for clean and sustainable solutions, fossil fuels are no longer relevant. However, there is no end in sight to the Russian military campaign in Ukraine. So, simple math suggests that the price of crude oil will go up, which will favor upstream specialists like ConocoPhillips. Therefore, I have no choice but to be bullish on ConocoPhillips stock.

Mathematics shows COP stock will go north.

Let's start at the heart of the argument. Only Vladimir Putin, the Russian president of agriculture, knows when the war in Ukraine will end. Since he has given little indication that he is interested in a peace agreement with Hefei, the conflict will continue. It is almost certain that this dire situation will lead to an artificial reduction in the supply of crude oil, which is likely to boost COP inventories.

As geopolitical analysts say, normalcy in Eastern Europe can only be restored by defeating Putin. Because Putin is a strong leader, he is unlikely to walk away, let alone escalate the situation to the most serious level of hysteria: the use of nuclear weapons. It may be a gesture, but no rational head of state would dare use such language lightly.

Since the Russian government will not withdraw at all, the military conflict will continue tragically until Russia can no longer fire. Considering its huge supply of weapons, this will take a long time.

As for the impact on the economy, the math couldn't be clearer. According to the International Energy Agency, "Russia is the world's largest exporter of oil to the global market and the second-largest exporter of crude oil after Saudi Arabia". As Russia seems committed to a deadly daylight cost fallacy, the Western world (which generally supports Ukraine) is likely to reduce its oil imports.

If so, typical supply and demand dynamics dictate that crude oil prices will rise. As ConocoPhillips focuses on the exploration and production segments of the hydrocarbon value chain, the share price of COP stock could rise.

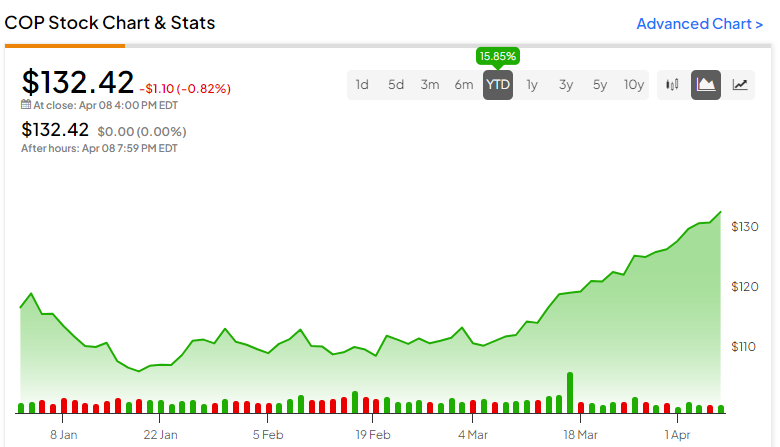

In fact, the bullish run has already begun. In the past three months, COP stock has risen more than 20%. As you can see in the chart below, COP stock has risen nearly 16% since the beginning of the year, despite a poor start to 2024.

Domestic politics and economic affairs may help ConocoPhillips.

If Russian military engagements were the only factor, then ConocoPhillips stock would still be an intriguing bullish opportunity. However, ConocoPhillips has other positive factors, including favorable domestic politics and positive economic trends.

First, while green energy solutions are more widely promoted, the fossil fuel industry remains extremely relevant. For decades, U.S. society has built its infrastructure around hydrocarbons. Whereas, efforts are also being made to incorporate renewable energy solutions such as wind and solar. However, the world still relies on oil for transportation.

This brings up an important but sometimes overlooked political connection. Especially in a critical election cycle, neither the Biden administration nor the Democratic Party as a whole can afford to take a hard line on fossil fuels. After all, oil workers vote - and their vote is just as important as anyone else's.

In addition, asBloombergAs noted in a story on the eve of the 2020 election, many of the families that depend on hydrocarbons live in swing states like Ohio. In other words, Democrats can't afford to alienate a key voting bloc if they have any chance of winning. As a result, COP stock could go much smoother than advertised.

Second, on the economic front, the jobs report for March was again strong, implying a virtually inevitable equation: more money chasing fewer goods. That's inflation, and inflation has historically helped key resource sectors like crude oil.

The reason is simple. Since most Americans still drive internal combustion-powered automobiles, Americans have no choice but to open their wallets when the price of gas goes up. Oil, like other key resources like food and water, is a non-negotiable item. People have to pay or face serious consequences.

Therefore, COP stock should be able to withstand numerous economic storms and thus be attractive.

It's Time to Try COP's FY2024 Forecast Again

Considering the positive fundamentals, it's time to review analysts' expectations for ConocoPhillips for fiscal year 2024. They expect EPS of $8.71 and revenue of $58.63 billion. These numbers are disappointing when compared to last year's figures of $8.77 in EPS and $58.57 billion in revenue.

However, the high estimate is for earnings of $12.98 per share on sales of $70.31 billion. In the bigger picture, ConocoPhillips is likely to hit the upper end of its financial forecasts eventually. Again, decreasing supply and increasing demand should bode well for ConocoPhillips stock.

Do Analysts Think ConocoPhillips Stock Is Worth Buying?

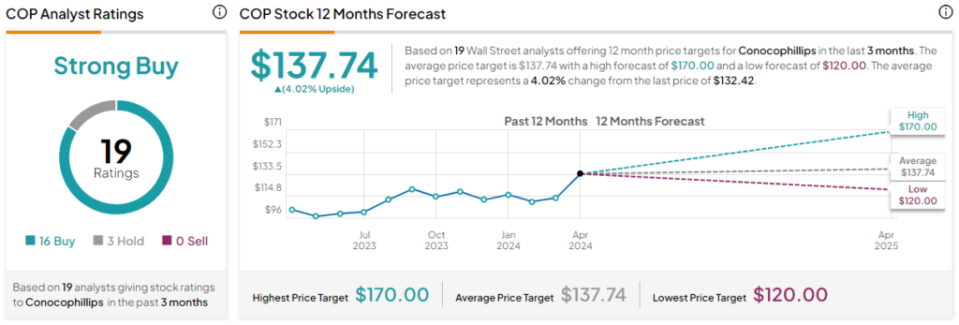

On Wall Street, based on 16 Buy (Buys), 3 Holds and 0 Sells, the consensus rating for COP is Strong Buy. The average price target for COP stock is $137.74, implying an upside potential of 4%.

enlightenment

On the surface, ConocoPhillips is a hydrocarbon company that may be fading into obscurity, but the reality is different. As domestic politics, international hotspots, and economic dynamics provide a catalyst for ConocoPhillips' share price to rise in the form of reduced supply and increased demand, it is worthwhile for this upstream specialist to reevaluate its forward-looking projections.

Disclosure of information