.

Can Taiwan Semiconductor Stock (NYSE:TSM) Replicate Invista's Performance?

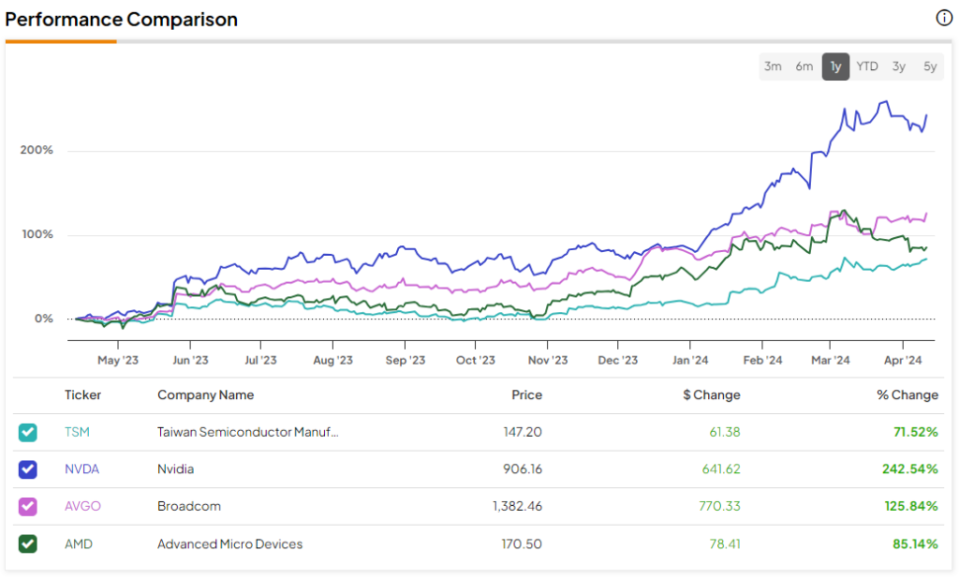

The world's largest chip maker, Taiwan Semiconductor Manufacturing Co.(NYSE:TSM)) recently released impressive March revenue numbers. Notably, the 242.5% uptick in INVISTA(NASDAQ:NVDA)TSM is a company that relies on TSM to make its chips. However, TSM's stock price performance (up 71.5% over the same period, see chart below for comparison) has been relatively sluggish. This begs the question: Can TSM replicate NVDA's glorious performance? The answer is probably "yes".

With the AI boom continuing to heat up, increasing capital from the U.S., and an attractive valuation, TSM now looks like a compelling buy.

Pre-announcement data suggests optimistic earnings outlook for the future

On April 10th, TSM announced impressive March revenue figures, posting the highest month-over-month growth rate since November 2022 at 34.3%, totaling NT$195.2 billion (approximately US$6.1 billion). In addition, first quarter revenue is expected to grow 16.5% year-over-year to NT$592.6 billion (approximately US$18.4 billion).

Notably, TSMC expects to realize revenue growth of around 20% in FY2024, driven by strong demand for its latest nano-chips from the AI wave. In addition, the company also reiterated in January 2024 that its AI revenues are growing at a rapid rate of about 50% per year. This reaffirmation is particularly reassuring after the decline in reported revenues in 2023!The

TSM produces chips with Nvidia and Advanced Micro Devices.(NASDAQ:AMD)) and Apple(NASDAQ:AAPL)) and other tech giants. Ahead of its first quarter earnings report, which is expected to be released on April 18, let's take a look at what the future holds for TSM.

Artificial Intelligence Revolution to Spur TSM Growth

The Artificial Intelligence revolution has swept the world. I firmly believe that its growth trajectory is here to stay. Although the AI industry is still in its infancy, it is expected to see significant expansion across a wide range of industries and applications. According toNext Move Strategy Consulting The AI industry is expected to surge to $1.85 trillion by 2030, up from about $208 billion in 2023, according to a forecast by the U.S. Department of Defense.

TSM's customers rely heavily on the company to produce the chips they design. The high demand for all things AI has led to a huge demand for AI chips.

With the rapid development of artificial intelligence, TSM's manufacturing business has received a further boost as it has been awarded a direct federal grant worth $11.6 billion under the U.S. government's CHIPS Act. The company will receive $6.6 billion for the expansion of its Phoenix, Arizona manufacturing facility. In addition, TSM is eligible for an incremental loan of $5 billion.

TSM has already invested in two plants at the site and will use the funds to build another. The company's total investment in all three plants is estimated at $65 billion. According to the press release, this marks "the largest new foreign direct investment project in U.S. history".

TSM plans to start production of 2nm technology chips in a second plant in 2028. In the coming years, TSM will benefit from large investments that will significantly strengthen its production operations and bring about the latest technological advances.

Mark Liu, Chairman of TSM, is optimistic: "Our U.S. operations enable us to better support our U.S. customers, which include several of the world's leading technology companies. Our U.S. presence will also expand our ability to lead the future development of semiconductor technology.

To date, the majority of TSM's manufacturing capacity has been located in Taiwan, which presents a geographic risk (potential for Chinese invasion, earthquakes, etc.). With the announcement of the latest expansion plans, this risk will be mitigated. With increased manufacturing capacity in the U.S., TSM will be better positioned to meet the needs of its top tier customers such as Nvidia, AMD and Apple.

TSM is cheaply valued

In terms of valuation, TSM looks cheap. Currently, the company trades at a forward P/E of 23x, which is much higher than its peers. Advanced Micro Devices, a semiconductor company, has a higher forward P/E (49x), while AI prodigy Nvidia has a forward P/E of 36.4x.

Wall Street analysts expect TSM to report earnings of $9.02 per share for fiscal year 2026. If TSM maintains the same forward P/E ratio at that time, its stock price would be approximately $207, a 45% premium to its current price, so it makes sense to consider buying TSM stock at its current price given the strong growth potential in the AI space.

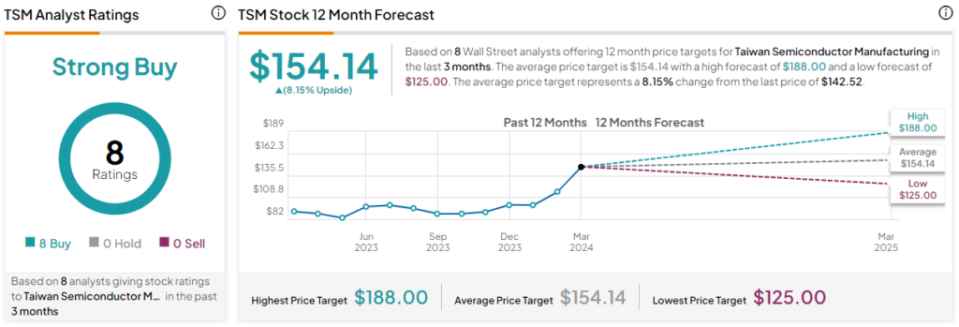

Do analysts think TSM stock is worth buying?

Wall Street is clearly bullish on shares of Taiwan Semiconductor Manufacturing Company. In total, the stock has received a consensus rating of Strong Buy. TSM stock has an average price target of $154.14, which implies an upside potential of 8.21 TP3T from prior levels.

Conclusion: TSM offers a good opportunity for long-term growth.

The semiconductor industry is experiencing significant growth driven by the artificial intelligence boom, and TSM and its AI-focused counterparts are poised to benefit from this relentless demand. With strategic investments and expansion plans in place to meet future demand, TSM appears well positioned for continued growth. With these factors in mind, I'm inclined to buy the stock at a prebubbles price and look to benefit from its AI potential over the long term.

Disclosure of information