.

Before Buying High-Yield Enterprise Product Partners, Consider This Top ETF

Enterprise Product Partners (NYSE: EPD)The company has long been favored by income-oriented investors for its stable and consistently growing distributions. The company has long been one of the best-run midstream companies and was at the forefront of shareholder-friendly initiatives, such as being one of the first MLPs to eliminate IDRs (incentive distribution rights). This allowed the company to continue to increase distributions during the energy price crash of the mid-2010s.

To the extent possible, investing in a single master limited partnership (MLP) like Enterprise Product Partners may not be suitable for everyone. Instead, investing in an MLP exchange-traded fund or ETF such asAlps ETF Trust-Alerian MLP ETF (NYSEMKT: AMLP)It may be a better choice. It also has a big plus: no extra paperwork.

Investment MLP

The Alerian MLP ETF tracks the Alerian MLP Index, which holds a variety of midstream energy stocks that are structured as MLPs.The MLP structure is designed to provide tax benefits to companies and their unitholders that are engaged in the production or transportation of natural resources.MLPs are not taxed at the corporate level, and typically a large portion of the MLP distribution is designated as a capital return. This portion of the distribution is tax-deferred until the stock is sold, which reduces the investor's original cost basis.

This is a good deal for the investor. However, it does have one drawback: it requires a tax form called a K-1. Many investors don't like dealing with complicated K-1 forms, and they usually come after most other tax forms. In some cases, MLP investments can also create problems when held in retirement accounts, resulting in taxable situations. As a result, some investors want to avoid MLPs altogether.

However, there are some top MLP stocks that offer attractive yields, and investors can hold them while avoiding a K-1 by investing in the Alerian MLP ETF.

Why MLPs look attractive at the moment

The Alerian MLP ETF invests in energy midstream companies engaged in the gathering, processing, storage and transportation of natural gas, oil, natural gas liquids (NGLs) and refined products. These companies generally do not have much direct commodity exposure and are often characterized as toll roads. They tend to generate large cash flows and pay generous dividends. The ETF's yield is 7.3% and its expense ratio is 0.85%.

MLPs have seen many positive changes in the midstream space over the past decade. In the past, MLP structures were very unfriendly to investors because the General Personality Partner (GP) of the company would take advantage of the shares most commonly held by LP holders, the retail investors, and the GP had the Incentive Distribution Rights (IDRs), whereby the LP would have to pay the GP a certain percentage of the distribution when the distribution reached a certain level.

Once the IDR reaches a high 50/50 split, the LP pays double for any increase in allocation. For example, if an LP increases its allocation by 2 cents per unit, or $2 million for a carry, the additional $2 million would go to the GP and any units held by the GP would not be counted. Most Koon MLPs have IDRs, albeit in slightly different proportions, and a few energy producers have MLPs that have never had IDRs.

This has resulted in many MLPs increasing their leverage and increasing their capital frequently in order to continue to push up distributions in the pursuit of underperforming projects. About 15 years ago, it was not uncommon for MLPs to do two or three equity raises per year, diluting holders' shares. Investors liked these large distribution increases, but they ultimately benefited the GPs, not the average MLP unitholder. At the same time, this has resulted in many MLPs being over-leveraged and under-distributing their distribution coverage ratios, which measure the extent to which a company's cash flows cover its distributions.

Enterprise Partners was one of the first Koon MLPs to address the IDR issue, reducing its high share to 75%/25% in 2002 and eliminating IDRs altogether by the end of 2010; however, most MLPs followed suit a few years later, as the industry had to start making changes in the face of a tough energy environment and tax reform rulings. They were forced to start playing nice. IDRs were eliminated in corporate transactions, GPs and LPs were created, balance sheets were repaired, growth slowed, and most of the industry's conflicts of interest were eliminated. Today, most MLPs have no IDRs and only a few stragglers still hold IDRs.

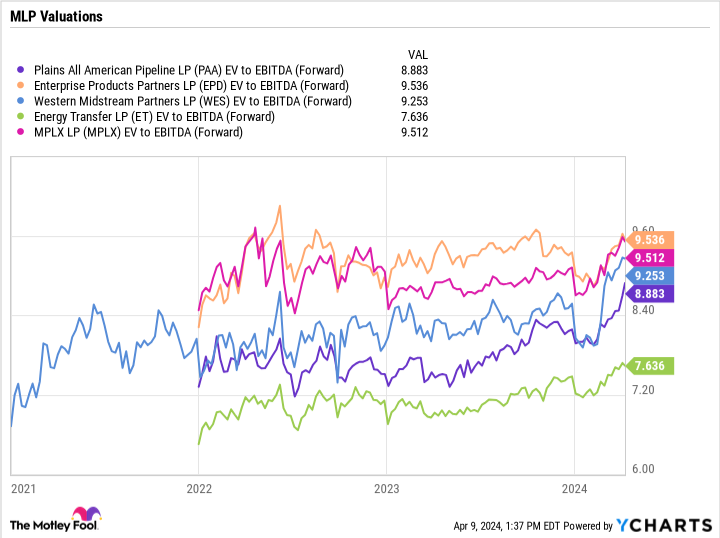

Despite these positive changes, MLPs are actually trading below pre-pandemic levels. Prior to the COVID-19 pandemic, the ratio of average enterprise value (EV) to adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) for MLPs was close to 12x over the past 10 years. Today, the top five holdings in the Alerian MLP Index are all valued at less than 10x EV/EBITDA.

The Best Time to Buy the Alerian MLP Index

The Alerian MLP Index has performed well over the past few years. The ETF is up more than 131 TP3T this year and has a cumulative return of nearly 1001 TP3T over the past three years.

Despite recent solid performance, MLPs are still trading at historically low valuations. At the same time, companies are in much better financial and operational shape today than they were a decade ago. Leverage is down across the industry, coverage ratios are up, and companies are now typically looking to pay for growth projects with post-dividend free cash flow. This allows them to grow while still paying down debt and reducing leverage.

The Alerian MLP Index provides investors with some of the best-run MLPs, includingEnterprise Products Partners (NYSE: EPD)respond in singingMPLX (NYSE: MPLX)These two companies have consistently increased their dividends year after year. The ETF also holdsEnergy Transfer (NYSE: ET)respond in singingPlains All American Pipeline(Nasdaq Resonance Stock Code: PAA) Two companies that have turned around in the last couple of yearsThe

For income-seeking investors, there's nothing better than an MLP, and the Alerian MLP Index is a fantastic way to invest in the sector.

Should You Invest $1,000 in Alpine ETF Trust - Alerian MLP ETF Right Now?

Consider this before buying shares of Alps ETF Trust - Alerian Mlp ETF:

Motley Fool Stock AdvisorA team of analysts has just confirmed that they think investors are nowIt's the right thing to do.purchased10Only ...... and the Alps ETF Trust - Alerian Mlp ETF are excluded. The 10 stocks that made the list are likely to generate huge returns over the next few years.

Consider April 15, 2005Nvidia) on the list at ...... If you invest $1,000 at the time of our recommendation, theYou will have $555,209.! * *The

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View these 10 stocks."

*Stock Advisor's Circular as of April 8, 2024

Geoffrey Seiler has positions in Alps ETF Trust-Alerian Mlp ETF, Energy Transfer, Enterprise Products Partners and Western Midstream Partners. recommended by The Motley Fool. Enterprise Products Partners.The Motley Fool has a disclosure policy.

Before buying the high-yield stock Enterprise Product Partners, consider this top-rated ETF.