.

Billionaire investor Carl Icahn bet $6.3 billion on one stock.

Carl Icahn is one of the most famous investors in history. Throughout the 1980s and 1990s of the 20th century, he was known as a corporate predator, buying up shares of companies in an attempt to drive change. Over the decades, he amassed a multi-billion dollar fortune.

Icahn has never shied away from gambling. Now, he's got almost his entire fortune - about $6.3 billion - invested in a single stock. With the company's stock price at an all-time low, this could be a lucrative way to compete with the legendary billionaire investor.

Billionaire Carl Icahn bets on himself.

It's no surprise that Carl Icahn has invested most of his money in a company that bears his name:Icahn Enterprises (NASDAQ resonance code: IEP)The company was founded in 1987. Founded in 1987, Carl Icahn has long made Icahn Enterprises his primary investment vehicle. He currently owns more than 80% shares of the company, valued at approximately $6.3 billion. In essence, Carl Icahn is in complete control of Icahn Enterprises, and the company's stock price is a direct result of his long-term decision-making ability.

Icahn Enterprises is a conglomerate. This means that it is a conglomerate of different businesses, most of which are unrelated. As of last quarter, the aggregate value of the net assets of these businesses was approximately $4.8 billion. A portion of this net asset value is made up of various real estate assets and a few industrial and automotive businesses. But about two-thirds of that value is tied up in two things: oil-chaining plantsCVR Energy shares in CVR Energy and a controlling interest in Carl Icahn's investment funds, which operate separately from the Company. As a result, while Carl Icahn has diversified his business to a certain extent, it is heavily dependent on CVR Energy and his investment funds for its business performance.

As Carl Icahn is probably well aware, Icahn Enterprises has focused on placing bets. These bets seem to represent two of his most confident areas. With a long track record of creating billions of dollars in wealth, investors can instantly join Carl Icahn by simply buying stock in Icahn Enterprises.

A not-so-sensible question

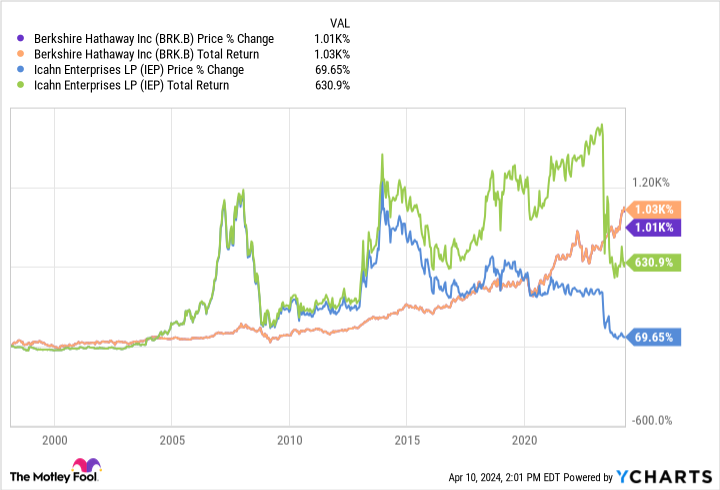

Investing with legendary billionaire investors is a logical strategy. Take a look atBerkshire HathawayThe patient investor who trusts Warren Buffett has been getting double-digit compound returns every year for decades. Patient investors who trust Warren Buffett have been getting double-digit compounded returns every year for decades. But Icahn Enterprises is not Berkshire Hathaway. It is not even close. Since 1998, the value of Berkshire Hathaway's stock has risen by more than 1000%. Icahn Enterprises' stock has only increased in value by 691 TP3T, but the company pays large, regular dividends. These dividends have narrowed the gap considerably, with Icahn Corp. returning an aggregate return of 6,30% during this period, but admittedly, Berkshire Hathaway has proven to be an excellent long-term investment with much less volatility. In addition, if you reinvest the dividends from Icahn Enterprises into Icahn Enterprises stock, your total return will be much lower than 630%.

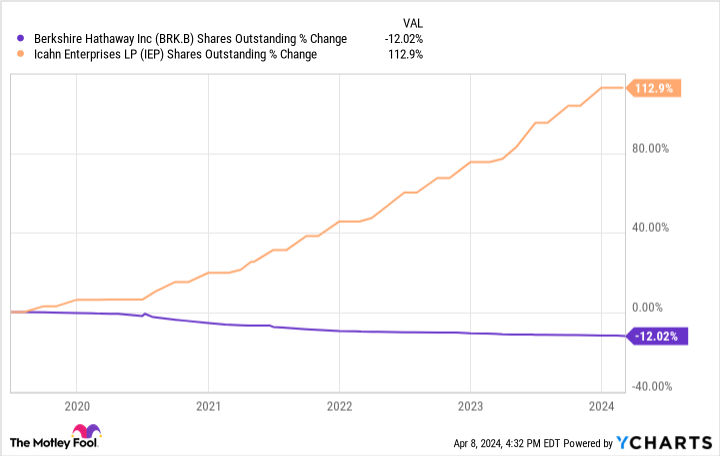

So why does Icahn Enterprise stock seem to be trading at a higher price than Berkshire Hathaway? On a price-to-book basis (a very simple measure of how much the market is willing to pay for a company's assets), Icahn Enterprises is currently trading at 2.3 times book value. Berkshire is trading at just 1.6 times its book value. There is even reason to believe that resonance's price-to-book ratio is overstated, as the company has purchased tens of billions of dollars of stock over the years. These purchases have created a lot of shareholder value, but due to accounting rules, they have depressed the company's true book value. At the same time, Icahn Enterprises has been issuing new shares on a large scale. In the last five years, the number of shares has jumped by 112%.

Compared to Berkshire Hathaway, it is difficult to justify the purchase of Icahn Enterprises, especially given the premium valuation. Looking at the business portfolio of Icahn Enterprises, it is difficult to say what businesses should be valued at more than their book value. For example, the value of the company's interest in the Carl Icahn Investment Fund has fallen from US$4.2 billion last year to US$3.2 billion today. Meanwhile, the company's stake in CVR Energy, which should be worth close to book value because it is a publicly traded asset, has fallen from $2.2 billion to just $2 billion over the same period. Icahn's other assets haven't fared much better. Last summer, for example, one of Icahn Enterprises' automotive businesses went bankrupt.

Carl Icahn is betting a huge amount of money on Icahn Enterprises, but that's likely because he has to. If he suddenly wanted to sell all of his shares, the value of the company would likely collapse. Since Icahn Enterprises' stock trades at a much higher price than Warren Buffett's Berkshire Hathaway, investors might be better off betting against the billionaire than with the billionaire.

Should you invest $1,000 in Icahn Enterprises now?

Before buying shares of Icahn Enterprises, consider the following:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Only ...... and Icahn Enterprises were not included. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 8, 2024

Ryan Vanzo does not own any of the stocks listed above. the Motley Fool holds shares of recommended Berkshire Hathaway. the Motley Fool has a disclosure policy.

Billionaire Investor Carl Icahn Is Betting $63 Billion on This 1Stock was originally published by The Motley Fool.