.

Four Reasons to Buy McDonald's Stock Now

Generally speaking, the food and beverage industry is not a good place to be. The costs of entering the industry are high, the failure rate is relatively high, and running a surviving restaurant is a stressful, time-consuming, and labor-intensive endeavor. Simply owning stock in a listed restaurant chain is not necessarily a less risky and more rewarding option.

However, there is one notable exception. That is.McDonald's (NYSE: MCD)The 68-year-old company has perfected the art and science of managing thousands of fast-food restaurants. This 68-year-old company has perfected the art and science of managing thousands of fast-food restaurants. You can enjoy this success at an affordable price, and be confident that your investment will pay off handsomely in the near and distant future.

There are many reasons to buy McDonald's stock like there's no tomorrow, but four stand out.

Four Reasons Why McDonald's Stock Is The Best Choice

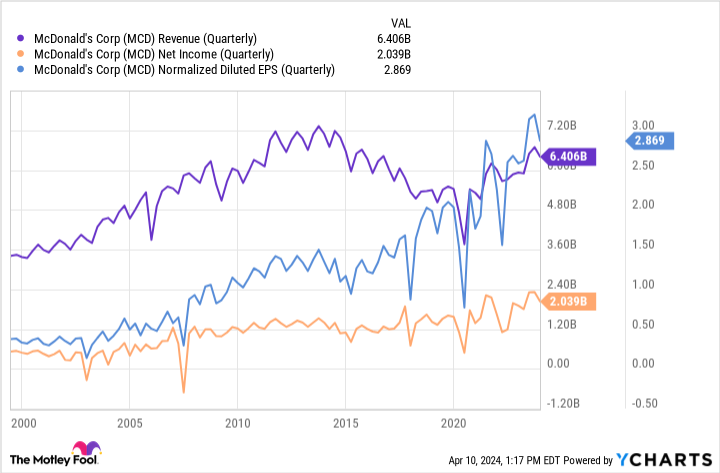

You know this company. McDonald's is easily the largest restaurant chain in the world, operating 41,822 stores worldwide. It's no exaggeration to say that McElpine epitomizes the fast food chain way of doing business. It has also remained profitable, even in the early, difficult days of the COVID-19 pandemic, and has remained largely unaffected.

However, what makes McDonald's stock the best choice right now is not an arbitrary hunch about the future based on the past. The secret to the company's longevity is no secret at all. There are four clearly identifiable factors that work in the company's favor, factors that its competitors often try to emulate but seldom actually duplicate.

1. Its brand name is attractive in itself

It's no coincidence that the mere sight of McDonald's golden arches or the sound of its jingles can trigger a Big Mac craving. McEllo has invested a lot of time and money in effective branding, and even the red and yellow colors seen on its signage make people feel happy while their hearts beat faster. In fact, the company has long associated its logo and colors with its television commercials and jingles, so much so that just seeing or hearing an advertisement, or seeing the golden arches from afar, reminds you of those crispy fries!

The result? McDonald's and its golden arches (from the word flour) are one of the most recognized brand names and logos in the world. This made it much easier to market the company's services, as the audience had already eagerly embraced the message.

2. Business model with amazing flexibility

You might think that McDonald's core business is selling hamburgers. But that's not true. Today, the company is primarily a real estate conglomerate. Coincidentally, the core business of its tenants is selling hamburgers.

Most McDonald's franchisees do not own the premises. McEllo's parent company owns the premises, and the parent company rents the premises to the operator at market rates. Unlike mortgage payments, these rents increase over time. While the organization is not prone to divulge these details, about one-third of its total revenue comes from rentals. In other words, the franchisee pays the parent company about two-thirds of its gross revenue in rent each year. Whereas, franchisees must also purchase supplies from McElroy.

As you can imagine, the Franchisor's Power Model has been the subject of much debate amongst franchisors for many years ...... and healing! It doesn't matter. Because the McDonald's brand is so strong, the operators of its 95% franchise studios continue to pay these escalating costs.

3. Stable dividend with continuous growth

These reliable rents and royalties translate into reliable cash flows. The company also reliably translates them into shareholder dividends. Based on the most recent data, McDonald's stock has an above average yield of 2.5%.

McDonald's also has the ability to pay these dividends. Last year McLean paid a dividend of $6.23 per share, which is slightly more than half of the $11.56 earnings per share for the same period.

But perhaps more noteworthy about the company's dividend is that it has not only paid it consistently over time, but it has also raised it consistently. With the October quarterly dividend increase, McDonald's total annual payout has been raised for 47 consecutive years. That's one of the best dividend pedigrees in the stock market.

4. McDonald's shares are undervalued.

Last but not least, McDonald's stock is not just cheap. It's undervalued.

That's a surprising statement given McLean's recent share price performance. McDonald's shares haven't grown by leaps and bounds over the past two, three, and five years, but they're still hovering around the all-time highs they hit in January of this year. Not bad.

However, even with this relatively good performance, the stock is still well below the consensus analyst price target. They believe the stock is worth $325.46 per share, which is 22% above the current price. In fact, the stock is currently priced well below all of the current analysts' lowest price targets. ...... Incidentally, most analysts rate McDonald's stock as a Buy or higher.

Investors as a whole may not believe in McDonald's too much right now. But there's a reason why analysts are sticking with their bullishness.

You can do better than that.

Is there a more exciting stock to buy? There's no double-digit growth here, of course, and while the dividend is rock-solid, you can find stocks with higher yields.

However, from the perspective of risk and return, the outlook for this stock is not very promising.(negative prefix)The treatment of the body is not a matter of choice.

It's worth noting that these four main reasons to buy McDonald's stock have been the top bullish reasons for the stock for years. These reasons won't change in the near or distant future, so McElroy is a stock you can hold for the long term without worrying about keeping an eye on it.

Should you invest $1000 in McDonald's now?

Before buying McDonald's stock, consider the following:

Motley Fool Stock AdvisorThe analyst team has just selected what they think is the best name for investors to buy now.10Only ...... and McDonald's is not one of them. The 10 stocks that made the list could generate huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 8, 2024

James Brumley does not hold any of the shares listed above.The Motley Fool does not hold any of the shares listed above.The Motley Fool has a disclosure policy.

4 Reasons to Buy McDonald's Stock Like There's No Tomorrow was originally published by The Motley Fool.