.

1 Super Low Stocks I Wouldn't Touch If I Were Only 10 Feet Away

Bargain hunting in the stock market is the basis of value investing. Theoretically, given enough time, undervalued stocks will rise to their intrinsic value.

But cheap has many meanings and is often subjective. For example, bank stocks usually trade at much lower valuations than other stocks, and growth companies can command high prices even when they are suffering heavy losses.

There is also the question of whether "cheap" stocks are opportunities or value traps.Peloton Interactive (NASDAQ: PTON)The stock's price-to-sales ratio is below 0.5, which is low for any company, and could suggest a rare opportunity if Peloton can resume growth. However, its recovery is far from certain.

Peloton's Error

Peloton sells High B耑 Internet-enabled fitness equipment and subscription-based digital content. Its equipment includes stationary bikes, treadmills and other fitness equipment that can be connected to live and recorded classes.

In the early days of the pandemic, when fitness enthusiasts turned to home gym equipment, the company's sales skyrocketed, but that's when things started to go wrong for the company. in fiscal year 2021, Pelot's revenues spiked by $1,20%, marking the first of many consecutive years of triple digit growth. The surge in demand has led Peloton to invest heavily in infrastructure, including plans to spend $400 million to open its first U.S. manufacturing plant.

However, the perfect market conditions for connected fitness did not last. As COVID-related restrictions were eased and demand leveled off, Peloton's operations became large and confusing.

A new Chief Executive Officer was brought in to take charge of the company and restructure the business model. The U.S. plant was shut down and management announced several rounds of layoffs. However, after eight consecutive quarters of declining revenue, Peloton was unable to return to growth.

Koon has tried a number of initiatives. Most notably, Peloton shifted from a hardware focus (fitness equipment) to a software-as-a-service (SaaS) model by promoting high-margin paid apps that do not require Peloton equipment. In the second quarter of fiscal year 2024 (ended December 31), paid app subscriptions declined 16% year-over-year, but total subscription revenue grew 3%.

Peloton has also started working onDick's Sporting Goodsrespond in singingAmazonIn the second quarter, sales through these channels increased by 74% year-on-year. In the second quarter, sales through these channels grew 74% year-on-year, and its bike rental business is booming, which management expects to more than double in the current fiscal year.

Peloton's original product was an exercise bike, but its treadmill model is benefiting from a larger market (about twice the size of the bike market, according to management). Demand for Peloton's treadmills has also been stronger than expected.

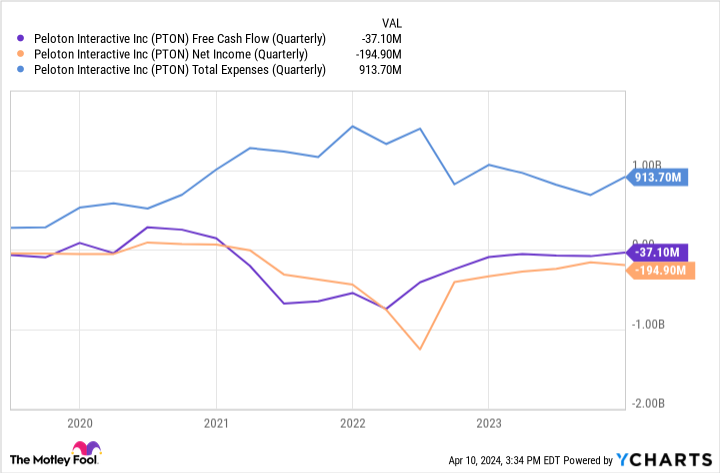

One of Koon's goals is to achieve free cash flow by fiscal 2024, but that milestone has now been pushed back to the fourth quarter. The company also expects revenue growth to eventually resume in the same quarter.

Will Peloton ever recover?

If you think about what the fitness world will look like in 10 years, it will likely include a lot of digital and personalized content. That's where Peloton comes in. Peloton has a first-mover advantage in this area, and with the arrival of profitability, the company's leadership can focus on finding a way forward.

Despite these advances, the Company's performance does not justify the risk, even at this price. There are still too many unknowns.

Peloton's stock price could rise if management meets its cash flow and growth targets for fiscal 2024. But I'd prefer to have a clearer picture of the stock's prospects before considering it, even if it means paying a higher price.

Should you invest $1,000 in Peloton Interactive right now?

Before buying shares of Peloton Interactive, consider the following:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)The name of the person is suitable for the investor to purchase10Peloton Interactive is not one of the 10 stocks listed on ....... The 10 stocks selected are expected to bring in good returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 8, 2024

John Mackey, former Chief Executive Officer of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's Board of Directors. jennifer Saibil does not own any of the above stocks. the Motley Fool owns recommended Amazon and Peloton Interactive. the Motley Fool has a Disclosure Policy. The Motley Fool has a disclosure policy.

1 The Ultra-Low Stocks I Wouldn't Touch With A Ten-Foot Pole was originally published by The Motley Fool.