.

Why Industrial Stocks Are in for a Tough Earnings Season

Expect more volatility during the pre-earnings season. At least, if industrial supply companiesMSC Industrial Direct (NYSE: MSM)If the company's financial results are anything to go by, then the same is true for the industrial sector. Here are the basics of the company and how to prepare your investments for the upcoming earnings season.

Another weak quarter for MSC Industrial

Industrial supply companies are reliable indicators of the industrial economy. They have significantly shorter sales cycles, which means they feel the effects of market slowdowns quickly and are able to expand sales quickly when conditions improve. This sensitivity emphasizes the need for careful consideration when making investment decisions.

Of course, not all industrial supply companies are the same. In the case of MSC Industrial, its sales are concentrated in the heavy manufacturing sector (almost half of its sales), followed by the light manufacturing sector (approximately 20%).

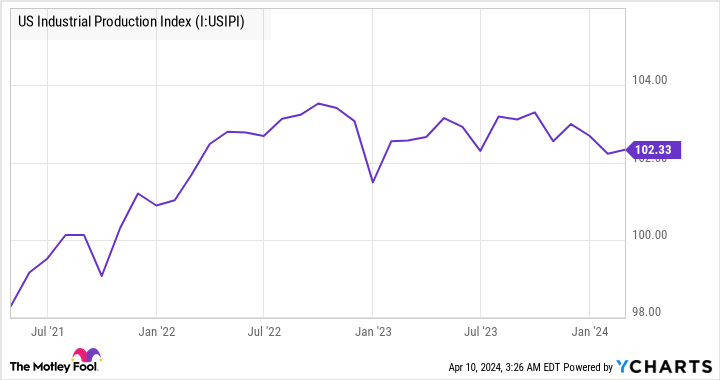

Unfortunately, these markets do not fare well in 2024. First, the U.S. Industrial Production Index weakened in 2024.

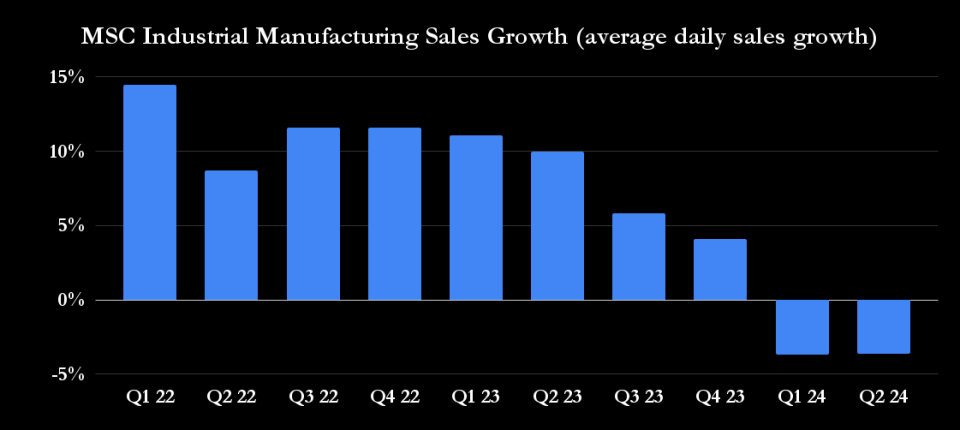

Second, MSC Industries' core heavy manufacturing end-user market is particularly weak. Unfortunately, this is an ongoing problem. For example, MSC Industrial's sales in the second quarter fell short of expectations, resulting in a disappointing first quarter.

This weakness continued into MSC's second quarter, with the company's chief executive Erik Gershwind noting that "of its top 100 national customers, only 45 achieved growth in the previous quarter. As a result, year-to-date revenue growth is below our expectations."

As a result, MSC Industries' average daily sales growth continued to disappoint.

|

MSC Industries, Inc. |

September |

October |

eleventh month (of the lunar year) |

twelfth month (of the lunar year) |

first month (of the lunar year) |

second month (of the lunar year) |

March Estimate |

|---|---|---|---|---|---|---|---|

|

Average daily sales growth |

1.3% |

(1.7)% |

(1.2)% |

(2.4)% |

(3.7)% |

(2.2)% |

(3.5) % to (4) % |

Data source: MSC Industry Direct Report.

Looking at the growth of its manufacturing sales, it is clear that the state of the end-user market remains weak. As a result, the matron, Kristen Actis-Grande, told investors that its full-year average daily sales growth and adjusted operating margin would be "at the lower end" of the guidance range, based on its year-to-date performance. lower end" of the guidance range.

In fact, to reach the lower end of the average daily sales growth rate (0%-5%), MSC Industries will need to rely on improvements in the heavy manufacturing end-user market and the easing of public sector budget constraints.

MSC's performance is even more disappointing when one considers that its initiatives in expanding in-plant projects and vending machines are beginning to bear fruit. For example, MSC now has 312 in-factory projects, compared with 224 a year ago. In addition, the number of vending machines has increased to 25,854, up from 23,286 a year ago. The results of these efforts have exceeded expectations, according to Koon.

In other words, the company is doing its part, but ultimately the market is not helping.

What it means for industry

Many industrial companies are relying on a post-耑 loaded year to deliver on their full-year expectations, and if what MSC Industrial is saying is understood by the industry as a whole, there could be some disappointment this fiscal quarter. As a result, there will likely be many mentions of longer than expected run-offs and recoveries in the coming weeks.

This is not an argument against buying stocks in this environment. After all, if the valuation is right and the company's long-term prospects remain good, then a quarter or two of trading shouldn't have much impact on long-term investors. Incidentally, MSC Industrial trades at 16 times estimated 2024 earnings (2024 is supposed to be a down year) and has good growth opportunities from its vending machine program, of which MSC Industrial is one.

However, in general, a good entry point is important for generating investment returns. It is wise to wait for earnings and guidance before seeking to establish a long-term position. If MSC Industrial's earnings and guidance are good, there will be plenty of opportunities for this approach to work soon.

Should you invest $1,000 in MSC Industrial Direct now?

Before buying MSC Industrial Direct shares, please consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only ...... and MSC Industrial Direct were not included. The 10 stocks selected will generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 8, 2024

Lee Samaha does not hold any of the shares mentioned above.The Motley Fool holds a recommendation for MSC Industrial Direct.The Motley Fool has a disclosure policy.

Why Industrial Stocks Are in for a Tough Earnings Season