.

Is Uranium Energy Corporation a Millionaire Stock?

Stock investors usually have some financial goals. A common goal is to become a millionaire. Sometimes these investors are so obsessed with finding a stock that will make them "rich," preferably as soon as possible, that they lose sight of the risks inherent in investing.

If you seeUranium energy Company (NYSEMKT: UEC)The stock market has been on a tear over the past year, and if you think it might create some new millionaires (including you), then you need to stop. Selling uranium is a tough business with a long history.

Uranium Energy makes smart choices

Uranium Energy Company sells uranium. It's worth noting that the company does not currently mine nuclear fuel. Instead, management signed a deal to buy uranium at a time when the price was near historic lows, which was a stroke of genius, at least in hindsight. Now, the company has a large stockpile of nuclear fuel that it can sell at a profit, as the price of uranium has risen significantly since it began buying.

Uranium Energy's decision to buy uranium when everyone else is selling it makes its management team look good. The profits it makes from this activity can be used to fund capital investments in the actual uranium. In the grand scheme of things, it has found a way to self-finance its growth. The company hopes to reopen a mine in August, when it will be its only operating mine asset. But the company also has a number of other seamount projects in North and South America, so there are bigger opportunities ahead. If Uranium Energy can get all of these mountains up and running, it will be a major player in the uranium sector.

With a backstory like that, it's understandable that some investors might see Uranium Energy as a diamond in the rough - a stock that can turn a small investment into a huge one. Indeed, the stock has risen a whopping 1,51% in the past year, but before you jump on board with dreams of becoming a millionaire, take a step back.

What's wrong with you?

The first big thing to consider is that uranium is a commodity. And just like any other commodity, its price fluctuates wildly. There are many reasons to be optimistic about the future of the uranium market, not the least of which is that nuclear power does not emit carbon. In other words, it can provide clean baseload power to supplement renewable energy sources such as solar and wind. That's an attractive backstory in a world that's moving away from carbon-based fuels.

The problem is that nuclear energy has a bad image. It is often labeled as a dangerous source of energy. First of all, nuclear radiation makes people feel uneasy. But the really big problem is that accidents at nuclear power plants are usually large, newsworthy events. Think of Chernobyl or the recent Fukushima. The Fukushima accident is a good example of what happens to the uranium market after the headlines.

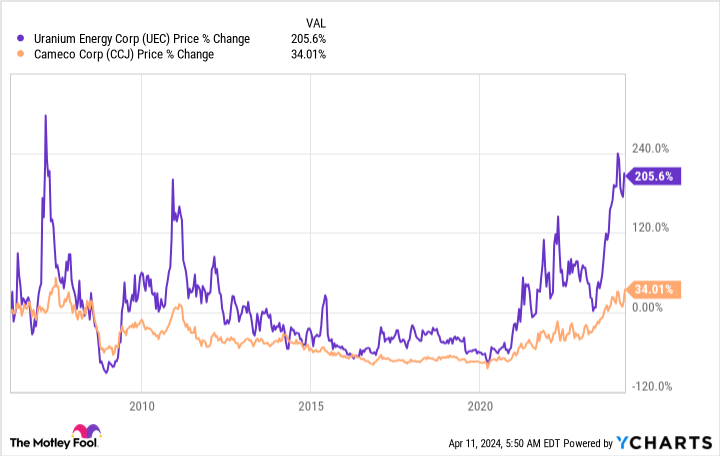

After the events of 2011, the price of uranium, which had begun to rise, plummeted to an all-time low. The world began to question whether nuclear power was worth the risk. Germany actually decided to start shutting down its reactors. It took more than a decade for uranium prices to recover to 2011 levels. Meanwhile, the share prices of uranium mining companies followed the price of nuclear fuel.

It's fair to say that the drop in uranium prices is a good time for Uranium Energy to build up a low-cost uranium inventory. But investors shouldn't buy the stock with the assumption that the price will only rise in the future. If history is any guide, that's not the case. And, frankly, it wouldn't take another nuclear power plant accident to drive the price of uranium down. As mentioned earlier, uranium is a commodity, so supply and demand alone could keep the price of nuclear fuel fluctuating. This, in turn, could lead to volatility in the share prices of uranium stocks such as Uranium Energy.

Is Uranium Energy a Millionaire Maker?

At the end of the day, the uranium energy company story is an interesting one. Maybe it's even attractive to those who are willing to make more aggressive investments. But you shouldn't look at it as a get-rich-quick scheme, or even as the only way to a seven-figure fortune. The inherent volatility of commodities and the additional risks associated with the uranium market make uranium energy companies a high-risk investment, and their share prices are prone to sharp fluctuations. It may help you become a millionaire as part of a more diversified portfolio, but there is a real risk that investing alone will break the bank.

Should you invest $1,000 in Uranium now?

Before buying shares of Uranium Energy, consider the following:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Uranium Energy is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the coming years.

Consider April 15, 2005Nvidia) on the list at ...... If you invest $1,000 at the time of our recommendation, theYou will have 540,321dollar! * *The

Stock AdvisorProvides investors with an easy-to-follow blueprint for success, including guidance on building an investment team, regular updates from analysts and two new stock picks each month. Stock Advisor The rate of return for the service since 2002 has been the same as that for the S&P 500 index, but the rate of return for the service has been the same as that for the S&P 500 index.quadruple*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 8, 2024

Reuben Gregg Brewer does not own any of the shares listed above.The Motley Fool does not own any of the shares listed above.The Motley Fool has a disclosure policy.

Is Uranium Energy a Millionaire Stock? This post was originally published by The Motley Fool.