.

Is this dividend growth stock with a yield of 5.5% the ultimate income stock?

Analysts estimate that millions of people worldwide die prematurely each year due to habitual smoking. This has been a problem for more than a century, so people and governments have been trying to reduce the rate of smoking among the global population. But what if I told you that one of the biggest drivers of smoking reduction today is one of the largest tobacco companies in the world?

Please seePhilip Morris Internationalfirms(NYSE: PM)That's right. That's right, the global tobacco giant has invested billions of dollars over the past decade or so to successfully shift its business away from cigarettes and toward "safer" nicotine products. Even though the company has embraced these fast-growing nicotine products, its shares continue to trade at a low earnings multiple with a strong dividend yield of more than 5.5%. Investors may still consider it a tobacco stock, a sector that is considered to be in a long-term recession.

Here's why this misunderstood nicotine giant can be a fantastic revenue generator for your stock portfolio.

Beyond Cigarettes

The best way to reduce cigarette use is to introduce safer nicotine alternatives. A good example of this is Sweden, which has popularized Snus and smokeless nicotine pouches in the country. After decades of development, these products are now more popular than cigarettes in the region.

Philip Morris International is trying to implement the same strategy worldwide. It has a safer inhalation brand called Iqos, which belongs to the "heat-not-burn" category of tobacco products. The brand is popular in Japan and Europe and currently generates annual sales of US$10 billion. Recently, the company acquired a company that owns Zyn nicotine pouches, a brand that is popular in the United States and Scandinavian countries. The brand recently surpassed $2 billion in U.S. retail sales. Over the next few years, the company hopes to introduce Iqos to the U.S. and the Zyn brand to more markets around the world.

In the fourth quarter of 2023, non-smoking products accounted for 39% of the company's sales, compared to less than 1% in 2025, an impressive increase. By 2030, management expects two-thirds of the company's revenue to come from non-smoking products such as Iqos or nicotine pouches. This sets the stage for more sustained, long-term growth away from the dying cigarette industry.

Pricing capacity

Despite the decline in cigarette sales, Phillip Morris International's traditional business still has a lot of room for profit. The company has a long history of raising prices to counteract declining sales, which has led to continued earnings growth in local currency. Prices for the company's traditional cigarette brands increased by 3.7% in 2020, 2.7% in 2021, 5% in 2022, and 8.9% in 2023, but still gained market share globally.

Even better, since the company owns the leading brand of non-smoking nicotine, this means that if nicotine users quit smoking due to the price hike, they are likely to switch to one of the other brands owned by Philip Morris International. Therefore, investing in the company is much safer compared to other tobacco giants.

The downside for Phillip Morris International, especially for U.S. investors, is that most of the company's sales come from emerging markets. After the spin-off from Phillip Morris USA, the company is now exposed to a lot of foreign exchange risk. Even if sales in local currencies increase due to higher prices, if those currencies depreciate against the U.S. dollar, it won't show up as revenue growth for U.S. investors. In recent years, the value of the U.S. dollar has risen sharply against many other currencies, creating a disadvantage for investors in Phillip Morris International. This disadvantage is unpredictable and is likely to continue in the coming years.

Can the dividend be increased?

Currently, Phillip Morris International Inc. has a dividend yield of 5.73%, which is close toStandard & Poor's 500This is 4 times the average index value of 1.47%. This suggests that some investors are bearish on the company's ability to grow or even maintain its dividend payments.

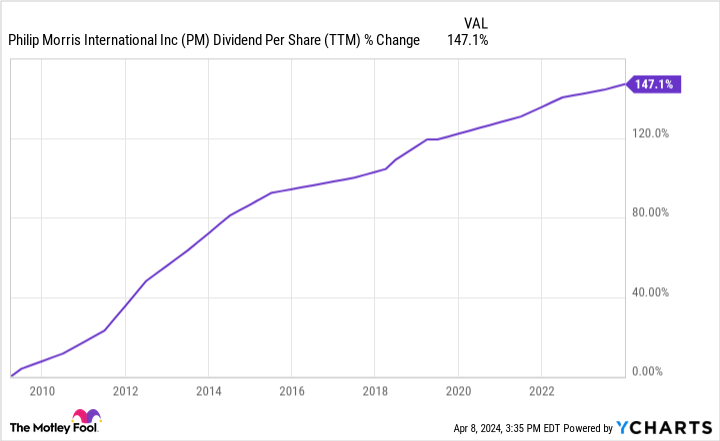

Historical evidence suggests that this is likely to be misleading. Phillip Morris International's dividend per share has grown by 1,47% since it became a separate public company in 2009, and it continues to grow every year. Now, with even more room for price growth and the incredible growth of the non-smoking brands, I think there's a lot of room for dividend per share appreciation over the next 10 to 15 years.

I believe that Phillip Morris International, with its high dividend yield and its ability to continue to grow for many years, is a safe income stock with great growth potential, and is well suited to any investor's portfolio.

Should you invest $1,000 in Phillip Morris International now?

Consider the following before purchasing stock in Phillip Morris International, Inc:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Only the stock ...... Philip Morris International Inc. was excluded. The 10 stocks that made the list have the potential to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 8, 2024

Brett Schafer does not own any of these shares.The Motley Fool recommends Philip Morris International.The Motley Fool has a disclosure policy.

Is This Dividend Growth Stock With a 5.5% Yield the Ultimate Yield Stock? This post was originally published by The Motley Fool.