.

Is it too late to buy toast stock?

Toastfirms(New York Stock Exchange)Stock Code(TOST)The stock has been hot lately. The stock has risen 34% in one year, and has gained 72% since last November, when the stock price fell sharply.

But that's all in the past. Savvy investors should be asking whether Toast can find more butter in the coming years. Is it too late to buy into the restaurant software specialist?

Toast by the numbers

The stock has brought mixed messages to investors who use data as a guide.

-

As mentioned above, the stock has risen strongly recently. It trades at 39 times forward earnings estimates and 139 times free cash flow. Other profit-based valuation ratios are not much help, as the company has had mostly negative profit metrics over the past four quarters. Thus, Toast's valuation looks expensive.

-

On the other hand, the price-to-earnings (P/S) ratio of 3.2 is at a perfectly reasonable level. On a longer-term basis, Toast's share price is down 64% from its all-time high in November 2021, and from this perspective, Toast's price appears to be affordable, even very cheap.

But those headline numbers don't tell the whole story. You should also know that Toast's business is growing in all the right places. For example, sales in the fourth quarter of 2023 were up 351 TP3T year-over-year. gross profit grew at a rapid pace of 421 TP3T, thanks to expanded gross margins.

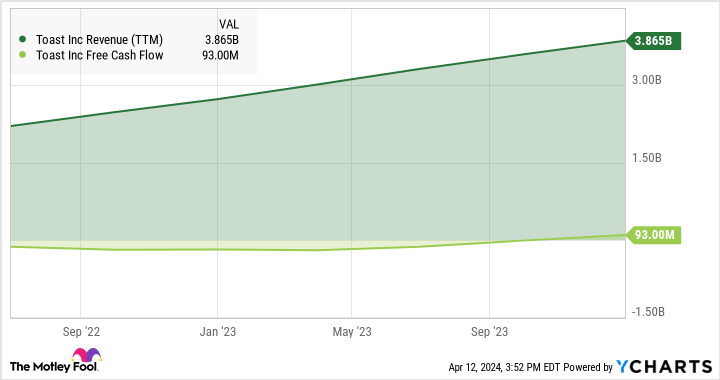

In addition, the cash flow valuation appears unusually high since Toast's trailing cash flow has only recently exceeded the break-even point. This recent change could distort the valuation ratios, especially if the denominator in these calculations, which has recently been negative or small, suddenly increases:

Great Business Mentality

Toast sells an advanced B耑 in the Cloud software that can help solve almost all the problems of running a restaurant (or restaurant chain). From payment processing and menu management, to tracking ingredient inventory, to developing the right marketing strategy based on local sales details, Toast can do it all in one compact package.

This one-stop shop often replaces multiple software solutions from different vendors, each of which focuses on only one piece of a pre-approved puzzle that doesn't match. Making it easier for operational data to flow seamlessly from real-time transaction inputs to all other parts of the business, Toast's single software package is also often more cost-effective than several separate solutions.

It's no surprise, then, to see Toast's solution pop up in many formal dining and takeout lunch breaks. Next step is to validate Toast-branded ordering tablets, which the company sells below-cost, effectively making the hardware part of Toast's marketing campaign.

I've seen the brand in Tampa-area coffee shops, Greek gypsy chains, full-service Italian studios, etc. Toast's customers range from single-store, family-owned businesses to multi-regional chains, brand-new businesses to those that have been in business for decades.

Since Toast focuses its expansion on specific target markets, things may be different in your home town. Send out a large team of sales reps to try out the hardware in a particular city, and keep up the marketing campaign until more and more happy customers start making waves on the streets. Once the word-of-mouth marketing machine is up and running, move on to the next city.

It's a good growth engine that's only recently shifted into revenue-generating mode, and as the business expands, it should become even more lucrative. In other words, I don't think Toast is late to the party. The company is aiming at a huge target market, and its huge early growth is just the beginning of a long, shareholder-friendly growth story.

Should you invest $1,000 in Toast now?

Before buying shares of Toast, consider the following:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Toast is not one of the 10 stocks listed at ....... The 10 stocks that made the list are poised to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 8, 2024

Anders Bylund does not hold any of the shares mentioned above.The Motley Fool holds the recommended Toast.The Motley Fool has a disclosure policy.

Is It Too Late to Buy Toast Stock? This post was originally published by The Motley Fool.