.

Is INVISTA stock worth buying?

Last year.INVISTA (NASDAQ: NVDA)The stock has risen 2,39% in 12 months, making it a hot stock to own. Nvidia's earnings have skyrocketed as the company's chips have become the preferred choice of artificial intelligence (AI) developers around the world.

In 2024, Nvidia's stock price continued to hit new highs, rising 76% since the market closed at rock bottom in 2023.The tech giant remains on a good growth trajectory, and its business is likely to benefit from the tailwinds of AI and other tech areas in a few years' time.

NVIDIA's meteoric rise has some analysts questioning how much room the company has left to grow. However, its stock price continues to defy expectations. Considering the huge potential for artificial intelligence and the chipmaker's dominant position in the market, I wouldn't bet against it long-term.

So the lower noodles are why Nvidia's stock is still a screaming buy right now.

Profit from the Tailwinds of Tech Stocks

As a leading chipmaker, Nvidia has a strong position in the technology sector. In addition to providing hardware for artificial intelligence developers, the company's chips power everything from cloud-based platforms to multi-frequency gaming machines, laptops, and custom PCs.

Nvidia, yes.Nintendo The partnership with Hewlett-Packard, the leading supplier of the Switch console, has brought the chipmaker's hardware into the mainstream consumer space. the Nintendo Switch is the third best-selling console of all time, with 139 million units sold to date. the Nintendo Switch is the third best-selling console of all time, with 139 million units sold to date. the Nintendo Switch is the third best-selling console of all time, with 139 million units sold to date.

Still, the best reason to invest in Nvidia is its artificial intelligence prospects. According to Grand View Research, the AI market, which amounted to nearly $200 billion last year, is expected to expand at a compound annual growth rate of 37% through at least 2030. By 2030, the AI industry is expected to reach nearly $2 trillion. There seems to be no end in sight to the surge in demand for AI GPUs, which is good news for Nvidia.

Last year, Nvidia captured about 90% of market share in the AI chip space, resulting in an earnings surge.

In the most recent quarter, the fourth quarter of fiscal year 2024 ending in January, the company's revenues rose 2,65% year-over-year to $22 billion. Operating income jumped 9,831 TP3T to nearly $14 billion. This monster growth was largely driven by a 4,09% increase in data center revenue, reflecting a surge in AI GPU sales.

In addition, last year, Nvidia's free cash flow grew by 4,30% to more than $27 billion, significantly higher than that of its chip competitors.AMD The $1 billion andIntelThe amount is negative $14 billion.While both competitors have released new GPUs, Nvidia has a much larger cash reserve and can continue to invest in its technology to maintain its market leadership.

NVIDIA is at its best trading value in months.

Last year, Nvidia became the first chipmaker with a market capitalization of more than $1 trillion. Currently, Nvidia's market capitalization has exceeded $2 trillion, making it the second-largest chip maker in the world afterMicrosoft respond in singingAppleThe third most valuable company in the world.

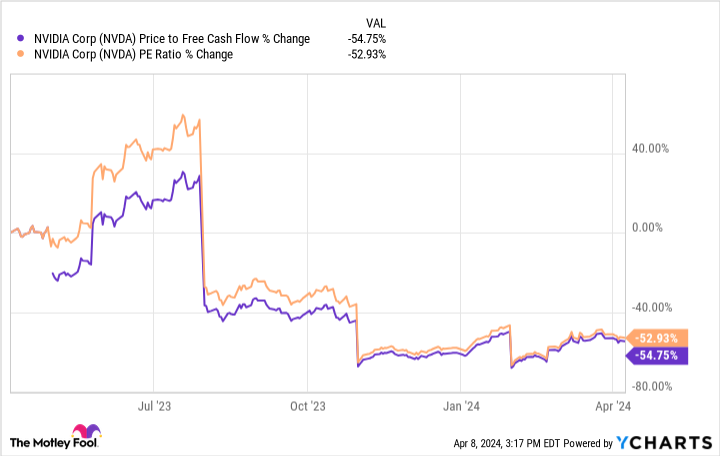

Nvidia has come a long way in a short period of time, but based on the P/E and free cash flow ratios, its stock has actually become more valuable over the past 12 months.

The chart below shows that Nvidia's P/E and P/N ratios have declined significantly over the past year, suggesting that its stock price is in one of the most valuable positions over the 12-month period.

The P/E ratio is calculated by dividing a company's stock price by its earnings per share (EPS). Meanwhile, the P/E ratio is calculated by dividing the market capitalization by the free cash flow. These are useful valuation metrics because they take into account the financial health of the company. For both indicators, the lower the number, the higher the value.

Nvidia's sharp declines in these two metrics make its stock an attractive buy, as the company's future looks bright.

Estimates indicate that Nvidia will continue to outperform theStandard & Poor's 500indices

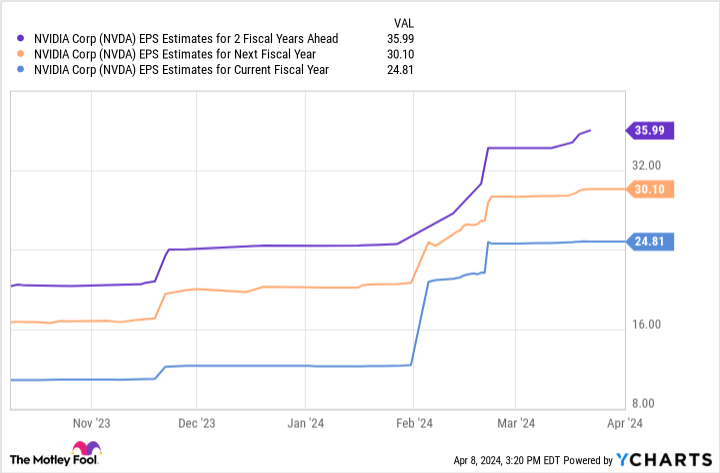

Nvidia's outlook for the next few years is exciting; its earnings-per-share (EPS) expectations are also optimistic.

The chart above shows that analysts believe Nvidia could earn close to $36 per share by fiscal 2026. Multiply that by a forward P/E of 35, and you get a stock price of $1,260.

If this figure is reached, the share price will rise by 44% over the next two years, which will not replicate the 2023 price trend, but will exceed the 2023 price.Standard & Poor's 500 The increase in 24% over the previous two years.

Nvidia still offers a lot of opportunities for new investors and is a stock to consider right now.

Should you invest $1,000 in Nvidia now?

Before buying Nvidia stock, consider the following:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)Worth investing in10Nvidia is not one of the 10 stocks listed on ....... The 10 stocks that made the list are poised to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 8, 2024

Dani Cook has no position in any of the stocks mentioned above. the Motley Fool recommends Advanced Micro Devices, Apple, Microsoft, and NVIDIA. the Motley Fool recommends Intel and Nintendo, and recommends the following options: Intel January 2023 $57.50 Call Options Long, Intel January 2025 $45 Call Options Long, Microsoft January 2026 $395 Call Options Long, Microsoft January 2026 $405 Call Options Long, Microsoft January 2026 $405 Call Options Long, and Microsoft January 2026 $395 Call Options Long. The Motley Fool recommends the following options: Intel January 2023 $57.50 Calls Long, Intel January 2025 $45 Calls Long, Microsoft January 2026 $395 Calls Long, Microsoft January 2026 $405 Calls Short, Intel May 2024 $47 Calls Short. The Motley Fool has a disclosure policy.

Is INVISTA Stock Worth Buying? This post was originally published by The Motley Fool.