.

Two Reasons to Buy Coinbase Stock Like There's No Tomorrow

At first glance.Coinbase Global (NASDAQ resonance code: COIN)It seems to be a bad investment now.

The stock price has more than tripled in 52 weeks. The cryptocurrency exchange operator's stock trades at a valuation of 103 times free cash flow and 950 times earnings. I mean, that's enough to make even well-heeled growth investors sniff their salt.

Many investors won't give it a second glance. They're happy to skip this seemingly overvalued crypto stock and move on to the next opportunity.

Coinbase is going through the usual four-year boom-and-bust cycle in the cryptocurrency space, with rising bottom-line profits barely above the break-even line so far.

Let me tell you two reasons why you should consider Coinbase as your next stock investment.

1. Coinbase is ripe for operation

Whereas, Coinbase stock looks expensive at the moment. The cryptocurrency market is waking up from another cold snap, and the whole industry is on the rise.bitcoin (virtual currency) (CRYPTO: BTC)Last year, I went up to 138%.Ether-lane (usually as part of a street name)(CRYPTO: ETH)The 85% has been increased.Solana (CRYPTO: SOL)Coinbase's rate of return for the same period was 270%, which makes sense.

The company does not create value by holding Bitcoin or Ether tokens. Coinbase does not even record changes in the value of its digital assets as revenue, but rather as part of its operating costs.

Instead, it makes money through transaction fees, interest and blockchain incentives, and subscription-based services. Mind you, this is similar to a regular bank, but based on a different set of financial assets. The company's financial health is closely tied to the underlying interest in cryptocurrencies, not the price of any particular digital currency.

2. This cryptocurrency cycle is different from the previous ones

Coinbase has been around since the early days of cryptocurrency. Founded in 2012, when there were only three cryptocurrencies on the market and a Bitcoin was worth less than $7, the exchange has gone through three Bitcoin halving cycles. The fourth halving cycle is coming next week, when Bitcoin mining incentives will be halved again. So far, each halving cycle has driven the price of Bitcoin up significantly, putting the cryptocurrency industry back in the spotlight and generating more trading volume in different types of digital currencies.

So it's about to happen again, but this time it's different. This is the case of Exchange Traded Funds (ETFs) that are tied to the spot price of Bitcoin.

Spot Bitcoin ETFs offer investors a completely different way to invest in this novel asset class. Instead of opening a new account on Coinbase or other cryptocurrency exchanges, learning different trading rules and procedures, and holding the digital currency directly, you can now trade Bitcoin like a regular stock. The U.S. Securities and Exchange Commission (SEC) approved 11 applications for this new ETF type in January, and they already hold more than $53 billion in Bitcoin assets.

The expected arrival of spot Bitcoin ETFs has triggered the early start of the fourth halving wave. As mentioned earlier, many cryptocurrencies and related stocks have risen over the past year thanks to the expected halving, ETF programs, and a calmer inflationary trend in the economy. On top of this strong start-up platform, Coinbase will see even higher trading volumes on the back of the new ETFs.

But wait - why is this a good thing? These ETFs are not from the Coinbase system.Gone.Potential Crypto Volume?

Thank you for your question. As a matter of fact, most ETFs are using third-party trustee services to execute Bitcoin trades and keep crypto assets in secure digital wallets. Nine out of 11 ETFs rely on Coinbase.

We're not just making money on TOG, we're making money on trading and financing," Coinbase chief executive Brian Armstrong said on an earnings call in February, four weeks after the ETF was approved. " Every institution is now starting to hold cryptocurrencies, and the asset class will become a standard part of every diversified portfolio. The financial system is officially adopting cryptocurrencies. This is really good, and Coinbase is the most trusted name partner here."

As a result, Coinbase has found a new source of revenue, while giving a boost to the cryptocurrency market as a whole. It's a win-win situation.

Coinbase's valuation is getting higher and higher.

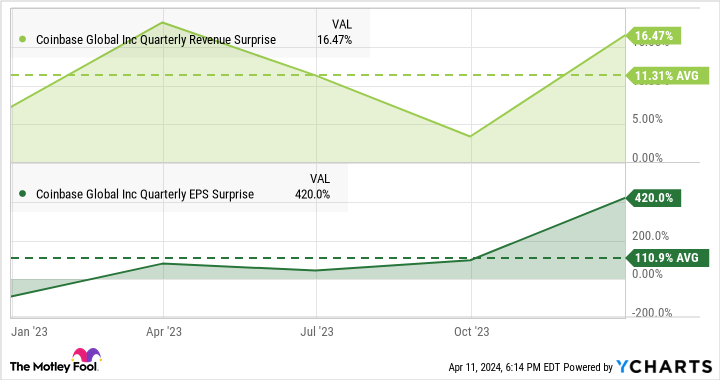

Coinbase's valuation will shrink dramatically if we look ahead to the upcoming market rally. The stock trades at 12 times next year's average revenue estimate and 108 times earnings estimate. In its last five quarterly reports, the company has beaten the consensus revenue target by an average of 11%, while earnings have more than doubled the Wall Street average.

Past performance is no guarantee of future results, but Coinbase has a track record of exceeding analysts' expectations, and the company is currently facing a unique set of growth drivers. If this bullish momentum can be sustained over the course of a 12- to 18-month halving cycle, the current share price could soon look like a bargain.

That's why you should consider buying some Coinbase shares now. They won't be cheap forever.

Should you invest $1,000 in Coinbase Global right now?

Before buying shares of Coinbase Global, please consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only ...... and Coinbase Global were not included. The 10 stocks that made the list have the potential to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 8, 2024

Anders Bylund has positions in Bitcoin, Coinbase Global, Ether and Solana.The Motley Fool has recommended positions in Bitcoin, Coinbase Global, Ether and Solana.The Motley Fool has a disclosure policy.

Two Reasons Buying Coinbase Stock Is Like There's No Tomorrow was originally published by The Motley Fool.