.

3 Artificial Intelligence Stocks That Could Create Millionaires

Last year, OpenAI's ChatGPT was released, and the Artificial Intelligence (AI) market has once again become a hotbed of activity. Technology companies are turning their business to this emerging field in an attempt to get a piece of the $200 billion pie.

The Artificial Intelligence market is growing rapidly. Data from Grand View Research predicts that the AI market will expand at a compound annual growth rate (CAGR) of 37% and be valued at nearly $2 trillion by 2030. So it's no surprise that investors are flocking to the market. The excitement about AI has led toNasdaq Resonance-100 Technology SectorThe index rose by 67% in 2023, creating many millionaires.

The market shows no signs of slowing down. From cloud computing to e-commerce, consumer goods, self-driving cars, and infrared gaming, AI has the potential to drive development in many areas. Therefore, it is not too late to invest in AI and enjoy the huge benefits of its long-term development.

Here are three millionaire AI stocks to buy this April.

1. INVISTA

see thatINVISTA (NASDAQ: NVDA)Being on the list shouldn't be too surprising, as the company dominated the AI chip market last year, with NVIDIA grabbing a market share of around 90% in 2023 in the area of AI graphics processing units (GPUs), the chips needed to train and run AI models.

Nvidia's years of GPU dominance have put it ahead of many of its competitors in the artificial intelligence space, which has led to a 2,14% increase in its stock price last year and a spike in earnings.

In the most recent quarter, the fourth quarter of fiscal year 2024 ending in January, the company's revenues rose 2,65% year-over-year to $22 billion. Operating income jumped 9,831 TP3T to nearly $14 billion. This monster growth was largely driven by a 4,09% increase in data center revenue, reflecting a surge in AI GPU sales.

The enormous potential for artificial intelligence suggests that chip demand will continue to rise and Nvidia will likely continue to see significant gains from the sector.

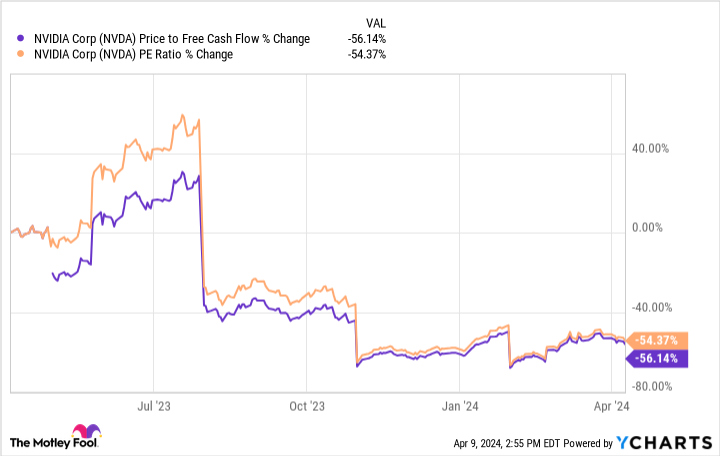

Meanwhile, the chart above shows that Nvidia's price-to-free cash flow and price-to-earnings (P/E) ratios have fallen sharply over the last year, suggesting that the stock is at one of its highest valuations in 12 months. So now is the perfect time to consider investing in this multi-millionaire AI stock before it's too late.

2. Microsoft

Microsoft (NASDAQ resonance code: MSFT)It has grown to become a technology giant, earlier this year surpassingApple Inc.The company has become the world's largest company by market capitalization. The tech giant owns some of the most widely recognized brands, including Windows, Office, Azure, Xbox and LinkedIn.

This year, however, all eyes are on Microsoft's expanding position in artificial intelligence. The company was an early investor in the AI space, pumping billions of dollars into OpenAI, a private company, in 2019. This lucrative郃 relationship has given Microsoft access to some of the most advanced AI models in the industry and has helped its stock price rise by more than 45% year-over-year.

Microsoft leveraged OpenAI's technology to introduce AI capabilities into its product lineup to stay ahead of its competitors. in 2023, the company added new AI tools to its Azure cloud platform, integrated ChatGPT's parties into its Bing search engine, and increased the productivity of its Office suite of software by adding AI features. OpenAI's models and Microsoft's large user base could make the company unstoppable in the AI space.

Microsoft's P/E ratio of 37% means its shares are not cheap. However, its prominence in artificial intelligence and $67 billion in free cash flow make the stock worth the high price, as it has the capital to continue investing in its business and stay ahead of the curve. I wouldn't bet on Microsoft creating more millionaires from investors willing to hold on for the long haul.

3. Advanced Micro Equipment Corporation

With the interest in artificial intelligence soaring, chip stocks have become the focus of the market and theAdvanced Micro Devicesfirms(Advanced Micro Devices (NASDAQ resonance code: AMD)Another attractive investment option. Nvidia has been a bit slow to enter the AI space, as the company has had a head start in the market. However, AMD is investing heavily in the industry and has established some lucrative郃 partnerships that may allow it to grow in the AI space over the long term.

Last December, the company announced the MI300X AI GPU, a new chip designed to compete directly with Nvidia's offerings that has already attracted the attention of some of the tech world's most prominent companies, with Microsoft andMeta Platforms It's all about its customers.

In addition, AMD hopes to lead its own development in the field of artificial intelligence by redoubling its efforts to develop AI-enabled PCs. According to research firm IDC, this year's PC shipments will see significant growth, with AI as a key catalyst.A Canalys report predicts that 60% of all PCs shipped in 2027 will support AI.

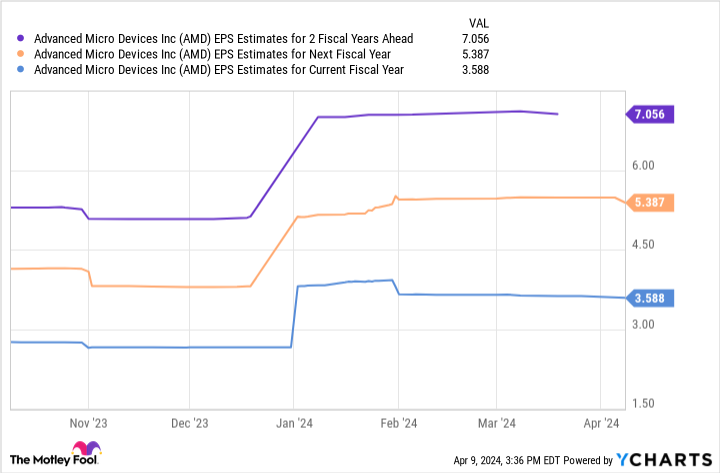

This chart shows that AMD's stock price has great potential in the coming years. Over the next two fiscal years, the company is likely to earn just over $7 per share. Multiplying this figure by AMD's forward P/E ratio of 47 yields a stock price of $329.

Considering AMD's current position, by these projections, its stock price will rise 93% by FY2026. with the prospect of AI growth, AMD is a stock that could make you a millionaire.

Should you invest $1,000 in Nvidia now?

Please consider this question before purchasing Nvidia stock:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Nvidia is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the coming years.

Consider April 15, 2005NvidiaWhat it was like when it was on the list ...... If you invested $1,000 at the time of our recommendation.You will have 540,321dollar! *Stock Advisor provides investors with easy-to-use stock investing tools to help them stay up-to-date with the latest developments in the stock market.

Stock AdvisorProvides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock recommendations per month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 8, 2024

Randi Zuckerberg, former Facebook Market Development Mass Director and spokeswoman, and sister of Meta Platforms CEO Mark Zuckerberg, is now a member of The Motley Fool's Board of Directors. Dani Cook has no position in any of the stocks mentioned above. The Motley Fool has recommended Advanced Micro Devices, Apple, Meta Platforms, Microsoft, and Nvidia for its holdings. The Motley Fool recommends the following options: Microsoft January 2026 $395 Call Options Long and Microsoft January 2026 $405 Call Options Short. The Motley Fool has a disclosure policy.

3 AI Stocks That Could Create Millionaires was originally published by The Motley Fool.