.

Refrigerated Markets Have a Mediocre Spring

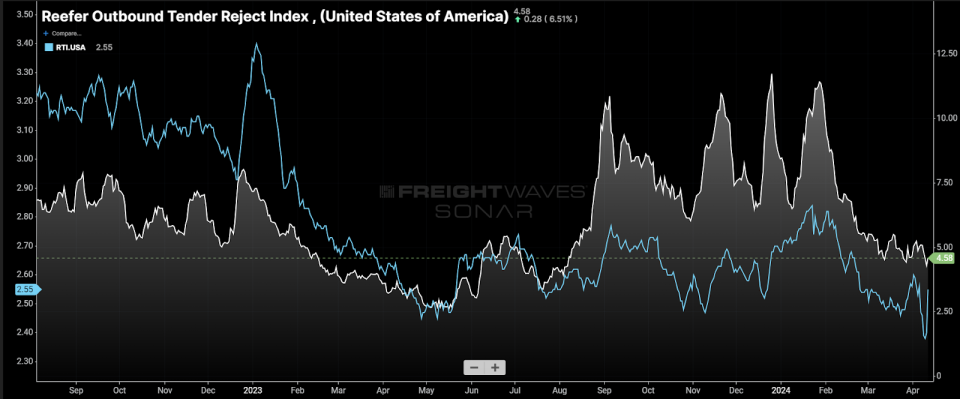

Chart of the Week:Refrigerated Vehicle Tender Rejection Index, Refrigerated Vehicle Trucking Index - United States Claims: ROTRI.USA, RTI.USA

The refrigerated (reefer) truckload market has stabilized after showing signs of instability ahead of the Big Rock in last year's swing season.

The Reefer Outbound Tender Rejection Index (ROTRI) was above 81 TP3T for most of the fourth quarter and January 2023 and has averaged below 51 TP3T since early March.The Reefer Truckload Tariff Index (RTI), a measure of aggregate spot freight rates for reefer cargo, showed a similar change, indicating that the market has returned to an easing condition.

The rejection rate measures the rate at which carriers reject shipper requests. The higher the rejection rate, the more difficult it is to find trucking capacity.

The refrigerated transportation market tends to be much smaller and less public than the dry freight market. Because of this, rejection rates and spot rates tend to be more volatile.

The refrigerated cargo sector is often severely affected by seasonal fluctuations in demand. Even for companies that do not transport frozen products, the transportation of various frozen products can be extremely disruptive.

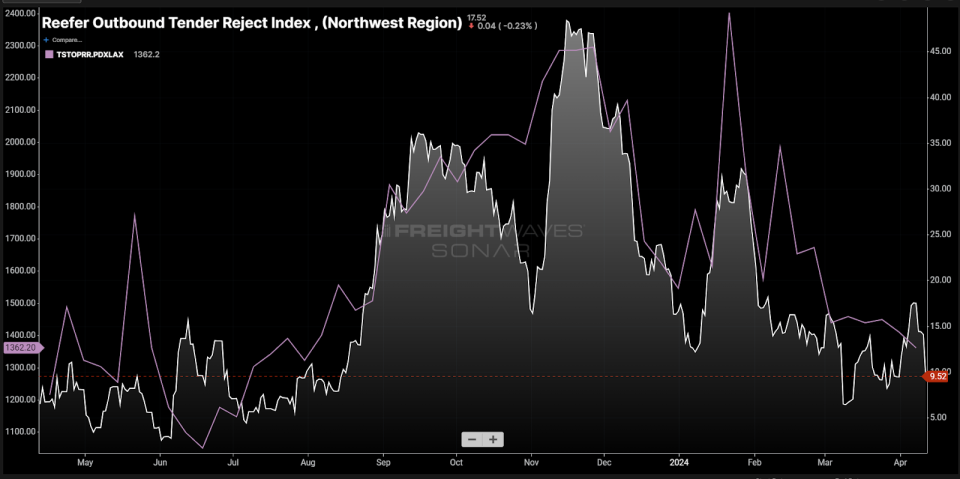

Where seasonal harvests exceed expectations, soaring rates can lure carriers away from more stable business. This appears to be a motivating factor in the Pacific Northwest's rate spikes and load denials during last year's season.

Northwest rejection rates spiked above 301 TP3T last September, after averaging below 81 TP3T for much of the spring and summer, and according to Truckstop.com, spot prices from Portland, Oregon, to Los Angeles, often a very cheap and easy-to-reach route, spiked from $1,330 to $1,950 (461 TP3T) in less than a month. to $1,950 (46%) in less than a month.

From August through October, there are several harvest seasons in the Northwest. The apple harvest may be the most familiar to those outside of the trucking industry, but potatoes, berries, onions, and hops are also big commodities in this region.

Christmas tree harvesting begins in November, which can also lead to a spike in freight rates in areas where demand for cargo is usually extremely slow.

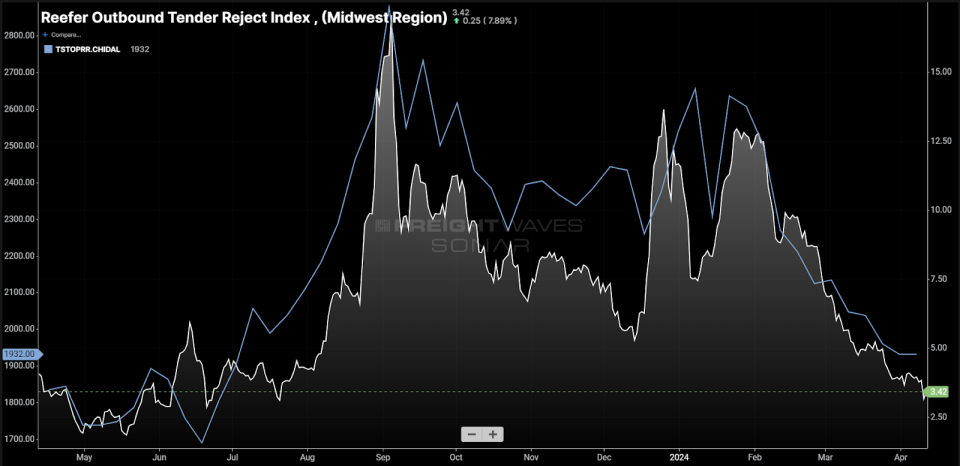

January temperatures were the lowest of the year, hitting the Midwest especially hard.

The demand for freeze protection services from shippers has increased dramatically, and as refrigerated trailers are insulated and temperature-controlled, they are also able to provide freeze protection services.

Anyone who watched the Tyler Sweeney ...... uh ...... Kansas City Chiefs playoff game against the Miami Dolphins in January remembers when the wind chill was 20 degrees below zero.

In mid-January, reefer rejects in the Midwest rose to over 12% and spot rates from Chicago to Dallas jumped 15% in one week.

Reefer rejection and spot rates have been declining since the extreme cold event, with signs of a recovery in late March, but it was not sustained and not as strong as the previous two occasions.

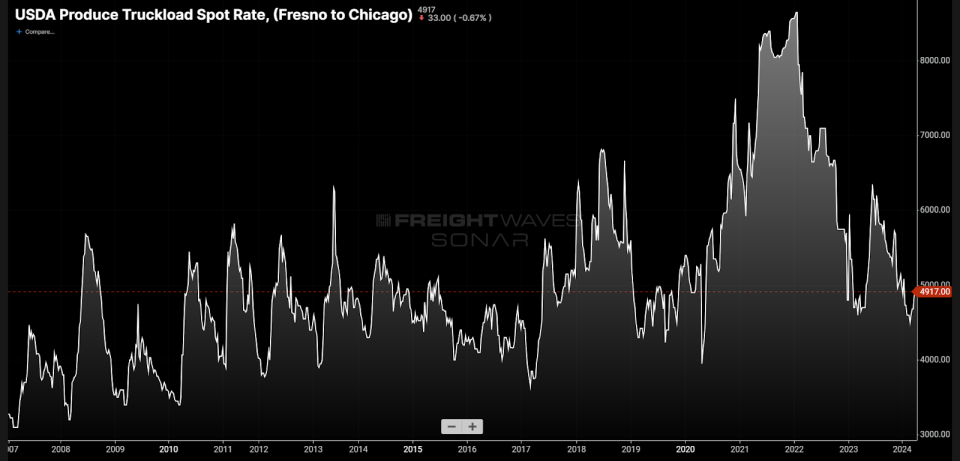

Mistletoe shipments on the West Coast are about to begin, usually between now and June. For specific product shipments from California's Central Valley to Chicago, spot freight rates tend to jump from now until July. A wet season can delay harvests, which tends to make markets more responsive when harvests deviate from plans.

However, market transformation will not be caused by the product alone. This depends to a large extent on the still-abundant capacity environment. As long as there are more trucks than cargoes, the disruption will be temporary, but that doesn't mean that reefer carriers will remain quiet this year.

The Californian Mistletoe season is a leading indicator of a wider market turnaround in 2017. While it is not a turning point, it does signal that a turnaround may be coming. At the very least, the reefer industry seems to be telling us that, despite the weak spring, change is coming.

About this week's chart

The FreightWaves Weekly Chart is a selection of charts from SONAR that provide an interesting data point on the state of the freight market. The charts are selected from thousands of potential charts on SONAR and help participants gain a real-time, intuitive understanding of the freight market. Each week, market experts publish a chart on the front page with commentary. The "Chart of the Week" is then archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presents the data in graphs and maps, and provides real-time industry commentary that freight market experts want to know.

The FreightWaves data science and product teams release new datasets every week to improve customer satisfaction.

For SONAR logo, please click here.

Refrigerated Markets Have Mediocre Spring" on FreightWaves.