.

1 Gorgeous Dividend Stock with 27% Dividend Yield Drop and Valuation Near 1-in-10 Years, Worth Buying Now

Union Hewlett-Packard (NYSE: UL)A consumer products giant with some of the world's most recognizable brands, including Dove, Axe, Vaseline, Knorr, and Ben & Jerry's, the company has a number of popular products in the consumer staples industry and is a perfect example of a cornerstone stock that could be the cornerstone of any investment portfolio. It is a perfect example of a cornerstone stock that can be the cornerstone of any investment portfolio.

With a beta of 0.45, Unilever is a more stable stock than the market. However, even though Unilever is considered a safe investment, it can still provide investors with an aggregate return that outperforms the market over the next ten years.

This stock is down 271 TP3T from its all-time high and trades at a once-in-a-decade valuation with a 3.91 TP3T (but safe) dividend yield. Here's why Union Carbide is worth buying right now.

The powerful brand name of UniHelix

UniHelix has more than 400 brands sold in 190 countries. The Company divides its business into five business units, each of which is illustrated below:

-

Beauty & Wellness (21% of sales)Dove hair and skin care, Sunsilk, TreSemmé and Clear hair care, and Pond's and Vaseline skin care.

-

Personal Care (23% of sales): Dove body wash, Axe and Rexona deodorants, PepsiCo and Signal toothpaste.

-

Home Care (20% of sales): OMO Detergent, Comfort Softener, Sunlight Detergent and Cif Cleaning Products.

-

Nutrition (22% of sales): Knorr Noodles, Hellman's Seasonings and other local specialties.

-

Ice cream (13% of sales): Ben & Jerry's, Talenti, Cornetto and Magnum.

Unique to Unilever is that approximately 78% of its sales are generated in North America.outside the region Of this total, 58% of revenue comes from emerging markets. These international markets offer the company the potential to grow beyond the expectations of the consumer staples industry.

However, while Koon's underlying sales (net of exchange rate effects) grew by 7% in 2023, Caritas' GAAP sales declined by 1% as a result of the stronger U.S. Dollar, which, in the end, should only be a temporary fluctuation and a by-product of Caritas' large global scale.

Keeping things lean globally was paramount for the company, so Goon shifted her marketing focus to 30 "strong brands", which accounted for about 75% of the company's sales in 2023, up 9% during the year, or 2 percentage points more than the company's overall growth.

To further the process of streamlining, Caritas has recently made a surprising announcement: it will spin off its ice cream division.

No more Ben & Jerry's?

UniHelp recently announced plans to spin off or sell its ice cream business, which has the lowest profit margins of its five business units. With an operating margin of only 11%, compared to an average margin of 17% for the other four business units, the ice cream business was a drag on UniHelix's profitability.

The Ice Cream Division requires more capital than other divisions due to the need to refrigerate the supply chain. As a stand-alone company, the Ice Cream Division can focus on its unique business model and create new synergies as part of a more direct operation.

For a refreshed UniHelva, the spin-off would result in a leaner business and a more market-friendly valuation due to higher profit margins. With the price of UniHelix's shares near their lowest valuation since 2015, this proposed spin-off could be the trigger for a resurgence in the price of UniHelix's shares.

Once-in-a-decade valuation for Union Carbide

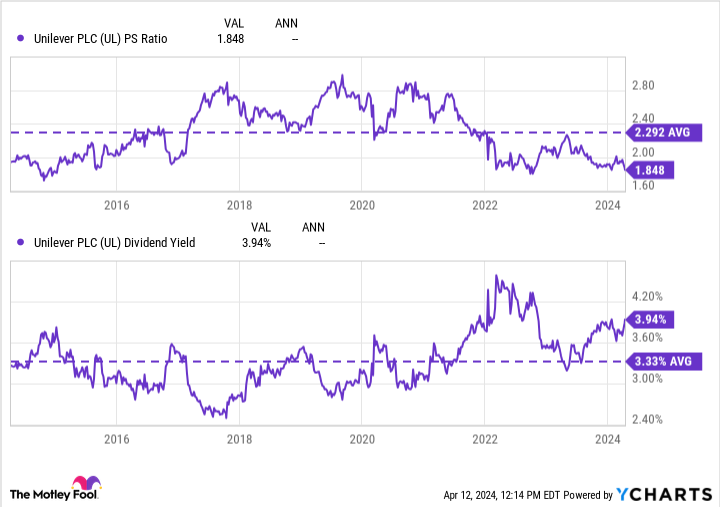

The combination of Union Carbide's dividend yield of 3.9% and price-to-sales ratio (P/S) of 1.8 highlights the fact that the company may be at one of the most attractive valuation levels of the last decade.

Unilever's 2023 free cash flow (FCF) margin is 12%, with FCF trading at just 15x. By comparison, the company's most similar consumer staples peers trade at 24 to 31 times FCF.

With this substantial cash flow, the company would only need to use 62% of FCF generated in 2023 to pay a dividend rate of 3.9%. This excess cash allows room to increase the dividend in the future and to proceed with a stock rotation, which has reduced the number of shares of UniHelix by 2% per year for the past three years.

These shareholder-friendly cash returns, coupled with Caritas' global model, streamlined operations, and discounted valuation, create a compelling cornerstone investment for patient investors willing to buy and hold for many years.

Should you invest 1000$ in Caritas now?

Please consider the following before purchasing shares of Union Carbide:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Only the stock ...... and Caritas are not among them. The 10 stocks that made the list could generate huge returns in the years to come.

Consider April 15, 2005Nvidia) on the list at ...... If you invest $1,000 at the time of our recommendation, theYou will have 540,321dollar! * *The

Stock AdvisorProvides investors with an easy-to-follow blueprint for success, including guidance on building an investment team, regular updates from analysts and two new stock picks each month. Stock Advisor The rate of return for the service since 2002 has been the same as that for the S&P 500 index, but the rate of return for the service has been the same as that for the S&P 500 index.quadruple*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 8, 2024

Josh Kohn-Lindquist does not own any of the above shares.The Motley Fool recommends Unilever Plc.The Motley Fool has a disclosure policy.

Buy 1 Gorgeous Dividend Stock Down 27% Now Near Once-in-a-Decade Valuations was originally published by The Motley Fool.