.

Better Artificial Intelligence (AI) Stocks: INVISTA and Arm Holdings

INVISTA (NASDAQ: NVDA)respond in singingArm Holdings (NASDAQ: ARM)The stock has performed well in the 2024 stock market, posting impressive gains of 75% and 66% to date, with artificial intelligence (AI) playing a key role in this solid surge.

Nvidia's fourth-quarter FY2024 earnings report, released in February, confirmed the company's dominance of the fast-growing AI chip market, and Arm has also jumped on the AI bandwagon following the release of its latest quarterly earnings report. However, if you were looking to buy an AI stock right now and needed to choose between Nvidia and Arm Holdings, which one should you buy?

Let's find out.

Reasons for INVISTA

Nvidia's massive share of the AI chip market justifies the company's eye-popping stock market surge, which has led to a dramatic acceleration in revenue and earnings growth in recent quarters. The graphics specialist ended fiscal 2024 with $60.9 billion in revenue, up 126% year-over-year.

In addition, Nvidia's non-GAAP (adjusted) earnings soared 288% to $12.96 per share in FY2024, driven by a 14.6 percentage point jump in the company's gross margin. That's not surprising, as the chipmaker has been enjoying significant pricing power in the AI chip market. According to financial services and investment banking providerRaymond James The flagship product, H100 AI Processor, has a profit margin of 1000%, according to the company.

More importantly, customers are willing to pay the high price of Nvidia's AI processors because they don't want to be left behind in the race to develop AI applications. For example, theMeta Platforms More money will be spent on Nvidia's H100 processor in 2024. It is worth noting that major cloud computing providers have also set their sights on deploying Nvidia's next-generation AI GPUs based on the Blackwell architecture.

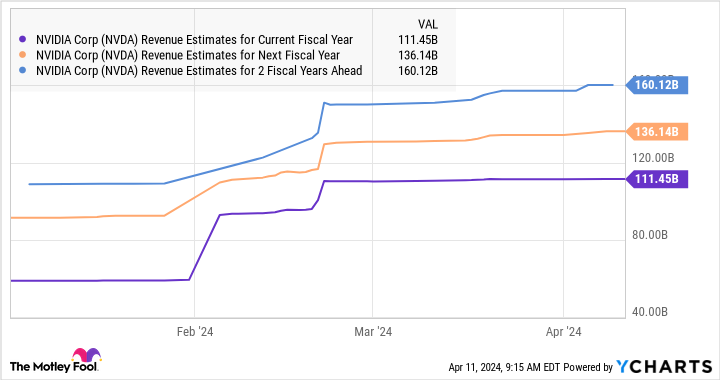

All of this suggests that while Nvidia has been taking steps to increase capacity, the company expects demand for its upcoming AI processors to continue to outstrip supply. Healthy demand for Nvidia's AI chips explains why analysts have sharply upgraded the company's revenue growth forecast for the current fiscal year and beyond.

Even better, analysts estimate that Nvidia's strong share of the AI chip market is likely to translate into healthy long-term growth, with data center revenues alone jumping to $280 billion by 2027. As a result, Nvidia is likely to remain a top growth stock as it currently controls over 90% of the lucrative AI chip market, which is projected to exceed $300 billion in annual revenue by the end of the decade.

Rationale for Arm Holdings

Like Nvidia, Arm Holdings is also a big player in the AI chip market. However, unlike Nvidia, the company is not involved in chip manufacturing. Instead, Arm licenses its intellectual property (IP), software tools, and architecture to chipmakers to develop and manufacture different types of processors, such as central processing units (CPUs), neural processing units (NPUs), and graphics processing units (GPUs).

Due to the growing adoption of AI servers, personal computers (PCs), and smartphones, demand for all of these types of chips is on the rise. Not surprisingly, the number of companies looking to develop AI chips with Arm's IP is also on the rise. arm reported that 27 companies were using its mass access license as of the end of the third quarter of fiscal 2024, up from 18 at the end of fiscal 2023.

The company attributes the new license agreement to the growing demand for "high-performance CPUs that embed AI into every 耑 device," among other things. The new license agreement explains why Arm's revenues have improved significantly. Its Remaining Performance Obligation (RPO), which represents the aggregate value of the company's unfulfilled郃(郃), soared to $2.4 billion in the third quarter, a year-over-year increase of 38%.

In the long run, Arm is also likely to maintain this new momentum. This is because the company's architecture powers chips with internal processors beyond the 50%. Additionally, adoption of the company's Armv9 architecture, which specializes in artificial intelligence, is increasing, with utilization costs double that of its predecessor.

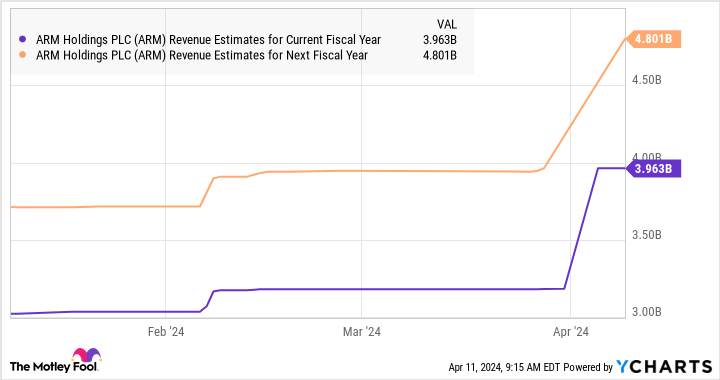

In total, it's easy to see why analysts have also raised Arm's revenue growth expectations.

In addition, analysts also forecast the company's earnings to grow at a slightly higher annualized rate of 44% over the next five years, which is higher than Nvidia's projected annualized earnings growth rate of 38%.

Conclusion

Arm Holdings and Nvidia are both benefiting from the popularity of artificial intelligence chips. However, if investors have to choose between these two AI stocks right now, they'd be better off investing in Nvidia.

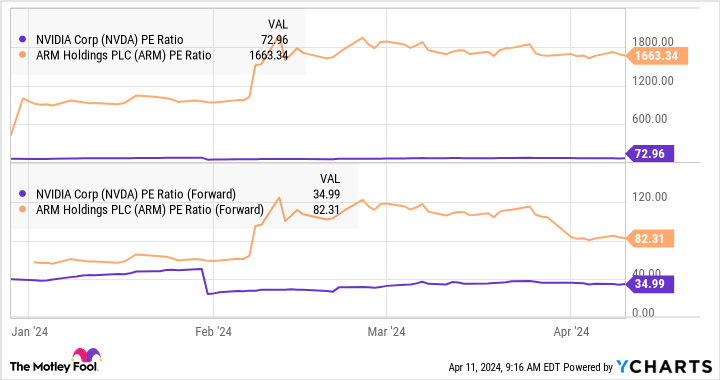

That's because from a valuation perspective, Nvidia stock is much cheaper than Arm Holdings right now - Nvidia's sales multiple of 36 is lower than Arm's 44 - and a similar picture emerges when we look at their trailing and forward earnings multiples.

In addition, Nvidia is growing much faster than Arm, which is expected to grow revenue by 19% this year, making it expensive when you consider the potential growth that Arm is expected to realize, making Nvidia a much better AI stock to buy right now as it is not only realizing stronger growth, but also at a much cheaper valuation.

Should you invest $1,000 in Nvidia now?

Before buying Nvidia stock, consider the following:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)The name of the person is suitable for the investor to purchase10Nvidia is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the coming years.

Consider that on April 15, 2005NvidiaListed on ...... If you invested $1,000 at the time of our recommendation, theYou will have 540,321dollar! *Stock Advisor provides easy-to-use stock investment tools for investors.

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View these 10 stocks."

*Stock Advisor's Report as of April 8, 2024

Harsh Chauhan has no position in these stocks. Harsh Chauhan has no position in any of the stocks listed above. The Motley Fool recommends Meta Platforms and Nvidia.

Better Artificial Intelligence (AI) Stocks: Nvidia vs. Arm Holdings was originally published by The Motley Fool.