.

More Room to Rise: Wells Fargo Says Double-Digit Returns for These Two Stocks.

Over the weekend, markets were in turmoil as major stock indexes tumbled on the back of hot CPI data. Meanwhile, it remains to be seen how the Iranian missile and drone strikes against Israel on Saturday night will affect the Middle East and market sentiment in the week ahead.

Wells Fargo's premier equity strategist, resonance Chris Harvey, says that in the grand scheme of things, investors shouldn't worry too much about the market going for the jugular right now. He told us in a recent note about the state of the market until then, "There's still more upside to come. Harvey expects the stock market to continue to grow; his year-end forecast for the S&P 500 is now 5,535, up from 4,625, which implies a gain of 8% from the previous level.

"We believe," Harvey said in explaining his position, "that the bull market, the long-term growth story of AI, and index concentration have shifted investor attention away from traditional valuation metrics to long-term growth and discount metrics. This long-term optimism is a function of the fact that since the end of 2022, investors' valuation thresholds appear to be decreasing while time horizons are increasing. A little over a year ago, we reduced the equity risk premium to zero, and now our focus shifts to 2025.

With that in mind, stock analysts at Wells Fargo are looking for stocks that can profit from the resumption of the bull market. They have selected two stocks that are expected to post double-digit returns this year, and a look at the TipRanks database reveals that both stocks have a consensus rating of "Strong Buy". Here are the details and Wells Fargo's comments.

GitLab (GTLB))

First up is GitLab, a DevOps company that created an open source platform for DevSecOps. This sounds like a mouthful, but anyone in the industry can understand it: GitLab provides its customers with a specialized platform solution that optimizes rapid, high-impact software development and yields high returns on the final product. As mentioned earlier, GitLab's platform is provided as open source software; the company's founding theory is that "everyone can contribute. The company's open-source model allows all of its users to become contributors to the platform code if they wish to do so; thus, the model is characterized by rapid innovation.

The open source platform also integrates directly into GitLab's "free" business model, where all users receive basic access and services, while paid users receive higher-level features and upgrades, as well as greater support. GitLab claims to have 1 million paid active licensees out of approximately 30 million total users. GitLab claims to have 1 million paid licensees out of approximately 30 million total users, and on the business side, the company employs approximately 2,000 people in 60 countries around the world, with more than 3,300 active contributors adding to the open source platform code.

In recent months and weeks, GitLab has begun to incorporate AI technology into its software platforms as part of an overall strategy that will utilize AI, particularly generative AI, to "solve customer pain points," that is, to solve users' most pressing problems and create seamlessness. GitLab has established a relationship with Google to use the tech giant's generative AI technology in its own cloud infrastructure; using the technology in GitLab's own cloud will enable the company to safeguard its own customers' privacy. GitLab has partnered with Google to use the tech giant's generative AI technology in its own cloud infrastructure; using the technology in GitLab's own cloud will enable the company to maintain the privacy and security of its own customers.

In addition to its foray into artificial intelligence, GitLab recently acquired Oxeye, an acquisition announced last month that will bring Oxeye's cloud-native security applications and risk management capabilities to GitLab's platform, enhancing GitLab's ability to analyze the composition of its software and the compliance side of its business. GitLab will also gain the ability to track vulnerabilities from code to the cloud, an important area for an open source company.

On the financial side, GitLab last reported results for the fourth quarter of FY24, which ended on January 31st of this year. Revenue for the quarter was $163.8 million, an increase of $33% year-over-year, exceeding expectations by $5.54 million. On a non-GAAP basis, GitLab reported earnings per share of 15 cents, beating estimates by 7 cents.

On the downside, GitLab's forward guidance for fiscal year 2025 is for revenue in the range of $725 million to $731 million, compared to analysts' guidance of $732.2 million. After the miss, GitLab's stock plummeted 21% and has not recovered since.

However, Wells Fargo analyst Michael Turrin was impressed by the company's moves into artificial intelligence and the opportunity that the current relative snap of the stock price presents to investors. He writes, "We think GTLB is well positioned to benefit from the genAI tailwind, given its code generation use case in Duo Pro. We think GTLB's current opportunity could be as high as $750 million in ARR, benefiting from both the added value of AI SKUs and incremental customer upgrades. ...... Shares are down 21% since Q4 Eps.(Now it's down)(modal particle intensifying preceding clause)23%), with FY25 models now set more conservatively and an AI-led product cycle in the making, we see a good opportunity to enter GTLB stock.

To quantify his outlook on the stock, Turrin rated the stock a Hold (Buy) with a price target of $70, which suggests an upside of 22.5% in the coming months. (For Turrin's track record, click here).

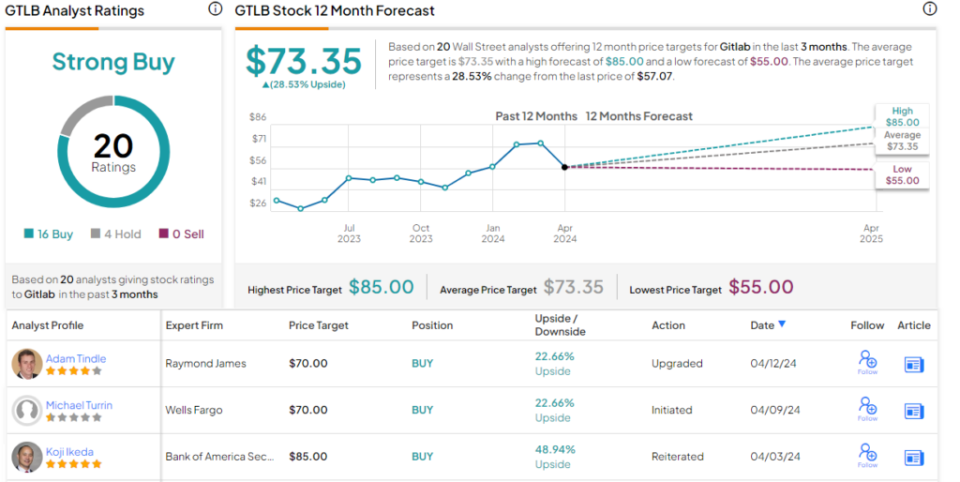

Of the 20 analyst ratings recently issued to GitLab, 16 were "Buy" (Buys), 4 were "Holds" (Holds), and the consensus rating was "Strong Buy The consensus rating is "Strong Buy". The company's stock is trading at $57.07 and the average price target of $73.35 implies an upside of 28.5% in one year. (View GitLab's stock forecast).

Mondays.com (MNDY)

Continuing our focus on the tech industry, we turned our attention to monday.com, a cloud software company that offers a range of Koonlogy products to its customers. Those products include office system optimization tools, project management and customer relationship management, and marketing and sales operations tools, all delivered on a cloud-based platform. monday.com's products are for all sorts of businesses, and it offers a software-as-a-service platform for its customers. The company's customer base includes well-known companies such as Coca-Cola and Uber.

Founded in 2012, monday.com has earned widespread recognition in its first decade of operation for its reputation for quality and support, as well as its easy-to-use "low-code, no-code" platform. Customers can quickly adapt monday's workgrooming system to their unique business model, staffing practices, and operational molds.

Since launching the product in 2014, the company has become the premier destination for workgrooming software. The company employs more than 1,800 people, has a product line in about 200 countries, and is used by more than 225,000 business customers every day. Notably, 2,295 of monday's customers generate more than $50,000 in annual recurring revenue.

According to the company's 4Q23 report, the last metric grew 56% year-over-year, in addition to 833 customers with annualized recurring revenues of more than $100,000, which was up 58% year-over-year. in total, monday.com generated $202.6 million in revenues for the quarter, which was up 35% year-over-year, and $4.83 million higher than expected. On a non-GAAP basis, earnings per share were 65 cents, 35 cents higher than expected.

Turning back to Wells Fargo, the firm's analyst Michael Berg made his position clear on the company and its stock's potential. Berg writes, "We believe that monday.com is a leader in a $150+ billion market. With its differentiated Koon & Co. platform, MNDY has a number of strong growth levers to capture market share and drive sustained growth, including 1) moving to the corporate 耑 market; 2) rapidly expanding its product portfolio to drive 耑 and cross-selling; 3) leveraging its expanding network of carpet makers to drive awareness and build strategic relationships; and 4) changing pricing". ".

These comments support the analyst's rating of Hold (Buy), with a target price of $260, implying a 34.5% increase in the stock price over the next 12 months. (To view Burger's track record, click here).

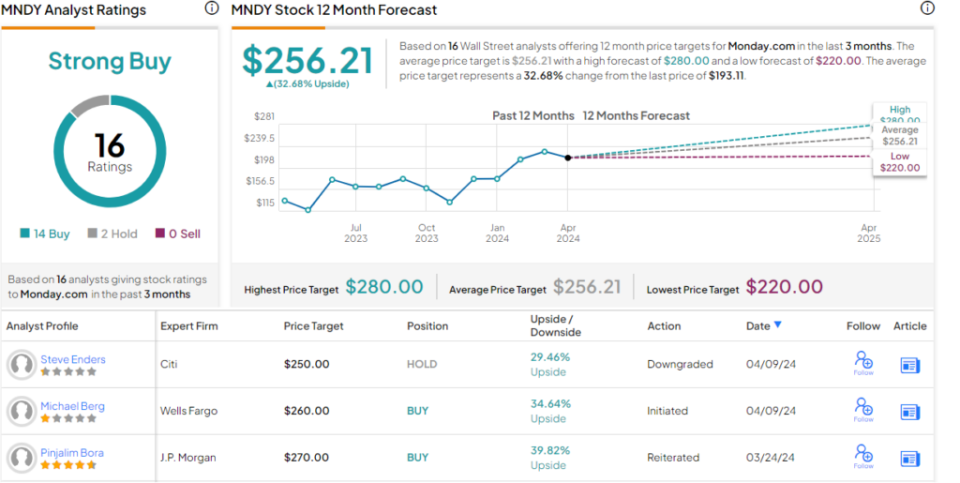

In total, monday.com has 16 recent recommendations, 14 of which are "Buy" and 2 are "Hold" with a consensus rating of "Strong Buy". With a share price of $193.11, the company's average price target of $256.21 is almost identical to WF's bullish rating, suggesting an upside of 33% in one year. (See also.Stock predictions for monday.com).

To find stocks with attractive valuations, visit TipRanks' Best Stocks to Buy, a tool that brings together all of TipRanks' stock insights.

Disclaimer: This article represents the views of the contributing analysts. The contents are for informational purposes only. It is important to conduct your own analysis before making any investment.