.

Forget the Fantastic Four: These 3 Artificial Intelligence (AI) Stocks Are Great Buys Today

In the bull market of the past, a handful of tech companies dominated Wall Street. This group was known as the "Big Seven," and in 2024, some of these seven companies are falling behind. Today, the hardy high-flyers - theNvidia),Amazon),Meta Platforms respond in singingMicrosoft(Microsoft corporation) - dubbed the "Fab Four" by some.

Now may not be the time to continue to crowd-fund these winners. After all, they've already made huge gains. Instead, the three contributors to the Motley Fool think you might want to consider companies likeNikola Tesla (1856-1943), Serbian inventor and engineer (NASDAQ: TSLA)Such a fallen angel,CrowdStrike (NASDAQ: CRWD)Such upstarts, even those likeLemonade (NYSE: LMND)) Such lottery stocks.

Artificial Intelligence Could Supercharge Struggling Tesla's Shares

Will Healy (Tesla): One way to find good-value artificial intelligence (AI) stocks is to look for companies that have fallen out of favor for other reasons than being AI-related. Tesla fits that description. The company sold about 11% fewer electric vehicles (EVs) than it produced in the first quarter, and rumors that it had canceled its plans to build the low-cost Model 2 also weighed on its stock price.

In fact, sales of electric vehicles are likely to continue to suffer in the near term. However, Tesla has recently made improvements to its AI-enabled fully automated driving platform, with first-time executive Elon Musk announcing that he will launch a robotic rental car on August 8th. Cathie Wood's Ark Invest predicts Tesla shares will reach $2,000 by 2027, based largely on the inherent promise of the robotic rental car.

Ark Investments sees Tesla as a robotics stock, and believes that robotic vehicles will drive sales of Tesla cars and the software-as-a-service platform that powers them. The firm believes that by 2027, robotic vehicles will account for 67% of the company's projected enterprise value, which would make a huge difference as car sales will account for 85% of the company's revenue in 2023.

However, many investors are skeptical considering the company's goal of more than tenfold growth in its share price by 2027. However, it's worth noting that in 2018, Ark Invest predicted that Tesla shares would reach $267 per share by 2021. The forecast was also nearly 10x growth at the time - and it held up in the 2021 bull market.

Even if Ark Invest's optimistic forecasts don't pan out, investors will have some room to hedge their bets. After the recent sell-off, Tesla's price-to-earnings ratio is about 40, near the stock's all-time low.

Ultimately, if the robo-rental platform is able to significantly increase revenues and profitability, then the valuation should rise. As a result, Tesla could be in for a big bounce as it reintegrates itself back into investors' portfolios in a self-motivated manner.

CrowdStrike is on the cusp of something big.

Jake Lerch, CrowdStrike: CrowdStrike is a leader in the field of cybersecurity solutions, which is growing in importance as the world witnesses seemingly endless cyberattacks. The Change Healthcare hack alone has paralyzed tens of thousands of healthcare providers' claims payments in recent weeks. Recognizing the high cost of being a victim of such cyberattacks, many organizations are rushing to strengthen their digital defenses.

CrowdStrike, whose software relies on machine learning to monitor customer networks and identify suspicious networks before they cause damage, is rapidly winning new customers.

In the most recent fiscal quarter (ended January 31), CrowdStrike's revenues grew 33% year-over-year to $845 million. Additionally, $796 million ($94%) of this was subscription revenue. This is important because subscription revenue is recurring, meaning it is more predictable than traditional sales, which tend to be more volatile.

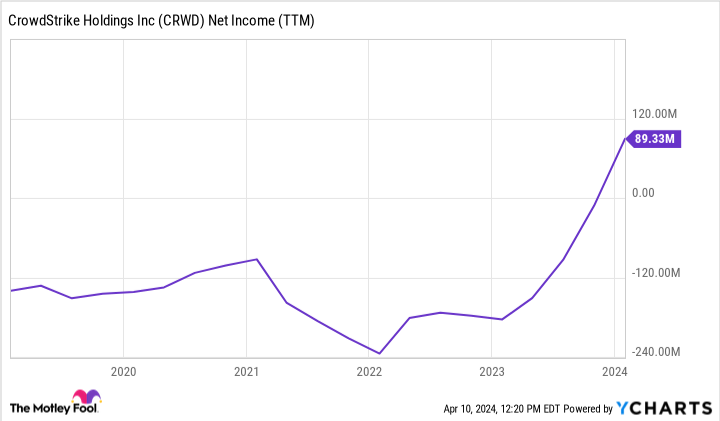

In addition, CrowdStrike is undergoing a key transformation in its life cycle: it is becoming profitable. The company recently turned its net income positive for the first time. Over the past 12 months, the company generated $89 million in net income. In addition, free cash flow has soared to $3.81 per share. This is important because an increase in free cash flow per share is considered by many to be the ultimate financial indicator of a public company's success and is often correlated with long-term stock price gains.

In short, CrowdStrike is the best of both worlds. It's a young company with growing free cash flow that's making the transition to sustainable profitability. At the same time, CrowdStrike's business is showing long-term growth as more and more organizations upgrade and strengthen their cyber defenses in the face of growing danger. For these reasons, this stock is worth considering.

Lemonade's Artificial Intelligence Offers New Ideas for the Insurance Industry

Justin Pope (Lemonade).: The insurance industry is an old one, ripe for disruption. Existing insurers - the big ones you're familiar with, the ones that feature professional athletes, funny mascots, and famous spokespeople in their ads - do use AI to analyze data. But they're still selling policies through an agency model, which gives Lemonade plenty of opportunity to break into the market, using AI chatbots to communicate with customers and process claims. These robots can complete a task in as little as 90 seconds and get a claim processed in less than three minutes. At a traditional insurance company, you may have to wait longer to talk to an agent.

Lemonade's application-first approach has won it many customers. In the fourth quarter, its customer base grew 12% year-over-year to more than 2 million, a growth rate that suggests some people are leaving other insurers and switching to Lemonade, which doesn't yet have a product line as rich as that of its longer-established competitors, but customers can get renters, homeowners, auto, pet and life insurance from it.

Lemonade is not yet profitable where the aggregate amount of claims paid by insurers is less than the aggregate amount of premiums paid by customers. However, its non-GAAP EBITDA loss for the fourth quarter was $29 million, a decrease of $44% from the same period a year ago. Importantly, Lemonade has $945 million in cash on its books, and generated positive cash flow in the second half of last year. This is a good sign of the company's financial stability.

For now, Lemonade is a high-risk investment - for the company to succeed, it must continue to attract customers and find a way to make a profit. However, the higher the risk, the higher the reward, and Lemonade, with a market capitalization of US$1.2 billion, has the potential to change its portfolio if it grows into a major player in the insurance industry.

Where to invest your $1000 now

It's good to listen to our analyst team when they have stock tips. After all, they've been running a newsletter for 20 years called "The New York Times".Motley Fool Stock AdvisorIt has more than tripled the market*.

They have just announced what they think investors are currently doing.-est (superlative suffix)Worth Buying10Gone are the stocks ...... Tesla is on the list, but there are 9 other stocks you may have overlooked.

View these 10 stocks

*Stock Advisory Rates as of April 8, 2024

Randi Zuckerberg, former Marketplace Development Director of Arms and Spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool Board of Directors. John Mackey, former Chief Executive Officer of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool. Jake Lerch owns shares of Amazon, CrowdStrike, Nvidia, and Tesla, in which Justin Pope has no position. Will Healy owns shares of CrowdStrike. The Motley Fool owns and recommends shares of Amazon, CrowdStrike, Lemonade, Meta Platforms, Microsoft, Nvidia, and Tesla, among others. The Motley Fool recommends the following options: Microsoft January 2026 The Motley Fool recommends the following options: Microsoft Jan 2026 $395 Call Option Long and Microsoft Jan 2026 $405 Call Option Short. The Motley Fool has a disclosure policy.

Forget the 'Big Four': These 3 Artificial Intelligence (AI) Stocks Are Great Buys Today was originally published by The Motley Fool.