.

A Wall Street Analyst Says Artificial Intelligence (AI) Is a Once-in-a-Lifetime Investment Opportunity: 1 Top Artificial Intelligence (AI) Stock to Buy Before It Surges 55% in April

The buzz around artificial intelligence (AI) is driving the market to new heights. In the first few months of this year, theS&P 500Indices andNasdaq ResonanceThe indexes have all set new records.

Much of this increase can be attributed to the "Big 7"-a term used to describe theMicrosoft,Apple,Nvidia,Alphabet,Amazon,Nikola Tesla (1856-1943), Serbian inventor and engineerrespond in singingMeta Platforms The world's biggest companies are also known as the biggest companies in the world. But savvy investors understand that there are many other opportunities in AI beyond the giant tech companies.

Big Data Analytics Software CompanyPalantir Technologies (NYSE: PLTR)One of the companies that is making a name for itself is Palantir, which has a breakout year in 2023 as it releases its fourth major product: the Palantir Artificial Intelligence Platform (AIP).

The huge success of AIP has helped Palantir accelerate revenue and profit growth, and investors are taking notice. But is it too late to buy the company's stock, which has risen nearly 180% in the last year?

Wedbush Securities analyst Dan Ives sees more room for growth in the stock. As of the close of business on April 10, his price target was $35 per share, which implies an upside of about 59% from where the company is currently trading.

Read on to find out why buying Palantir stock now is a profitable opportunity.

The Rise of Palantir's Artificial Intelligence Platform

For years, Palantir has sold three core software products: Apollo, Gotham, and Foundry, but in April of last year, Palantir quietly announced its entry into the artificial intelligence (AI) space with the release of AIP. But the AIP announcement has been largely overshadowed by moves by large tech companies, including investments in ChatGPT developer OpenAI and its competitors.

To promote AIP, Palantir used a creative lead generation strategy. Namely, the company began organizing immersive seminars called "boot camps". At these seminars, potential customers were shown Palantir's various software platforms. The idea behind this is to demonstrate Palantir's technical prowess in a tangible way while helping business leaders identify and formulate use cases around artificial intelligence (AI).

Since the program began, Palantir has conducted more than 850 boot camps. In addition, AIP customers have publicly demonstrated how the product can be utilized to discover new insights in a wide range of applications.

Although AIP has only been commercially available for about a year, its initial success is encouraging.2023 saw Palantir grow its customer base by 35% year-on-year and make progress in the private sector. In the fourth quarter alone, the company's commercial revenue in the U.S. grew by 70%.

The journey has just begun.

The mass of accelerated revenue growth is, of course, welcome. It's especially meaningful for Palantir, which has been challenged for years by Wall Street skeptics - many of whom believe the company is overly reliant on one-off government deals with the U.S. military and its Western allies.

However, AIP is proving that Palantir has the technical capabilities of a persona that is attracting customers from many industries outside the public sector. Considering the pulse of big tech companies across the AI space, Palantir is proving that it can compete with the biggest players.

I see 2023 as the first chapter in the company's long AI story. The company is growing rapidly and other tech giants are eager to partner with Palantir AIP. Palantir AIP can continue to deliver strong revenue growth while maintaining healthy profitability and a strong balance sheet.

Premium valuation, value for money

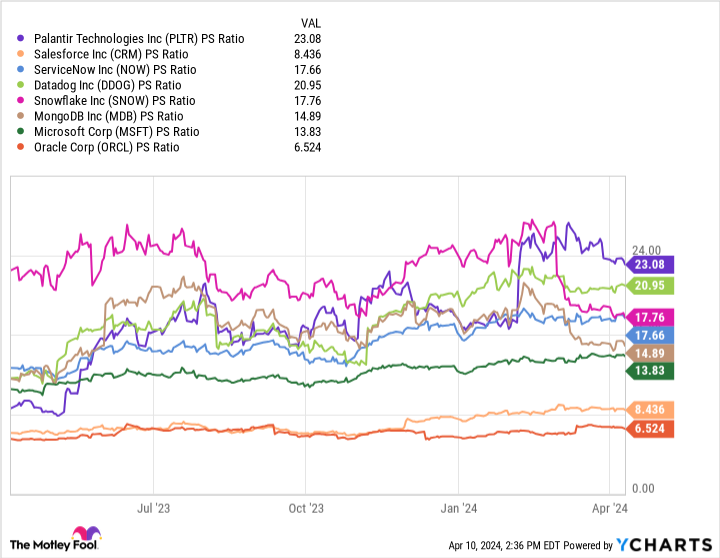

The chart below shows how Palantir compares to other leading Artificial Intelligence Software-as-a-Service (SaaS) companies on a price-to-sales (P/S) basis. Based on this metric, Palantir has a P/S ratio of 23.1, making it the most expensive stock among its peers.

Palantir saw its valuation multiple skyrocket in February after it released eye-popping fourth-quarter earnings. Since then, the stock has seen some upward momentum and is only now starting to catch its breath.

Moreover, Palantir's impressive revenue growth isn't the only thing. The company's entire financial picture is strong. The success of the boot camps has allowed Palantir to keep sales and marketing expenses relatively low. As a result, unlike many of its competitors, the company has remained profitable.

In 2023, Palantir's operating margins grew by 6%. In 2023, the company generated $730 million in free cash flow, more than tripling its year-over-year growth.

The company's share price is at such a premium to its competitors that investors may be tempted to sell for some profit. But I encourage investors to look at the bigger picture.

While AIP has acted as a catalyst for Palantir's business and played a role in driving the excitement of the stock up, the company's stock is still down 40% from its all-time highs. now is a great time to grab shares as Palantir continues to capitalize on the long, long term theme of Artificial Intelligence.

Using the Average Dollar Cost method is a prudent strategy for starting a position or adding to an existing position, and Palantir has so much potential upside that it is hard to ignore.

Should you invest $1,000 in Palantir Technologies now?

Before buying shares of Palantir Technologies, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only ...... and Palantir Technologies were not included. The 10 stocks that made the list could generate huge returns in the coming years.

Consider April 15, 2005Nvidia) on the list at ...... If you invest $1,000 at the time of our recommendation, theYou will have 540,321dollar! *Stock Advisor provides easy-to-use stock investment tools for investors.

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 8, 2024

Suzanne Frey, an Alphabet executive, is a member of The Motley Fool Board of Directors. John Mackey, former Chief Executive Officer of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool Board of Directors. Randi Zuckerberg, former Director of Mass Development and Spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool. Adam Spatacco has served on the boards of Alphabet, Amazon.com and Amazon.com. Adam Spatacco owns shares of Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, and Tesla.The Motley Fool has positions in Alphabet, Amazon, Apple, Datadog, Meta Platforms, Microsoft, MongoDB, Nvidia, Oracle, Palantir Technologies, Salesforce, ServiceNow, Snowflake and Tesla. The Motley Fool recommends the following options: Long Microsoft Jan 2026 $395 Call Options and Short Microsoft Jan 2026 $405 Call Options. The Motley Fool has a disclosure policy.

A New Generation of Investing Opportunities: Artificial Intelligence (AI) Stocks to Buy 1 Top Stock Before April Surge 55%, According to a Wall Street Analyst was originally published by The Motley Fool.