.

There's No Bubble at INVISTA: You Should Buy This Artificial Intelligence (AI) Stock Before It Soars

INVISTA (NASDAQ: NVDA)Investors and analysts have been awestruck by the incredible growth of artificial intelligence (AI). Shares of the chipmaker, originally known for its personal computer (PC) graphics cards, have soared nearly six-fold since early 2023.

However, the surge has raised suspicions in some corners of Wall Street that Nvidia's stock may be in a bubble. From comparisons to the 1999 Internet bubble, to the potential decline in demand for AI-related chips, to its expensive valuation, there are a number of reasons why some think Nvidia is a bubble waiting to burst.

But a closer look at the AI market in general, and Nvidia in particular, shows why the company is far from being in a bubble.

Why is Nvidia and AI a bubble?

A stock market bubble is "a sharp increase in stock prices without a corresponding increase in the value of the companies they represent". In a bubble, companies are valued on the basis of speculation rather than the actual basic noodles.

However, if you take a closer look at how AI is driving productivity gains across a number of industries, it's easier to understand that, ideally, the adoption of this technology should continue to gain momentum. For example.Meta PlatformsThe company says that the entirety of the AI tool has seen the campaign's return rate jump by an impressive 321 TP3T. Meanwhile, customer service agents reportedly saw a 141 TP3T improvement in their work rate thanks to AI.

On the other hand, Bain & Company says that factory productivity is expected to jump from 30% to 50% in the future through the integration of artificial intelligence. investment bankUBSAI is expected to drive productivity growth of 2.5% this year, higher than the Fed's estimate of 1.5%. Over the next three years, UBS expects AI to deliver productivity growth of 17%.

Nvidia's chips will play a central role in driving productivity across all industries. That's because AI models need to be trained with millions to billions of cells before they can be deployed in the real world. These models, known as Large Language Models (LLMs), are being deployed in a variety of verticals, from manufacturing to automotive to cloud computing.

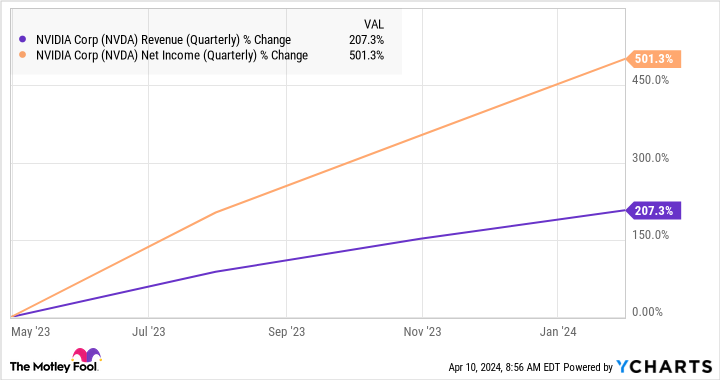

Training these LLMs requires enormous computational power, which Nvidia's GPUs can provide. This explains why companies are lining up to buy Nvidia's flagship H100 processor, which has given the chip maker a monopoly-like position in the AI chip market, with an estimated share of more than 90%. H100 is priced at $25,000 to $30,000, and, according to the Nvidia GPUs, it is the only chip maker that can offer this kind of processing power.Raymond James.Nvidia's profits on these graphics cards amounted to 1,000%, according to the company. that's why Nvidia's revenue and profit growth is outstanding.

As such, the surge in Nvidia's stock price isn't based on speculation or excitement, but rather on the company's eye-popping revenue and earnings growth. Happily, Nvidia seems well positioned to maintain its impressive growth momentum over the long term, and the U.S. government is likely to play a key role in helping it maintain its dominant position in the AI chip market.

A new U.S. government grant could help INVISTA maintain its AI supremacy

Not surprisingly, Nvidia's Hopper-based H100 processor has strong pricing power, as it has been the chip of choice for customers training AI models. As a matter of fact, the demand for this chip has been so high that customers have had to wait up to a year to get it.

Nvidia is now preparing to introduce a new chip architecture to the曏 market, known as Blackwell, and when it launches later this year, the B200 Blackwell card will reportedly be the successor to the H100, with a performance increase of 7 to 30 times over the H100, and Nvidia also claims that it will reduce power consumption by up to 25 times.

It has been reported that Blackwell will be usingTaiwan Semiconductor Manufacturer(commonly known as TSMC) in a customized 4-nanometer (nm) node, so the performance gains are not surprising. In contrast, the Hopper-based H100 uses TSMC's custom 5nm process. By reducing the size of the process node, TSMC allowed Nvidia to package 208 billion instances of Koon, while the H100 packages 80 billion instances of Koon.

Now, these wafers are more tightly packed on the chip, so they provide more computing power, generate less heat, and thus consume less power. Now, TSMC has received a $6.6 billion grant and a $5 billion low-cost loan from the U.S. government to build a third chip plant in Arizona.

TSMC is expected to use the funds to build a 2nm chip factory. With Nvidia expected to be one of the customers for TSMC's 2nm chips, which are expected to be in volume production by 2025, it's no surprise that the graphics specialist is launching a more powerful AI graphics card. This explains why analysts expect Nvidia's data center revenue to grow exponentially in the coming years.

What's more, Nvidia's earnings are expected to grow at an annualized rate of 35% over the next five years, according to consensus estimates. Based on the company's FY2024 earnings of $12.96 per share, its EPS would jump to $58.11 five years from now.

Nvidia's five-year average forward earnings multiple of 39 is slightly higher than its forward earnings multiple of 36. However, even after discounting Nvidia's forward earnings to 27x after five years (vs.Nasdaq Resonance-100 The index's forward earnings multiple is consistent with that of the tech stocks it represents), its shares could also jump to $1,569. That would be an increase of 85% from current levels.

But don't be surprised if this AI stock rises even more. NVIDIA could outpace Wall Street's earnings growth, and the market will likely continue to value it at a premium because its product development initiatives should ideally help it maintain its lead in the lucrative AI chip market.

Should you invest $1,000 in Nvidia now?

Please consider this question before purchasing Nvidia stock:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Nvidia is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the coming years.

Consider that on April 15, 2005NvidiaListed on ...... If you invested $1,000 at the time of our recommendation, theYou will have 540,321dollar! * *The

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisor's Report as of April 8, 2024

Randi Zuckerberg, former Facebook Market Development Arbitrator and Spokeswoman, and sister of Meta Platforms CEO Mark Zuckerberg, is now a member of The Motley Fool's Board of Directors. Harsh Chauhan has no position in any of the above stocks. Harsh Chauhan has no position in any of the stocks listed above. The Motley Fool recommends Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing Company, Inc. The Motley Fool has a disclosure policy.

Nvidia No Bubble: You Should Buy This Artificial Intelligence (AI) Stock Before It Soars was originally published by The Motley Fool.