.

Two reasons to buy INVISTA stock

INVISTAfirms(NASDAQ: NVDA)Nvidia's GPU market has been dominated by Nvidia for a long time. Graphics processing units (GPUs) are a hot commodity powering data-centric artificial intelligence (AI), and Nvidia has long dominated the GPU market.

The shift in artificial intelligence is driving growth in data center investment, and that's giving Nvidia a tailwind. The company expects first-quarter revenue to quadruple year-over-year to $24 billion, but there are two big reasons why this AI stock still has room to rise in the long-term outlook.

1. Growth in AI Infrastructure Spending

Data center products are Nvidia's largest revenue source. In the most recent quarter, this segment accounted for $82 billion in revenue, making investment in data center infrastructure critical to Nvidia's growth.

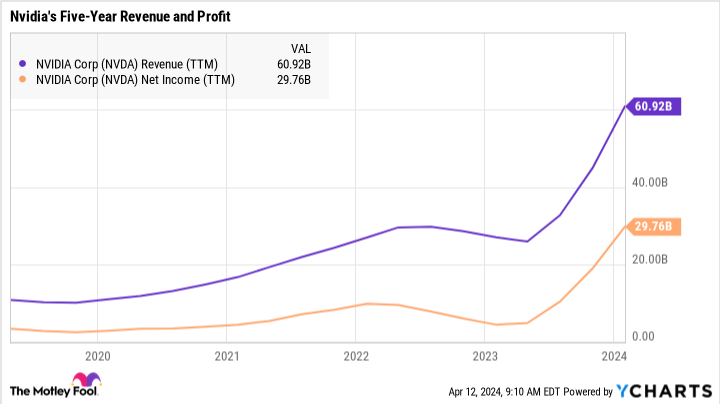

According to Dell'Oro Group, the aggregate spending on data center flour by the 10 largest cloud service providers will reach $260 billion in 2023. Artificial intelligence-related spending is growing at a much faster rate than the data center market as a whole, as evidenced by Nvidia's numbers. The company's revenue more than doubled last year to nearly $61 billion.

In 2024, Dell'Oro expects aggregate spending on data center infrastructure to accelerate to 11%, driven by investments to support new applications powered by Generative AI. Other companies also noted high demand for Nvidia's chips.Dell Technologies) said its AI optimization server backlog nearly doubled in the most recent quarter.

It's important to remember that Nvidia offers more than just GPUs; it also offers software and systems, which is a lucrative opportunity.

2. Nvidia will squeeze every last ounce of profit out of this opportunity.

Despite all the hype around Nvidia's market-leading AI chips, the company hasn't gotten enough credit for how smartly it's positioned its products to grow profitably.

Over the years, Nvidia has positioned its gaming GPUs so that the average selling price has increased as gamers have upgraded to the latest graphics cards. This has boosted the company's profits and generated a good return for shareholders. The company's approach to its data center business is also aimed at generating high returns.

For example, Nvidia doesn't just sell individual chips for data centers, it bundles them into a system - Nvidia's DGX system includes eight H100 GPUs, which are expensive individually, and Nvidia's add-on software and services on top of the hardware add a lot of value, which can be monetized through high profit margins.

Nvidia's net income grew 5,81% last year to nearly $30 billion, almost half of its total revenue, and Nvidia's high margins from sales make its stock a solid long-term investment.

Nvidia will face competition.Intelrespond in singingAdvanced Micro DevicesAlready developing AI chips to compete with Nvidia, but Nvidia is an innovator in GPU technology, and its recent growth momentum gives it a huge advantage on the financial side of the equation to protect its lead in the GPU market.

Analysts now expect Nvidia's earnings per share to grow 35% year over year over the next few years, and while the stock won't translate year over year, there's still plenty of room for new highs over the next ten years as management estimates the value of its data center opportunity to be worth $1 trillion.

Should you invest $1,000 in Nvidia now?

Before buying Nvidia stock, consider the following:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Nvidia is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 8, 2024

John Ballard has positions in Advanced Micro Devices and Nvidia.The Motley Fool holds and recommends Advanced Micro Devices and Nvidia.The Motley Fool recommends Intel and recommends the following options:Intel January 2023 $57.50 Call Option Long.Intel January 2025 $45 Call Option Short.The Motley Fool May 2024 $47 Call Option Short.The Motley Fool recommends Intel January 2024 $47 Call Option Short.The Motley Fool recommends Intel January 2025 $57.50 Call Option Long. The Motley Fool recommends the following options: Intel January 2023 $57.50 Call Options Long, Intel January 2025 $45 Call Options Long, and Intel May 2024 $47 Call Options Short. The Motley Fool has a disclosure policy.

Two Reasons to Buy INVISTA Stock Like There's No Tomorrow was originally published by The Motley Fool.