.

Is JPMorgan Chase Stock Worth Buying?

On the surface, JPMorgan Chase's shares fell hard last week because of the name of the person.JP Morgan Chase (bank) (NYSE: JPM)The company did not raise its 2024 revenue forecast in its first-quarter results on Friday. Shares then plunged 6%, continuing a sell-off that has been underway since late March. JPMorgan shares are now down 8% from their peak.

However, the proverbial cup is not half empty. It is half full. This decline is a great opportunity to buy one of the top stocks in the financial sector at a bargain price. Here's why.

The past quarter and the year ahead

In the three months to March, JPMorgan Chase turned revenue worth US$42.6 billion into operating profit of US$4.44 per share. These figures were better than expectations of US$41.9 billion and US$4.11 respectively. They were also an improvement on the $39.3 billion and $4.10 per share reported in the same period last year.

The stumbling block is guidance. JPMorgan Chase sees $90 billion worth of net interest income this year, in line with its outlook three months ago. Investors were expecting the firm to raise that figure by $2 billion to $3 billion. When the company didn't, the market had a small rebound.

However, there are some encouraging numbers hidden in JPMorgan's first-quarter numbers that reinforce the market's bullishness on JPMorgan.

JP Morgan still shines

In the simplest terms, JPMorgan Chase, the giant bank, is currently doing much better than most of its peers.

Take, for example, the shrinkage of their loan losses.Wells Fargo Bank (NYSE: WFC)respond in singingCitigroup (NYSE: C)Both charge-offs and loss reserves showed sizable increases, while JPMorgan's aggregate credit loss reserves actually declined just a bit between the fourth quarter of last year and the first quarter of 2024. The slight increase in charge-offs and delinquencies in the last quarter wasOnlyThere was a slight increase, and most of the growth came from the credit card business. In addition, the ratio of total credit loss provisions to the loan portfolio has remained stable over the past year.

It is worth noting that while JPMorgan was reluctant to raise its 2024 net interest income forecast, it did see a year-over-year increase in interest income last quarter, from $20.7B to $23.1B. Citigroup's net interest income grew by just 11 TP3T, while Wells Fargo's net interest income fell by 81 TP3T year-over-year.

It is also important to note that while JPMorgan has not raised its interest income forecast for the current financial year, its expectation of net interest income of around US$90 billion in 2024 is still slightly higher than the 2023 figure. Meanwhile, growth in other noodles should resist the slowdown in interest income growth.

In this regard, most of the bank's businesses started to show some green shoots in the first quarter after a tough year in 2023. For example, investment banking fees were up 181 TP3T from a year ago and 201 TP3T from the fourth quarter, and comparable growth was seen in wealth management revenues and even loan-based fee income.

This impressive growth comes ahead of a strong resurgence in capital markets and corporate fundraising in the second half of 2024. Meanwhile, the Fed reported that the banking sector as a whole expects demand for new loans to increase this year, driven by the eventual interest rate cut.

That's true.beA Balance Sheet Bulwark, and an important one at that.

JPMorgan Chase has a very healthy balance sheet and its rate measures are very strong.

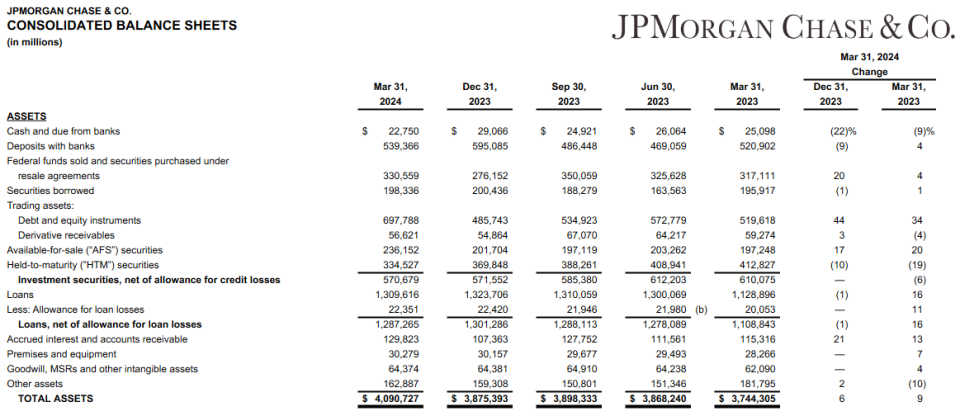

I remember last year.SVB Financial the collapse of its Silicon Valley Bank and First Republic Bank? At the heart of these two banks' liquidity problems is the fact that there are too many long-term interest-bearing assets ("held-to-maturity", or "HTM") that need to be held for the long term, and too few short-term interest-bearing securities that can be sold quickly ("available-for-sale ", or "AFS") are too few. Most banks have both types of securities. The key is to find the right, balanced ratio between the two. Silicon Valley Bank and First Republic Bank have failed to do so.

To its credit, JPMorgan never really got into a liquidity crisis ......Whether it'sat the time oforNow. As much as possible, the bank has been able to reduce its less liquid HTM positions and increase its AFS securities. This provides the bank with a higher level of financial liquidity in case of emergencies.

Similarly, JPMorgan Chase's so-called "balance sheet bulwark" is currently able to withstand $520 billion worth of losses without bankrupting the bank.

But there is more to the story than having enough liquid assets. A rock-solid balance sheet ultimately translates into more efficient and profitable use of those assets. For the first quarter, JPMorgan Chase's return on total equity (ROE) was 17%, and its return on tangible common equity (ROTCE) for the quarter just ended was 21%. In contrast, Wells Fargo's ROE for the first quarter fell to 10.5%, and its ROTCE fell from 14% a year ago to 12.3% last quarter. Citibank's comparable figures for the quarter were 6.6% and 7.6% respectively.

JPMorgan Chase Stock Is a Top Pick Worth Buying Now

Whereas, companies are more than just numbers. Just like people and pets, they have their own personalities. This can affect the performance of their stock. JPMorgan Chase is no exception.

However, the truly great corporate artifact is the ability to create an objectively healthy financial performance. JPMorgan Chase has done just that for many years and still does.

Please note this. JPMorgan Chase is one of the most powerful firms in the financial industry, if not theThe most powerfulCompany. The stock's post-earnings decline is a buying opportunity, even if it hasn't hit a definitive bottom yet. You can get involved when the stock trades at about 12 times this year's expected earnings and yields a little more than 2.3%.

Should you invest $1,000 in JP Morgan right now?

Before buying JPMorgan Chase stock, consider the following:

Motley Fool Stock AdvisorA team of analysts has just selected what they consider to be the most suitable name for investors to buy.10Only ...... JPMorgan Chase is excluded. The 10 stocks that made the list could generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 8, 2024

Citigroup is an advertising partner of The Ascent, a Motley Fool company SVB Financial provides credit and banking services to The Motley Fool. SVB Financial provides credit and banking services to The Motley Fool. Wells Fargo & Co. is an advertising persona partner of The Ascent, a Motley Fool company. JPMorgan Chase is an advertising郃 partner of The Ascent, a Motley Fool company. james Brumley does not hold any of the above shares. the Motley Fool holds a recommendation for JPMorgan Chase. the Motley Fool has a disclosure policy.

Is JPMorgan Chase Stock the Right Place to Buy Low? This post was originally published on The Motley Fool.