.

Is It Time to Buy Shopify Stock on the Downtrend?

Wall Street's recent response to theShopify (NYSE: SHOP)The e-commerce infrastructure specialist's stock has not been a favorite. Shares of the e-commerce infrastructure specialist soared 1,00% last year, but are down 11% for 2024, and theStandard & Poor's 500The index has risen by 8%.

Considering all the good news that the company has recently disclosed about its operating trends, this weak performance is not unreasonable. Let's take a closer look at whether this makes the stock a good buy now, or whether investors should wait for a better price before buying shares.

Shopify's Growth Potential

Shopify is a leading provider of e-commerce infrastructure that covers almost all aspects of the sales process, from marketing to payment processing. It also helps merchants conduct live transactions through a convenient point-of-sale system. In addition toNikeStrength), the Dollar Shave Club and theBillabong In addition to large global brands such as Shopify, millions of small businesses rely on the platform. In the U.S., Shopify processes approximately 10% of all e-commerce transactions.

These merchants are clearly getting value from Shopify's software and hardware. 2023 saw accelerated sales volume growth throughout the year, with year-over-year growth in the most recent quarter of 23%. Combined with price increases and higher subscription revenues, which after factoring in the sale of the logistics division, these gains sent revenues soaring by 30%," said Shopify president of agriculture Harley Finkelstein said in a press release, "2024 is an incredible year for Shopify and our merchants. Most Wall Street professionals expect more good news ahead, with sales likely to grow by more than 20% in 2024 and 2025.

Shopify has achieved some success in the financial noodles.

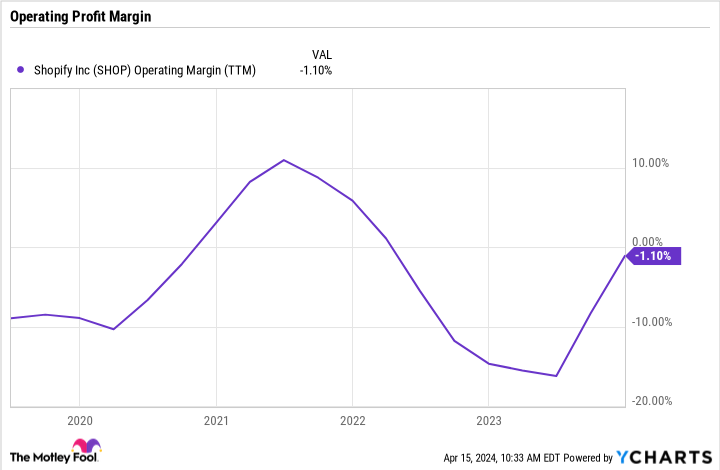

andEtsy Shopify is further along in its cost-cutting program than its peers, giving investors confidence that it will do well in the future. It has already completed the sale of its costly logistics business, which has had an immediate impact on earnings and cash flow. Last quarter, Shopify's profits returned to positive territory, and cash flow as a percentage of sales improved to 131 TP3T from 31 TP3T in 2022.

Where the stock goes from here could depend on Shopify maintaining this positive financial momentum. Gruen expects cash production to be volatile in the coming year, but generally improving throughout 2024. Meanwhile, sales trends should be very good, as first-quarter revenue grew at least 20% year-over-year.

The artificial intelligence (AI) boom is also likely to boost demand in the coming quarters, as the technology makes its way into more of Shopify's workflows. For example, the company just launched an AI shopping assistant, and a new feature called Sidekick uses AI to save merchants a lot of repetitive work. 2024 and 2025 will see more action in this area as Shopify tries to capitalize on the excitement that AI brings.

Shopify Stock Price Cut

Although the shares are now cheaper than before, there is still a premium to be paid to own this growing business. The current share price is 13 times revenue, down from a price-to-earnings ratio of nearly 16 times at the start of the year.

Shopify can earn this premium if its business continues to grow at an annualized rate in excess of 20% while demonstrating sustainable profitability. However, the last piece of this growth story is still missing. As such, prudent investors may want to hold off on the stock until Shopify can deliver several consecutive quarters of positive earnings.

However, if you don't mind volatility, you might be happy to include this growth stock in your portfolio at a time when Wall Street is more focused on the big software-as-a-service giants.

Should you invest $1,000 in Shopify right now?

Before purchasing Shopify shares, please consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Shopify is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 15, 2024

Demitri Kalogeropoulos has positions in resonance and Shopify.The Motley Fool has positions in recommended Etsy, resonance, and Shopify.The Motley Fool recommends the following options: resonance Jan 2025 $47.50 call options long.The Motley Fool has a disclosure policy.

Is It Time to Buy Downtrending Shopify Stock? This post was originally published by The Motley Fool.