.

Warning: This rising stock carries risks.

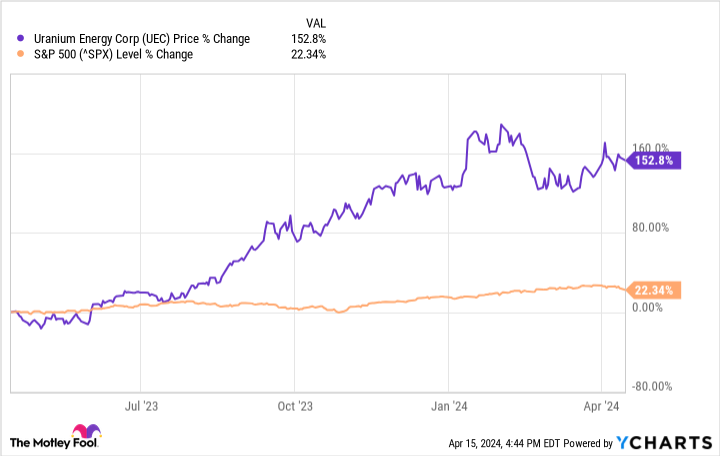

Uranium energyfirms(NYSEMKT: UEC)The share price of the company has risen sharply by around 153% in the past year. From this perspective, theStandard & Poor's 500The index has only risen by about 22% over the same period, but don't get too excited, there are a few big risks you can take if you ignore it.

Uranium Energy Company's business

Uranium Energy sells uranium, as its name suggests. However, it is important to note that it is not a uranium miner. Uranium Energy decided to start buying nuclear fuel when its price dropped to historic lows. It had accumulated a lot of nuclear fuel at a low price, and now it could sell it at a high price. In hindsight, this was a very smart choice, but the main value of the company was in those reserves.

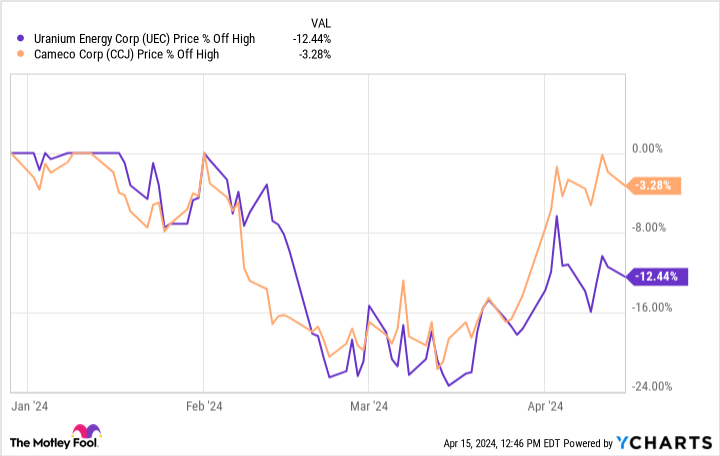

This is the first major issue that investors need to keep in mind when considering a stock price increase. Uranium is a commodity. Like all commodities, its price is volatile. Over the past year, the price of uranium has risen dramatically, as has the share price of Uranium Enegy. But interestingly, unlike its peers, Uranium EnegyCamecofirms(NYSE: CCJ)It is a leveraged game of the uranium price to have mining business like that.

It makes sense that Uranium Energy's share price would rise more than Cameco's when the uranium price goes up. But it can also fall even more when the uranium price goes down. This is the case so far in 2024, as nuclear fuel prices have softened slightly in recent months.

If you're looking for a way to pry yourself away from the price movements of uranium, then you might like this approach. But before buying uranium energy stocks, you should know that you are taking this aggressive stance.

Uranium Energy has big, expensive plans.

The second thing that investors need to consider before buying uranium energy stocks is that the company does want to become a uranium merchant. That's not a bad thing in itself, as it means it will have an operation to support its uranium reserves. It has a uranium operation that is scheduled to reopen in August, so things can change quickly.

However, operating a uranium plant requires significant capital and effort. While the company's wise decision to build up a uranium reserve may solve the problem of capitalization, there are still execution risks to consider. The problem is that reopening this mountain is only the beginning of the execution risk. Uranium Energy wants to mine ore from several zones in North and South America. It claims to have "the largest diversified resource base in the Western Hemisphere".

In other words, Uranium Energy has ambitions to become a major global supplier of uranium. That's all well and good, but reopening a mountain of uranium is only a small step on the company's path to realizing its ultimate goal. The execution risk is high, and there is no way of knowing where the uranium price will go in the long run. If the uranium price falls again as sharply as it has in the past, Uranium Energy could run out of money to fund its growth plans. Alternatively, if the uranium price falls enough, the plans could end up being shelved because it is simply unprofitable to build uranium.

Uranium Energy Corporation is a high risk investment.

While Uranium Energy's purchase of uranium, which began during the darkest days of the uranium industry, was clearly a wise choice, it is still an investment suitable only for aggressive investors. The fact that its value is largely tied to its uranium inventory is a hidden risk worth noting, but the need to execute large and costly development projects is also a risk that cannot be ignored.

Should you invest $1,000 in Bria now?

Before buying shares of Uranium Energy, consider the following:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Uranium Energy is not one of the 10 stocks selected from ....... The 10 stocks that made the list are expected to bring in good returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 15, 2024

Reuben Gregg Brewer does not own any of the stocks mentioned above.The Motley Fool recommends Cameco.The Motley Fool has a disclosure policy.

Warning: This Soaring Stock Carries Risks was originally published by The Motley Fool.