.

When will the Dow Jones Industrial Average reach 50,000? History suggests it will be sooner than you think.

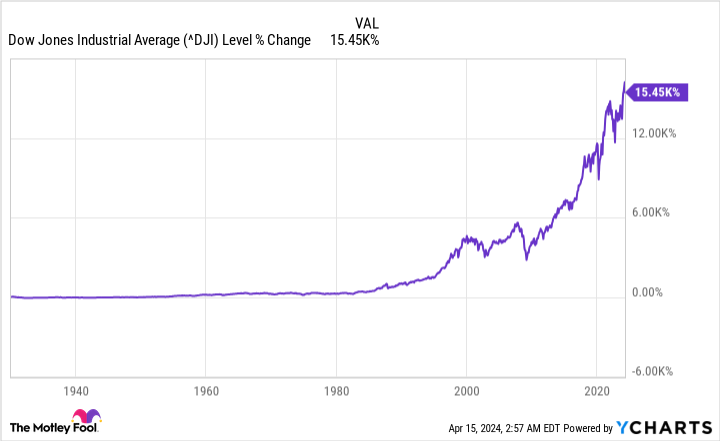

Over the long term, Wall Street has proven time and time again that it is the wealth creator par excellence. While gold, oil, housing, and Treasuries have all helped investors increase their nominal wealth over time, no asset class has delivered stronger annualized returns than stocks over the past century.

For more than a century, the iconicDow Jones Industrial Average (DJINDICES: ^DJI)has long been a barometer of the "health" of Wall Street. First published in May 1896, the index consisted of 12 industrial stocks and is now home to 30 time-tested multinational corporations.

Last month, the ageless Dow Jones Index did something it has done countless times in its long history: it made a new all-time high. It came within a stone's throw (about 111 points) of the 40,000-point high. Compared to the 41.22 points it closed at the height of the Great Depression in 1932, this is a remarkable achievement.

The $64,000 question is: Will the Dow Jones Industrial Average reach 50,000? If you look at history, the Dow Jones may reach 50,000 sooner than you think.

Based on historical evidence, Dow 50,000 may be within reach.

Let me preface this discussion by making it clear that short-term movements in the stock market are not consistently and accurately predictable. While there are some capital-based measures and predictors that correlate closely with the short-term movements of the Dow Jones and other major stock indexes throughout history, over the course of days, weeks and months, the movement of the曏 is largely uncertain.

But if there's one virtual guarantee on Wall Street, it's that the major stock indexes, including the Dow Jones, will go up for a long time. For decades, the Dow Jones has been a real moneymaker.

For example, the Federal Reserve Bank of St. Louis listed the value of the Dow Jones Index for April 1924 as 91.95. As of the close of April 12, 2024, the Dow Jones Index was 37,893.24 points. Despite the Great Depression, stagflation in the 1970s, runaway inflation in the early 1980s, the dot-com bubble, and the Financial Crisis, the average annualized rate of return of this iconic index over the past century has been 6.21%. At this rate, the Dow will break through the psychologically important 50,000 level in early 2029.

But what you may not realize is that the Dow Jones Industrial Average has been delivering outsized historical returns since the advent of the Internet 30 years ago. While the Dow Jones Industrial Average is made up primarily of established companies that have long since passed their prime, the Internet has opened up new avenues for even the stalwarts to shine.

On April 12, 1994, the Dow Jones Industrial Average closed at 3,681.69 points. Over the past 30 years, this popular index has grown at an annualized rate of 8.09%! If this remarkable rise continues, the Dow will reach 50,000 points before the calendar changes in 2028.

Dow 50,000 is inevitable for the following reasons

Even though the major Wall Street stock indexes seldom adhere to the annualized average rate of return (ARR), the history of the stock indexes has not been as good as it could be.strongThis suggests that the Dow reaching 50,000 is inevitable, but only a matter of time.

1. Dow constituents have a clear competitive advantage

The main reason for the Dow's long and sustained rise in value is that it is made up of profitable, industry-leading companies. Although most of these companies are not growing as fast as they used to, they have an undeniable competitive advantage.

To cite just one example, the retail giantWal-Mart (NYSE: WMT)It can utilize its modeling advantage. Wal-Mart's financial strength allows it to purchase products in large quantities, thus reducing unit costs. Wal-Mart also has a wider selection of products than traditional car-carrying and local stores. Wal-Mart's clear advantage over most brick-and-mortar retailers has led to a nearly 964 000% increase in Wal-Mart's stock price, including dividends, over the past 50 years.

2. Most Dow stocks are dividend-paying stocks.

Another reason for the Dow's record highs is that many of its constituent stocks pay regular dividends. In addition toAmazon (NASDAQ: AMZN)No dividend has ever been paid.mordent (music)Quarterly dividends were also discontinued during the COVID-19 pandemic, and all other 28 Dow components pay regular dividends.

Companies that share a percentage of their earnings with investors are almost invariably consistently profitable and usually offer transparent long-term growth prospects.

It's also worth noting that dividend-paying stocks have absolutely crushed companies that don't pay dividends over the past half-century. Hartford Funds, in partnership with Ned Davis Research, recently updated a report that found that dividend-paying stocks had an average annualized return of 9.17% over the 1973-2023 period, and were more volatile than the benchmarkStandard & Poor's 500 In contrast, the average annualized rate of return for companies that do not pay dividends over the same period is 4.271 TP3T, which is 181 TP3T more volatile than the S&P 500.

Coca-Cola (NYSE: KO)It is a shining example of a Dow dividend stock that continues to reward the patient investor. Coca-Cola has continuing operations in all but three countries, with more than a dozen brands in its portfolio and annual sales of at least US$1 billion. The predictability of Coca-Cola's cash flow gives management the confidence to increase the underlying annual dividend payout ratio for the 62nd consecutive year.

3. Companies with poor performance are eliminated

Lastly, the committee that oversees the growth and decline of the Dow Jones Indexes, S&P Dow Jones Indices, ensures that this benchmark index has no shortage of top performers.

For example, drugstore chainsWalgreens Boots Alliance (Walgreens) Boots Alliance (NASDAQ resonance stock code: WBA)It was eliminated before trading began on February 26th. Walgreens Boots Alliance only accounted for about 143 Dow points, according to its Dow divisor, which equates one dollar of stock price to the number of points in the Dow Jones Industrial Average.

Growing competition from online drugstores like Amazon has hurt its business. While Walgreens has a clear plan to turn around its losses, it's not the kind of stock that's going to push the Dow to new highs.

Perhaps it's fitting that Amazon has replaced Walgreens as the leader of the Dow Jones Index. While Amazon's huge share price gains may be history, its fast-growing cloud infrastructure services platform, Amazon Web Services (AWS), should drive significant growth in the company's operating cash flow throughout the decade.

Don't expect the Dow Jones to rise straight up, but don't be surprised if it reaches 50,000 by the turn of the century.

Should you invest $1,000 in Walmart now?

Consider this before buying Walmart stock:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Only ...... Wal-Mart is not one of these stocks. The 10 stocks that made the list could generate huge returns in the years to come.

Consider April 15, 2005Nvidia) on the list at ...... If you invest $1,000 at the time of our recommendation, theYou will have 540,321dollar! * *The

Stock AdvisorProvides investors with an easy-to-follow blueprint for success, including guidance on building an investment team, regular updates from analysts and two new stock picks each month. Stock Advisor The rate of return for the service since 2002 has been the same as that for the S&P 500 index, but the rate of return for the service has been the same as that for the S&P 500 index.quadruple*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 15, 2024

John Mackey, former chief executive officer of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors.Sean Williams owns shares of Amazon and Walgreens Boots Alliance.The Motley Fool owns shares of Amazon and Wal-Mart that it recommends.The Motley Fool has a The Motley Fool has a disclosure policy.

When will the Dow Jones Industrial Average reach 50,000? History suggests it's sooner than you think. Originally published in The Motley Fool.