.

This ETF Crushed the Markets and Even the Tech Industry: Don't Let Fear Mongers Keep You Out

Investors like long-term gains, but short-term investors can't stand volatility. This fear of short-term investors, especially those nearing retirement, may provide great opportunities for investors with a long-term mindset.

The best performing sector in the market over the past 10 years offers such an opportunity. While many investors tend to shy away from the sector due to its extreme booms and busts, over the long term it has actually provided superior long-term returns.

Don't let the fear mongers and naysayers shut you out. The industry remains a long-term winner.

Put your chips and chips together.

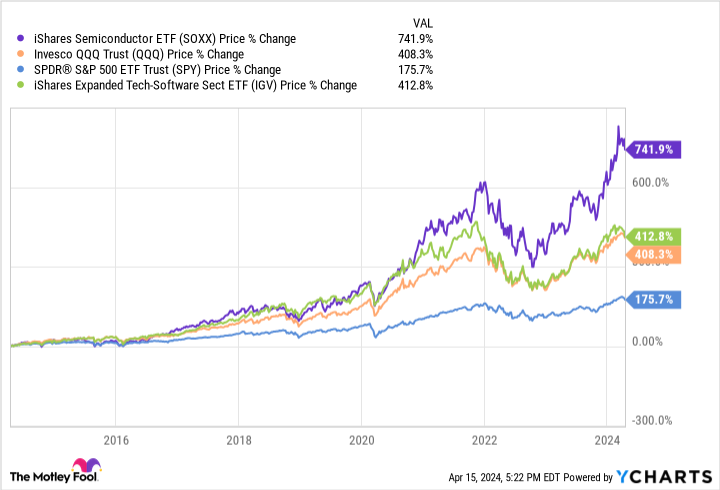

This industry is the semiconductor industry. From low-cost exchange traded funds (ETFs) tracking the chip sectoriShares Semiconductor ETF (NASDAQ: SOXX)Looking at the performance of the chip stocks over the past 10 years, we can clearly see how the aggregate performance of the chip stocks has crushed Big Rock and even outperformed the technology and software sectors in general.

The S&P 500 has risen by a cumulative 1,76% over the past decade, rewarding long-term shareholders with a return that far outpaces inflation. The tech sector has risen even more, of course, with strong innovation in areas such as cloud computing, e-commerce, smartphone apps, and now artificial intelligence (AI).

Technology Holdings Designed to Closely Mirror the Nasdaq Resonance 100 IndexInvesco QQQ Trust (NASDAQ: QQQ)In the technology sector, the ultra-fast-growing cloud software sector has driveniShares Expanded Tech-Software Sector ETF (NYSE: IGV)The 413% has been upgraded.

But all of this pales in comparison to the semiconductor sector, which has risen by a whopping 7,42%! That's almost twice the rate of return of the entire technology sector, and 4.2 times the rate of return of Big Rock over the past decade.

Why Many People Are Shying Away from the Chip Industry

Given the long-term excess returns of the semiconductor sector, it may come as a surprise that many investors are turning their backs on it. After all, Warren Buffett's purchase at the end of 2022 ofTaiwan Semiconductor Manufacturing Co.corporation(Taiwan) Semiconductor Manufacturing(math.) genus(NYSE: TSM)Never bought semiconductor stocks before, only sold all of them in two quarters due to geopolitical concerns.

Many of Buffett's supporters and value investors generally believe that the chip industry is developing too fast, the technology is changing day by day, the long-term competitive advantage is difficult to determine, or more likely to be broken by competitors.

There's some truth to that. After all, look.INVISTA (NASDAQ: NVDA)and foundry partner TSMC how to outperform theIntel (NASDAQ: INTC)You'll see. Now, Intel has suddenly fallen far behind in a relatively short period of time and is trying ambitiously to turn things around in order to survive.

But that's the beauty of buying ETFs. With ETFs, you can bet on the long-term growth of the industry through diversified winners and losers. In the end, the winners will be given the highest weighting, which in turn will drive the performance of the industry.

How do semiconductors do it? It's Not Just Artificial Intelligence

As the chart above shows, for the first six years or so of the last decade, the chip sector largely rose in line with the broader software sector, and it wasn't until the end of 2020 that the chip sector began to stand out, and it began to outperform the Nasdaq Resonance Index slightly.

Yes, during the pandemic, the tech industry began to really take off as companies flocked to the cloud to stay in business and consumers bought new laptops and smartphones with checks that stimulated the household economy. Software, the Internet and semiconductors all benefited.

However, between late 2020 and 2021, the separation began to appear - even before ChatGPT's thunderous debut in late 2022. Why is this?

I think this is due to a renewed interest in stock valuations as inflation and interest rates begin to climb back from the bottom. During this period, software valuations tended to be much higher than chip stocks because software is considered a more stable "recurring" subscription business while chip sales fluctuate from year to year.

However, rising interest rates reduce the present value of forward earnings. This tends to depress the valuation of stocks with high multiples, such as software.

On the other hand, semiconductor stocks tend to trade at lower valuations, especially often. Many of the leading chip companies are dividend payers and stock buyers while their technology drives growth. These shareholder returns only add to the long-term data of the industry.

While semiconductors may not be growing at the same overall rate as, for example, cloud software, they still hold their own in terms of long-term growth, according to DataHorizzon Research, which shows that while the industry can have its ups and downs in any given year, it is projected to grow at an annualized rate of 11.61 TP3T across the industry between 2023 and 2030.

Therefore, with the arrival of interest rate normalization, starting with lower valuations and lower thresholds could be a key factor in the sector's outperformance.

It's not just Invicta.

Many may scoff at the idea that Nvidia alone is responsible for the industry's rise. Nvidia's stock price has skyrocketed over the past two years as a pioneer of the graphics processing units (GPUs) needed for generative AI applications. As AI is a potentially transformative technology for society and humanity, Nvidia has become a success story.

But it's not just Nvidia that's actually driving the industry upward; in fact, seven of the 10 best-performing stocks in the S&P 500 over the past decade have been in the semiconductor industry, including four of the top five.

It is very difficult to produce a 耑 chip with billions of tiny crystals, and past cycles have made the chip industry into a handful of exceptional companies with these unique technological capabilities. Therefore, it is perhaps not surprising that not one, but a handful of stocks have been rewarded for their involvement in the AI chip design and manufacturing ecosystem.

While the chip industry may not be able to make the gains of the past decade in the next 10 years due to high initial valuations, our world seems to be becoming more automated, smarter, and interconnected. All of this is being driven by semiconductors. So this ETF remains a must-have for any ETF investor with a time horizon longer than 10 years.

Should you invest $1,000 in the iShares Trust - iShares Semiconductor ETF right now?

Before buying shares of the iShares Trust - iShares Semiconductor ETF, consider the following:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best of the best right now.-est (superlative suffix)The name of the person is suitable for the investor to purchase10The iShares Trust - iShares Semiconductor ETF is not included in the list. The 10 stocks that made the list could generate huge returns in the coming years.

Consider April 15, 2005Nvidia) on the list at ...... If you invest $1,000 at the time of our referral, theYou will have 540,321dollar! *

Stock AdvisorProvides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock recommendations per month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View these 10 stocks."

*Stock Advisor's Circular as of April 15, 2024

Billy Duberstein holds shares of Taiwan Semiconductor Manufacturing Company. His clients may hold shares of the above companies. The Motley Fool holds recommended Nvidia, Taiwan Semiconductor Manufacturing Company, and iShares Trust-iShares Semiconductor ETFs. The Motley Fool recommends Intel, and recommends the following options: a January 2025 $45 call option long on Intel and a May 2024 $47 call option short on Intel. The Motley Fool recommends Intel and recommends the following options: Intel January 2025 $45 Call Option Long and Intel May 2024 $47 Call Option Short. The Motley Fool has a disclosure policy.

This ETF Is Crushing the Markets, and Even the Tech Industry: Don't Let Fearmongers Keep You Out was originally published by The Motley Fool.