.

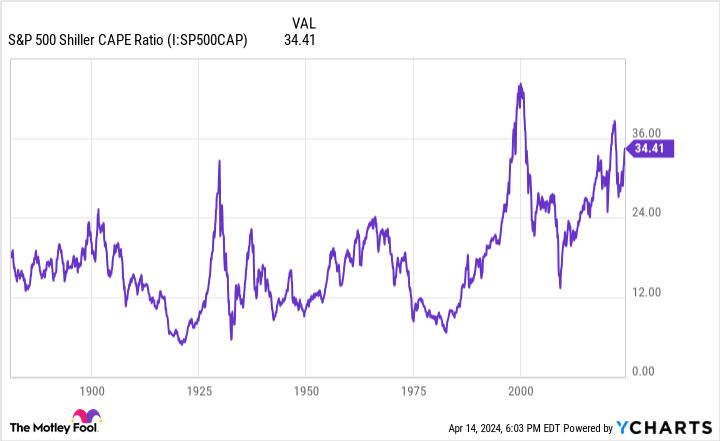

This valuation indicator for the S&P 500 is at the third highest level in history. Will stocks crash?

In books and movies, you have to be careful when everything is going well for the protagonist. There is an aggregate of disturbances that can throw things out of balance.

Investors may be in a similar situation now.Standard & Poor's 500The index rose 24% last year, and so far this year, it's up in the high single digits. Everything seems to be going well.

However, you don't have to look hard to see that this sunny market may be in trouble. One valuation measure for the S&P 500 has reached its third highest level ever. Are stocks headed for a crash?

Premium Markets

In 1988, economists Robert Shiller and John Y. Campbell proposed a new approach to stock valuation. They called it the cyclically adjusted price-to-earnings (CAPE) ratio. Over time, this metric came to be known as the Simmons P/E ratio.

The CAPE ratio is an innovation to the widely used price/earnings (P/E) ratio. Instead of looking at just 12 months of returns, it uses a 10-year average. The rationale is that this longer period helps smooth out short-term volatility and provides a better valuation scenario; the higher the CAPE ratio, the higher the valuation, and vice versa.

The CAPE Ratio can be used for individual stocks as well as for indices such as the S&P 500. In particular, the CAPE Ratio of the S&P 500 Index helps determine whether the index is priced attractively compared to historical levels.

The historical average CAPE ratio for the S&P 500 is about 16. Any value of 10 or less is considered low (indicating an attractive valuation). Any value of 25 or higher is considered high (reflecting a market premium).

What is the CAPE ratio of the S&P 500 today? It has peaked only twice, at the end of 1999 and at the end of 2021.

CAPE Panic

In the past, high CAPE ratios in the S&P 500 have often led to significant market declines. For example, the valuation metric peaked at the end of 2021 at nearly 38.6. The following year, the S&P 500 fell by more than 19%.

The highest CAPE in the history of the S&P 500 was 44.2 at the end of 1999. 2000 saw the S&P 500 drop 10%. This drop was just the beginning. By the end of 2002, the index had plunged 40%.

The CAPE ratio for the S&P 500 had another big jump. in September 1929, the valuation was close to 32.6. the following month, 1929 saw the infamous Stock Market Crash. The Great Depression followed.

These examples explain why some investors are concerned that with the S&P 500 CAPE ratio so high, stocks could crash again. However, at the beginning of 2021, the indicator was almost as high, but the S&P 500 jumped 27% that year.

Some also argue that comparing the S&P 500's CAPE ratio to past levels is not as useful as it once was. They point to changes in accounting standards that have affected the way companies report earnings. They also argue that structural changes, including technological advances, have made it possible for today's companies to generate higher earnings than in the past.

What should investors do?

A rising CAPE ratio on the S&P 500 doesn't necessarily mean that stocks are going to crash anytime soon. But there's no doubt that valuations in the S&P 500 are higher than historical levels.

In my opinion, investors would do well to follow Warren Buffett's lead. This legendaryBerkshire HathawayThe mat execs have accumulated a lot of cash. Importantly, Buffett did not get away with it, nor did he sell many or all of his Berkshire positions.

However, he hasn't bought as much stock as he would have if market prices had been more attractive. Buffett hasn't been completely out of the loop. He has bought several stocks in recent quarters, but none at a premium.

In my opinion, this is a good strategy. Hold stocks of companies that are well run and have been around for a long time. Build up a cash position to profit from future sell-offs. However, don't be afraid to buy good stocks when you see them at attractive prices.

Remember, in books and movies, there is always a solution after a conflict. The same is true of the stock market. Even if a stock falls because it is overvalued, investors will eventually start buying again. In the long run, you should be able to have a Hollywood ending.

Don't miss out on this potentially lucrative second chance!

Ever feel like you're missing out on the opportunity to buy the most successful stocks? Then you'll want to hear this.

On rare occasions, our expert team of analysts will recommend companies that they believe are poised for a major rally."Double Down" StocksIf you're worried that you're missing out on an investment opportunity, now is the time to buy. If you're worried that you're missing out on an investment opportunity, now is the time to buy before it's too late. The numbers speak for themselves:

-

Amazon:If you invested $1,000 when we doubled down in 2010, thenYou will have $20,963! * *.

-

Apple.if you invested $1,000 when we doubled down in 2008.you'd have $33,315!*

-

Netflix:If you invested $1,000 when we doubled our investment in 2004, youWill have $335,887! * Right now, we are issuing "Double Down" alerts for three incredible companies.

Right now, we're issuing "double dip" alerts for three incredible companies, and an opportunity like this may not come again anytime soon.

View 3 Only "Double Down" Stocks

*Stock Advisor's Circular as of April 15, 2024

Keith Speights owns shares of Resonance Hathaway, Inc.The Motley Fool owns shares of Resonance Hathaway, Inc.The Motley Fool recommends shares of Resonance Hathaway, Inc.The Motley Fool has a disclosure policy.

The S&P 500 valuation index is at the third highest level in history. Will Stocks Crash? This post was originally published by The Motley Fool.