.

Two Buffett Stocks to Hold Forever

Professional investors are not like professional athletes, where the top players in the game often become household names, but there are exceptions from time to time. The biggest exception is probably Warren Buffett, arguably the most recognizable investor in the investment world today.

It's no coincidence that many people far from Wall Street know Warren Buffett's name. Due to his personal success and his company'sDr. Konrad HathawayWith the success of the company, many investors were concerned about his investment moves, hoping to duplicate his returns.

While it may not be the best choice for all investors, there's nothing wrong with seeking guidance from Bubbles Omaha Oracle. Here are two Warren Buffett stocks that investors can feel good about holding forever.

1. Coca-Cola

Coca-Cola (NYSE: KO)is one of the oldest holdings in Berkshire Hathaway's portfolio of carpet names and its fourth-largest holding, accounting for more than 6% of its portfolio of carpet names.

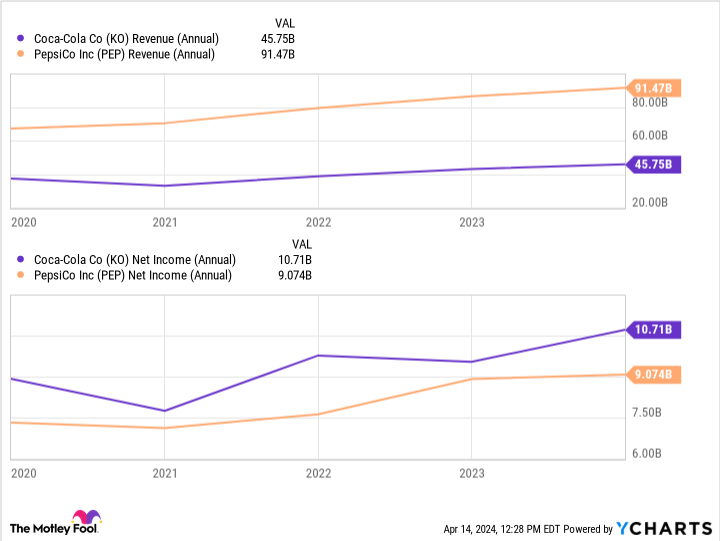

Investors shouldn't expect the kind of revenue or profit growth from Coca-Cola that they would expect from a growth stock, but the company has been growing for years. in 2023, Coca-Cola's revenue was $45.8 billion, up 6% y/y. its revenue growth outpaced its global sales (up 2% y/y), which is a sign of the company's pricing power.

Coca-Cola's brand influence in the beverage industry is unparalleled, and the company has been able to capitalize on this advantage even during periods of stagnation. Operating only in the beverage industry ensures that Coca-Cola is not overly fragmented and can focus on running its business as efficiently as possible. This is why Coca-Cola's net income is often higher than its net income.Pepsi ColaThis is partly due to the fact that Koon's revenues are much lower than those of the snack and beverage companies.

The main reason I advocate holding Coca-Cola stock forever is its dividend. The company is the king of dividends, having increased its annual dividend for 62 consecutive years and showing no signs of stopping. There are only a few companies with longer annual dividend increases.

Coca-Cola pays a quarterly dividend of $0.485 and has a 12-month trailing yield of about 3.2%. this isStandard & Poor's 500 This is more than twice the average of the index, which is enough to increase the investor's return on totalization if the stock price goes into a period of stagnation.

2. Apple

Apple Inc. (NASDAQ resonance code: AAPL)It is by far the largest holding of Berkshire Hathaway, accounting for nearly 43% of its equity portfolio. the huge concentration of Apple stock has done wonders for Berkshire Hathaway over the years, but this year hasn't been the best one for the iPhone maker. So far this year, Apple shares are down nearly 51 TP3T.

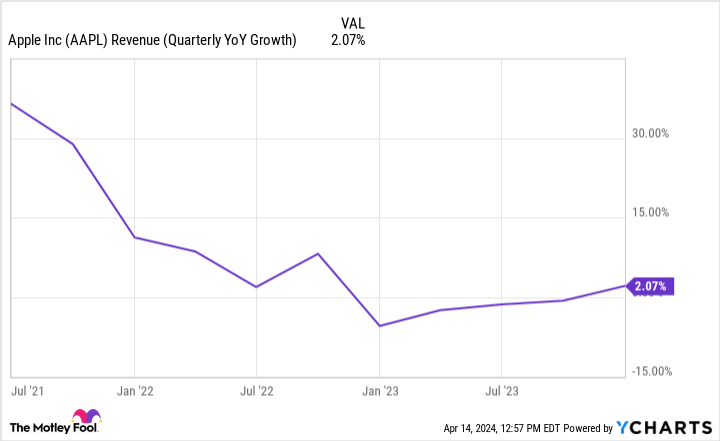

Apple's struggling stock price is largely due to investor concerns about the company's lack of growth in the near term. In the first quarter of fiscal 2024 (ended December 30, 2023), Apple reported revenue of $119.6 billion, but year-over-year growth was only 2%. This continues a worrisome trend.

While this trend exists, I think some of the concerns about Apple are valid but overblown. iPhone accounts for a large portion of Apple's revenue (over $58%), and the slowdown in smartphone sales over the past few years has taken its toll. in October 2023, global smartphone sales grew 5% year-over-year, the first positive growth in 27 months. This is the first positive growth in 27 months. Investors should not overlook this point.

Slow revenue growth aside, growth in the company's services division is an optimistic sign. Here's a look at Apple's product and service revenue over the past five fiscal years:

|

Financial Year |

Percentage of product revenue |

Percentage of income from services |

|---|---|---|

|

2019 |

82% |

18% |

|

2020 |

80% |

20% |

|

2021 |

81% |

19% |

|

2022 |

80% |

20% |

|

2023 |

78% |

22% |

Data Source: Data Source: Apple Inc.

Services are a higher margin business than products, and can provide Apple with more reliable revenue through subscriptions. Apple would be wise to focus on building a service ecosystem to complement its hardware.

Apple definitely has some issues to work out, but it has consistently shown that it is one of the greatest companies in the world for a reason. Warren Buffett famously said, "Fear when others are greedy, and be greedy only when others are fearful." Now seems to be the time for investors to fear Apple. Now seems to be a good time for long-term investors to snap up Apple stock.

Should you invest $1,000 in Coca-Cola now?

Consider this before buying Coca-Cola stock:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only ...... and Coca-Cola were not among them. These 10 stocks could generate huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 15, 2024

Stefon Walters owns shares of Apple Inc. The Motley Fool owns shares of recommended Apple Inc. and Berkshire Hathaway Inc. The Motley Fool has a disclosure policy.

2 Stocks Warren Buffett Has Held Forever was originally published by The Motley Fool.