.

Where will Palantir Technologies stock be in three years?

Palantir Technologies (NYSE: PLTR)It is one of the more polarized stocks in the market right now. Over the past year, it has had a very strong performance, rising over 150%. However, this has also given it a very high valuation.

Reasons to Oppose Palantir

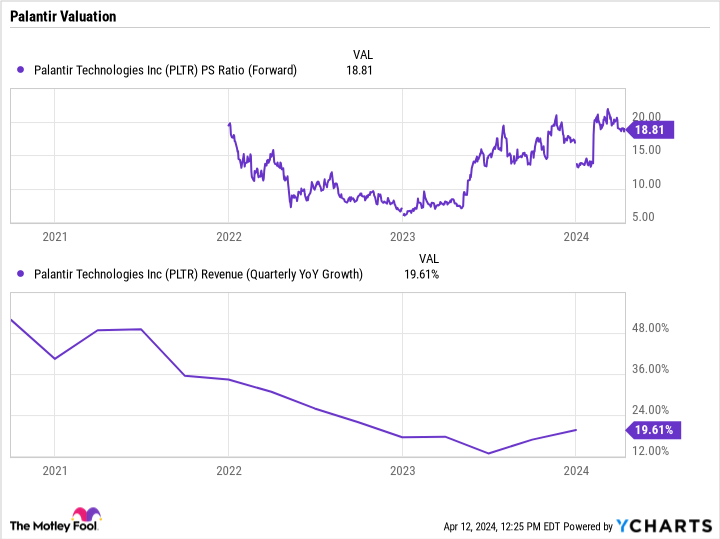

The reasons to be bearish on Palantir revolve around its valuation and where it is growing faster than before. The stock currently trades at a forward price-to-sales (P/S) ratio of just under 19.

PLTR PS Ratio (Forward) data provided by YCharts

If Palantir were to grow revenues at an alarming rate, then this valuation would be reasonable. However, the company's 2023 revenue growth rate is only 17%. This is solid growth, but probably not enough to justify a P/E of 19 for the name. Over time, the company's revenue growth did start to accelerate, with the fourth quarter showing the best quarterly revenue growth. However, the fourth quarter revenue growth rate was still only 20%.

Looking ahead, the company expects full year 2024 revenues of $2,652 million to $2,668 million. This would imply a growth of 19% to 20%.

In recent years, software-as-a-service (SAAS) companies growing at around 17% to 20% have typically traded at close to 7x sales, so Palantir's current valuation is much higher than most SaaS companies with similar growth rates.

Reasons to support Palantir

The reasons to be bullish on Palantir revolve around its mission-critical technology serving the private sector, as well as its growing opportunities in the public sector and artificial intelligence (AI) space.

The company is making a name for itself with its data collection and analytics platform, which helps the U.S. government's intelligence community track and combat terrorism, among other critical missions. The company's technology has also been instrumental in helping the Centers for Disease Control and Prevention (CDC) track the spread of COVID-19.

However, government revenues have slowed over the past few years, growing by 191 TP3T in 2022 and only 141 TP3T in 2023. as much as this is the case, the awarding of government carpet names by private sector contractors for the曏 industry is notoriously volatile, especially on the part of the U.S. government, which can go a long time without awarding a single carpet name before awarding a few big ones in quick succession. In fact, it was only last month that the US government passed a spending bill for the current fiscal year ending September 2024, well after the October 2023 start date. Now that the spending bill is in place, Palantir's U.S. government business will certainly begin to pick up steam, and management has said that its government business should begin to accelerate again this year.

However, revenues in the Commercial segment have begun to grow at a rapid pace. Fourth quarter growth was $32%, with U.S. commercial revenue soaring $70%.Palantir's success in the commercial space is largely due to its new Artificial Intelligence Platform (AIP) product and training camps.

The company utilizes boot camps to introduce potential customers to AIP, with seminars on how to apply AIP to mission-critical operations and potential use cases, as well as onboarding training. According to Koon, the use of boot camps has shortened the sales cycle and helped accelerate new customer acquisition.

Palantir recently announced a partnership withOracle Corporation (NYSE: ORCL)As a result of this partnership, Palantir's artificial intelligence and decision acceleration platform will be deployed on Oracle's distributed cloud platform. Oracle's cloud platform is developing rapidly and should therefore help drive Palantir's growth. However, the relationship withMicrosoftof Azure,AmazonNetwork Services (Amazon(Web Services) andAlphabet Oracle's cloud services division is still much smaller than the Google Cloud trio.

If artificial intelligence and Palantir's recent deal with Oracle can help Palantir re-accelerate its growth, the company could grow beyond its current valuation.

Palantir's share price after three years

If Palantir can increase its revenue growth to 30% this year and next, and then return to 25% and 20% revenue growth in 2026 and 2027, respectively, then the company will have revenues of about $4.7 billion and $5.6 billion in 2026 and 2027, respectively. Given Palantir's strong moat and unique technology, I think the stock's price-to-earnings ratio may be slightly higher than its peers. Using a forward P/E of 9x at the end of 2026 for 2027 revenues, the stock's current market capitalization would be $50.5 billion.

While Palantir's share price will be volatile over the next few years, I think it should be close to its current level by the end of 2026.

Should you invest $1,000 in Palantir Technologies now?

Before buying shares of Palantir Technologies, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only ...... and Palantir Technologies were not included. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorProvides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 15, 2024

Suzanne Frey, an Alphabet executive, is a board member of The Motley Fool. John Mackey, former Chief Executive Officer of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's Board of Directors. Geoffrey Seiler owns shares of Alphabet. The Motley Fool owns shares of recommended stocks of Alphabet, Amazon, Microsoft, Oracle and Palantir Technologies. The Motley Fool recommends the following options: Microsoft January 2026 $395 Call Option Long and Microsoft January 2026 $405 Call Option Short. The Motley Fool has a disclosure policy.

Where Will Palantir Technologies Stock Be in Three Years? This post was originally published by The Motley Fool.