.

Is it too late to buy Energy Transfer stock?

Energy Transfer (NYSE: ET)It has strengthened since the start of 2023. This Master Limited Partnership (MLP) has risen above 25%, which is a great improvement for a relatively slow-growing Gundo company.

MLP's The uptrend is likely to make some investors wonder if it's too late to buy. Let's take a look at the next noodle. Shares of Koon Do Co. be Even if you run out of gas, you'll still have plenty of fuel left in the tank.

What's driving the rise in Energy Transfer?

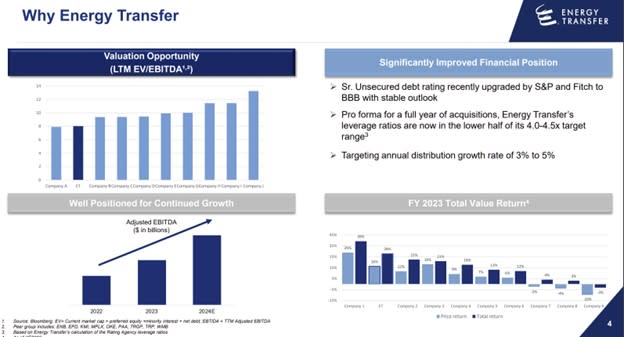

A big driver of Energy Transfer's recent uptick has been its growing earnings. The MLP's adjusted Earnings before interest, tax and depreciation (EBITDA) From $13.1 billion in 2022 to $13.7 billion last year, an increase of about 5%. The company expects earnings to increase to $14.5 billion to $14.8 billion this year, an increase of 7% to 8% year-on-year.

Energy Transfer's growth is driven by organic expansion and the acquisition of carbs. The company invested $1.6 billion in expansion projects last year and expects to spend $2.4 billion to $2.6 billion on growth capital projects in 2024. Meanwhile, in deals completed last year, the company acquired Lotus Midstream for $1.5 billion and fellow MLP Crestwood Equity Partners for $7.1 billion.

The company's growing earnings have provided the impetus to increase its already attractive distribution, which currently yields over 8%. The MLP's goal is to increase its payout ratio by 3% to 5% per year. leverageIt is expected that this year(used form a nominal expression)leverageWill reach 4.0-4.5 times the target range of LB.

Lower leverage ratios have recently enabled two creditworthinessRaters are confident that Energy Transfer's Credit Ratingget promoted The rating outlook is stable. The higher credit rating provides greater access to lower-cost capital. Earlier this year, the company utilized this channel to issue new notes and used the proceeds to redeem all outstanding Series C and Series D notes. preferred stockThe

Is there any room for advancement?

Energy Transfer's dramatic rise over the last year has made it the second best performing energy midstream company in its peer group. Its unit price has increased by 16%, and with its high income distribution, the total return is 28%. However, despite this positive trend, the company's valuation is still at the bottom of the barrel:

As the chart in the upper left corner shows, the Based on the profit for the past 12 monthsSituation.Energy Transfer (used form a nominal expression)Enterprise value and interest, tax and depreciation and amortizationsales frontProfit(EBITDA(i) Ratioamongst peerscome second The price is even lower in terms of forward earnings. On a forward earnings basis, it's even less expensive. Based on this low valuation alone, it's not too late to buy the MLP, as it has plenty of upside as its valuation multiples bounce around the peer average.

One catalyst that could help boost its valuation is the possibility that MLP will buy back some of its common stock this year. The company expects to generate about $7.5 billion in distributable cash flow annually, of which $4 billion will be distributed to investors. This leaves the company with excess free cash flow of about $3.5 billion. The company's long-term plan is to reinvest $2 billion to $3 billion in high-return capital projects, while utilizing the remaining capital ($500 million to $1.5 billion) to pay down debt and repurchase shares.

The company will have approximately $1 billion of excess free cash flow as capital expenditures this year are in the middle of the range. With its leverage near the lower end of its target range, the MLP may begin prioritizing unit purchases in the coming quarters.

In addition to these upside catalysts, Energy Transfer offers a very attractive income stream. The MLP is currently yielding 8.3%, which is more than Standard & Poor's 500 index Dividend yield (1.4%)Several times higher. The company's dividend payout ratio will continue to rise. The already high dividend payout ratio will continue to rise as the company realizes its plan to increase its dividend by 3% to 5% annually. Although MLPs are a bit complicated on the tax side (including sending out K-1 forms to investors every year), their generous deferred tax income makes them worth a try.

It's not too late to lock in the tantalizing Mass Accumulation Loop.

Despite this positive trend, Energy Transfer's price is still relatively low compared to other Goldman Sachs companies. Therefore, it's not too late to buy. The company has a clear catalyst on the horizon (a single-unit buyback) and still offers a very attractive revenue stream. Because of this, it can continue to generate substantial aggregate returns.

Should you invest $1,000 in Energy Transfer now?

Before buying Energy Transfer stock, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Energy Transfer is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisor's Report as of April 15, 2024

Matt DiLallo owns shares of Energy Transfer. the Motley Fool does not own any of these shares. the Motley Fool has a disclosure policy.

Is It Too Late to Buy Energy Transfer Stock? This post was originally published by The Motley Fool.