.

With a gain of nearly 80% this year, is there still room for INVISTA's stock price to rise?

After the glorious year 2023.INVISTA (NASDAQ: NVDA)The performance in 2024 is no less impressive. It's up nearly 80% this year, making it a top performer for the second year in a row.

However, because of this good start, most people are wondering if Nvidia has more room for growth. I think there is, but there is also the possibility of a reversal.

NVIDIA is a key part of the AI tech boom

Nvidia has been a rock star stock because of its ties to artificial intelligence (AI). Its main product, the graphics processing unit (GPU), has the kind of parallel computing power that is essential for training AI models. When it comes time to train AI models on GPUs, companies don't just use one or two GPUs; instead, they use thousands of GPUs to increase computational power.

Nvidia's flagship GPU for training AI models is the H100, which costs about $40,000 per unit. It's a good sign for Nvidia's business when companies are buying these GPUs by the thousands at this price.

This is well reflected in Nvidia's financial results, for example, in the fourth quarter of fiscal year 2024 (ended January 28), Nvidia's revenue grew by 2,65% year-over-year to $22.1 billion. With the infrastructure needed to train all these AI models yet to be built, this is a great sign for Nvidia that demand for its products will remain high.

This is the basic argument that Nvidia's stock price still has room to go up, because no one knows when there will be enough computing power to meet the demand for AI training. However, there is a flip side to the coin.

Nvidia's revenue stream will dry up once the industry builds up its computing power to meet demand. Nvidia will still be around because it has a number of other business units, but since most of its revenue comes from the AI demand wave, it will eventually flourish. But since most of Nvidia's revenue comes from the AI demand wave, it will eventually face a decline.

We don't know how long it will take to build up all the computing power for AI needs, or when it will start to stabilize. That's the debate behind Nvidia's stock price, but we'll have a better idea of where it's headed in a month's time.

Following the release of the first quarter earnings report, INVISTA's stock price could move in one of two ways

While Nvidia's stock price has risen nearly 801 TP3T so far this year, it's only risen 121 TP3T since its last earnings report, because most of the news that drives the stock price up is released in the earnings report.

If past trends hold, Nvidia's first-quarter results should be released sometime in late May. If Nvidia's management gives positive forward guidance and says it will maintain the status quo, it would not be surprising to see the stock rise even more. But if management is talking about stabilizing demand, be prepared for a serious sell-off.

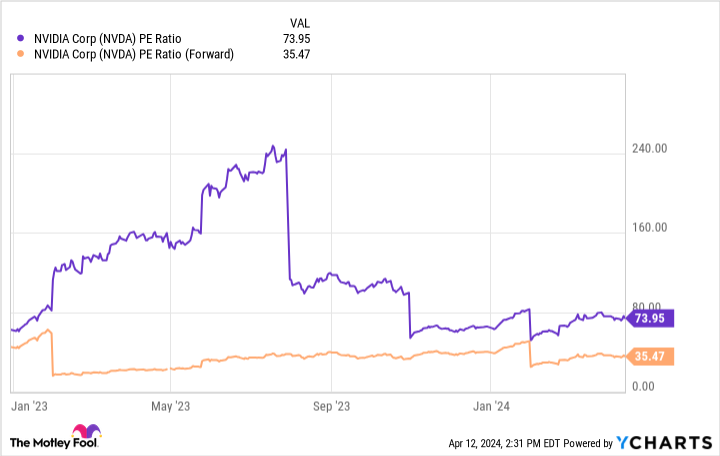

There are a lot of expectations for Nvidia stock, and one of them is strong growth throughout this year. By looking at the difference between the stock's trailing price-to-earnings (P/E) ratio and its forward P/E ratio, you can calculate the expected earnings growth rate for the year.

For Nvidia, this ratio is 109%. Therefore, Nvidia's earnings must be at least doubled, otherwise they will fall short of analysts' expectations.

That's a high bar, but considering Nvidia's Q4 earnings per share (EPS) growth of 765%, it's achievable.

So, to answer this question, is there room for Nvidia's stock price to rise? I think there is. If AI demand continues to drive Nvidia's revenues higher than expected, there is still room for the stock to rise further. But if it fails to achieve these lofty goals, there's still a lot of room for the stock to fall.

Should you invest $1,000 in Nvidia now?

Before buying Nvidia stock, consider the following:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Nvidia is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the coming years.

Consider that on April 15, 2005NvidiaOn the list at ...... If you invest $1,000 at the time of our referralYou will have $526,933.! * *The

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 15, 2024

Keithen Drury does not hold any of the shares mentioned above.The Motley Fool holds a recommendation for Nvidia.The Motley Fool has a disclosure policy.

Nearly 80% for the year, does INVISTA's stock have room to rise? This article was originally published in The Motley Fool.