.

1 Grab Artificial Intelligence (AI) Stocks to Buy Before They Surge 45%

The use of artificial intelligence (AI) systems in the cybersecurity industry is growing at an alarming rate. Last year, AI-focused cybersecurity spending amounted to about $24 billion, but that figure is expected to approach $134 billion by 2030, according to Statista.

As a result, it's a good time for investors to buy shares of cybersecurity companies that are actively integrating AI tools into their platforms.Fortinet (NASDAQ: FTNT)This is one such company that is utilizing AI to drive strong growth in its business.

Artificial Intelligence Improves Fortinet's Revenue Pipeline

Fortinet realized $5.3 billion in revenue in 2023, an increase of 20% from the previous year, but its deferred revenue grew even faster, to $5.74 billion, an increase of 24%. Deferred revenue is money that a company receives in advance for services rendered in the future. It is only recognized as revenue when the service is delivered.

As a result, the company's rapid growth in deferred revenue suggests strong demand for its subscription-based cybersecurity services, as evidenced by the fact that Fortinet's service revenues grew by 281 TP3T to $3.38 billion in 2023, accounting for 641 TP3T of its total revenues.

Fortinet attributes the solid growth in its services business to strong demand for subscriptions related to its Security Operations and Security Access Service Edge (SASE) products. Notably, the company has integrated artificial intelligence into both platforms. For example, Fortinet's AI-focused security operations platform allows customers to quickly detect and respond to threats. What's more, Fortinet management noted that the company has been using AI to enhance its products for a long time.

As Ken Xie, Simmons Executive Officer, said on the Q4 conference call

We have invested heavily in artificial intelligence in every feature and product. For more than a decade, Fortinet has leveraged machine learning and AI to provide advanced hypochondriac intelligence for more than 40 products in network, endpoint, and application security. Our solutions apply AI and ML in the expanding digital attack noodle to automatically contain and remediate incidents in seconds, compared to the industry average of days to detect and remediate.

Even better, the company has begun using generative AI to enhance its cybersecurity platform. It launched its Generative AI Cybersecurity Assistant in December, which is designed to help organizations "make better decisions, respond quickly to weiwaki, and save time on the most complex tasks."

All of this explains why the number of cybersecurity deals signed by Fortinet is growing nicely. in 2023, the company closed 13 deals worth $10 million or more, a jump of 1,60% from the previous year. in addition, in the fourth quarter of 2023, the company closed 474 deals worth $500,000 or more, a significant increase over the third quarter's 367 deals. In addition, in the fourth quarter of 2023, the company closed 474 deals valued at $500,000 or more, up from 367 in the third quarter.

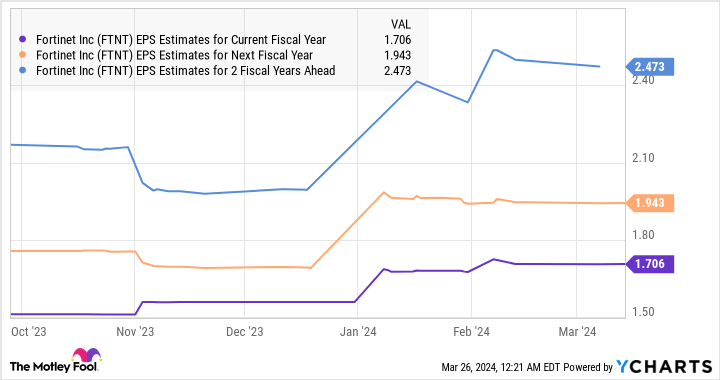

With Fortinet projecting its addressable market mass to jump from $150 billion this year to $208 billion by 2027, its trading momentum should remain strong, especially given its focus on using artificial intelligence to improve services. Not surprisingly, analysts expect bottom-line growth to accelerate in 2025 and 2026, following this year's forecast of a 4% jump from $1.63 per share in 2023.

Investors are expected to gain more from this cybersecurity game

So far in 2024, Fortinet shares have risen 161 TP3 T. The company currently trades at a P/E of 46x, a discount to its five-year average P/E of 56x. Its 42x forward earnings yield suggests that its bottom line will improve this year, below its five-year average of 44x.

However, Fortinet's earnings growth is expected to improve in 2025 and 2026, which explains why the market is valuing it at a premium. But if Fortinet can deliver earnings of $2.47 per share in 2026, as analysts predict, its shares could reach $99, even if it trades at a price-to-earnings ratio of just 40 times three years from now. That's a 45% jump from current levels, so investors should consider buying this cybersecurity stock now.

Should you invest $1,000 in Fortinet now?

Before purchasing shares of Fortinet stock, please consider the following:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Fortinet is not one of the 10 stocks listed at ....... The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of March 25, 2024

Harsh Chauhan does not hold any of the stocks mentioned above.The Motley Fool holds a recommendation for Fortinet.The Motley Fool has a disclosure policy.

The 1 Artificial Intelligence (AI) Stock You Should Get Out and Buy Before It Surges 45% was originally published by The Motley Fool.